For the first time in a quarter century, there is a new semiconductor chip leader according to market research firm, Gartner which recently announced Samsung has bested the 25 year long reign of Santa Clara, CA-based Intel as the top chip supplier by revenue.

Just at that moment, Intel made public a whopping security breach in its architecture affecting billions of devices across the entire computer device-driven spectrum from mobile to desktop to server farm.

For its part, Samsung clocked in with a whopping plus 52% growth on some $40 billion in revenue, and surpassed Intel as the largest semiconductor revenue generator. Market share for the year was 14.6% (to Intel’s 13.8%). Samsung did it on strong memory chip sales that accounted for over 66% of the cash growth for the Korean-based company.

Memory category demand drives semiconductor market

According to market research VP for Gartner, Andrew Norwood:

“Memory accounted for more than two-thirds of all semiconductor revenue growth in 2017, and became the largest semiconductor category”.

Gartner also reported that both NAND (memory in smartphones) and DRAM memory chips were in short supply and prices rose driving up the cost of most devices (the plus $1K iPhoneX is a good example)

|

2017 Rank |

2016 Rank |

Vendor |

2017 Revenue |

2017 Market Share (%) |

2016 Revenue |

2016-2017 Growth (%) |

|

1 |

2 |

Samsung Electronics |

61,215 |

14.6 |

40,104 |

52.6 |

|

2 |

1 |

Intel |

57,712 |

13.8 |

54,091 |

6.7 |

|

3 |

4 |

SK Hynix |

26,309 |

6.3 |

14,700 |

79.0 |

|

4 |

6 |

Micron Technology |

23,062 |

5.5 |

12,950 |

78.1 |

|

5 |

3 |

Qualcomm |

17,063 |

4.1 |

15,415 |

10.7 |

|

6 |

5 |

Broadcom |

15,490 |

3.7 |

13,223 |

17.1 |

|

7 |

7 |

Texas Instruments |

13,806 |

3.3 |

11,901 |

16.0 |

|

8 |

8 |

Toshiba |

12,813 |

3.1 |

9,918 |

29.2 |

|

9 |

17 |

Western Digital |

9,181 |

2.2 |

4,170 |

120.2 |

|

10 |

9 |

NXP |

8,651 |

2.1 |

9,306 |

-7.0 |

|

Others |

174,418 |

41.6 |

157,736 |

10.6 |

||

|

Total Market |

419,720 |

100.0 |

343,514 |

22.2 |

Source: Gartner (January 2018)

News of the shift came as Gartner reported overall world wide semiconductor revenue growth of 22% (about $420 billion total) in 2017, but it was the memory sales that added 31% of total semiconductor revenue growth for the industry overall, signaling the winds of change for the industry and the toppling of Intel as the number one semiconductor supplier worldwide. Total semiconductor revenue in 2016 was $343.5 billion.

Intel Drops a Bombshell

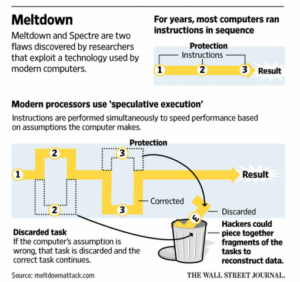

Intel dropped it’s bombshell news of chip security flaws (named Specter and Meltdown) that make devices including smartphones and servers “vulnerable to attack” according to disclosures from the company. Intel said the “design flaws” could allow hackers to gain access to information. Details including information on variants can be found on Google’s project zero security team blog site. Most everyone is affected, Apple, Alphabet Inc.’s Google, Amazon.com Inc. and Microsoft Corp. all have been working to address these know issues and issue patches to reduce the threat and ARM and AMD processors also have the problem.

Truth be told, this is not a sudden crisis, as the chip design flaws have been know and written about since June of 2017 with many larger device makers using Intel products already providing patches. Impact is expected to minimal. It’s more about public awareness than real impact on daily use of devices or lifestyle change.

Source: Meltdownattack.com from WSJ 2018 online report

So the winds of change are blowing in the semiconductor market, as Samsung takes number one market position on strong revenue growth in its memory category. For its part, Intel will continue to dominate microprocessors and the world will continue to turn. Isn’t that a nice thought after all? — Stephen Sechrist

IHS Releases Report on the Impact of Memory in iPhone BOM