PC shipments increased 1% YoY in Q4’14, indicating a slow but steady improvement in the market after two years of declines. Shipments reached 83.7 million units, according to Gartner.

PC displacements by tablets peaked in 2013 and the first half of 2014; now that these devices have penetrated key markets, spending is shifting back to PCs, said analyst Mikako Kitagawa. However, there are regional variations. Mature markets (mostly) show continued growth, but emerging markets remain weak.

The highest growth in Q4’14 came from the USA, followed by Western Europe. Weak results in emerging markets have been attributed to the popularity of mobile devices compared to PCs, which are a low priority for most consumers. Even low-cost notebooks are “struggling” to succeed.

Lenovo remained the global PC shipment leader, with a 19.4% market share. The company exhibited strong growth in the USA and EMEA, but saw falling shipments in LATAM and Japan. HP managed to raise its share by 16%, to 18.8%, narrowing the gap with Lenovo. HP achieved strong growth in the USA and positive results in EMEA and APAC. Dell took third place (12.7% share), with results indicating a successful expansion into the consumer market.

| Preliminary Unit Shipment Estimates for Top PC Vendors Worldwide in Q4’14 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q4’14 Units | Q4’13 Units | Q4’14 Market Share (%) | Q4’13 Market Share (%) | YoY Change (%) |

| Lenovo | 16,284.8 | 15,153.5 | 19.4 | 18.3 | 7.5 |

| HP | 15,769.6 | 13,291.3 | 18.8 | 16.4 | 16 |

| Dell | 10,674.1 | 9,810.6 | 12.7 | 11.8 | 8.8 |

| Acer | 6,786.9 | 6,083.4 | 8.1 | 7.3 | 11.6 |

| Asus | 6,259.8 | 6,220.2 | 7.5 | 7.5 | 0.6 |

| Others | 27,971.5 | 32,070.0 | 33.4 | 38.7 | -12.8 |

| Total | 83,746.7 | 82,929.1 | 100 | 100 | 1 |

| Source: Gartner | |||||

In regional terms, the USA saw 18.1 million unit shipments; a 13.1% YoY increase, the fastest growth the USA has experienced for four years. HP showed the strongest growth, up 26.2% to a 29.2% market share.

PC shipments in the USA had their best Q4 result for several years. Mobile PCs were the primary driver, including all types of notebook. Low-cost models boosted shipments, while ultrabooks and convertibles also had strong growth.

EMEA PC shipments reached 26.5 million units; a 2.8% increase YoY. Western Europe drove this slight growth, with notebooks again representing a significant portion. These low-cost devices drew attention from Android mobiles, but had a negative impact on ASPs and vendor margins.

A modest PC recovery was seen in APAC, where shipments rose 2% YoY to 26.6 million units. Growth varies by country; the overall trend is towards declining growth slowing, with mature markets leading the recovery. The bottoming-out of the market suggests that the installed base is stabilising and replacement demand is rising.

Despite the positive outlook for APAC PCs, smartphones are still very much in demand in the region. Kitagawa notes that in emerging markets, such as China and India, it is increasingly difficult to convince consumers to prioritise PC purchases, as they are more focused on content consumption or specific tasks that can be handled on a smartphone.

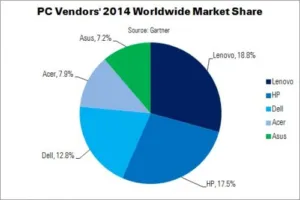

While Lenovo and HP were virtually equal in 2013, but Lenovo extended its lead in 2014 as a whole based on wordwide shipments. Lenovo took an 18.8% market share, compared to HP’s 17.5%.

| Preliminary Unit Shipment Estimates for Top PC Vendors Worldwide in 2014 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q4’14 Units | Q4’13 Units | Q4’14 Market Share (%) | Q4’13 Market Share (%) | YoY Change (%) |

| Lenovo | 59,446.6 | 53,493.6 | 18.8 | 16.9 | 11.1 |

| HP | 55,286.8 | 51,251.0 | 17.5 | 16.2 | 7.9 |

| Dell | 40,487.3 | 36,825.0 | 12.8 | 11.6 | 9.9 |

| Acer | 24,914.0 | 25,309.2 | 7.9 | 8 | -1.6 |

| Asus | 22,841.0 | 20,852.5 | 7.2 | 6.6 | 9.5 |

| Others | 112,890.1 | 128,733.5 | 35.7 | 40.7 | -12.3 |

| Total | 315,866.3 | 316,464.7 | 100 | 100 | -0.2 |

| Source: Gartner | |||||

Display Daily Comment

IDC’s conclusions were more pessimistic than Gartner’s, with data showing shipments actually fell 2.4%, to 80.8 million (although still above the expected 4.8% fall). Overall 2014 shipments, which Gartner said fell 0.2% YoY, were down 2.1% according to IDC.

Both firms agree that the USA and Western Europe showed the highest growth, although IDC believes that the growth is slowing. Both also say that low-cost PCs are fueling the market.

IDC put Lenovo as the leading worldwide vendor in 2014 with a 19.2% share, followed by HP (18.4%), Dell (13.5%), Acer (7.8%) and Apple (6.4%). (TA)