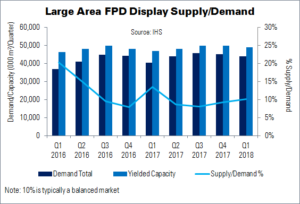

Flat panel display supply was 20% higher than demand, globally, in Q1’16 – the highest glut since early 2012, says IHS in a research note. This was due to seasonally weak demand and new capacity opening in China. However, the market began to correct itself in Q2 and is now quickly moving towards ‘surprising’ tightness in the second half of the year.

IHS expects supply to tighten still further in 2017. Firstly because capacity growth is restricted, as vendors adopt new (and more complex) processes in some factories while closing older and less productive ones. Secondly and thirdly, demand for large-screen TVs has increased thanks to falling panel prices; and demand for notebooks and monitors is stabilising.

Makers in South Korea are being especially aggressive in closing older facilities, up to and including G5 and G7 fabs. Charles Annis of IHS says, “The South Korean Gen 7 facility expected to be taken off-line late this year accounts for approximately…4% of capacity dedicated to large-area production. It would be the largest factory shutdown in the history of FPD manufacturing.”

IHS expects demand for large-area FPD applications to grow between 5% and 6% per year through 2018. Capacity dedicated to the same, however, is forecast to climb just 1% in 2017 and 5% in 2018. The market will begin to trend towards excess supply again in the second half of 2018, as more Chinese capacity – including the world’s first G10.5 factory – is brought online.