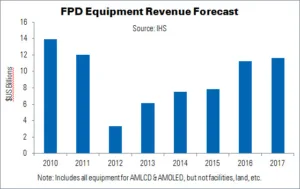

Spending on FPD equipment will reach $11.2 billion this year, says IHS, its highest level since 2011. Two trends are driving the growth: a rush to expand high volumes of flexible AMOLED panels, for smartphone applications, in South Korea; and panel makers building new factories in China, to produce a variety of FPD panel sizes and technologies. Spending is forecast to rise to $11.6 billion in 2017, almost four times higher than the 2012 total.

Many brands are showing interesting in adopting AMOLED technology, now that Samsung Display has made it cost-competitive with LCD technology. Plastic-based flexible AMOLED displays are still more expensive than rigid units, but are also more rugged, thinner and lighter than glass-based panels. Providing both higher image quality and design flexibility, IHS expects glass- and plastic-based AMOLED displays to quickly gain share in the premium smartphone market. The FPD supply chain is reacting to this demand, adding enough capacity to produce an additional 300 million flexible AMOLEDs by 2018.

“Thanks to direct investments, technology subsidies, low interest-rate loans, tax exemptions and other government-sponsored support mechanisms, ten different companies will be building 15 new factories in China over the next two years,” said Charles Annis, senior director at IHS. “Chinese FPD producers are targeting panel self-sufficiency for the country’s enormous consumer electronics industry.”

IHS’ latest data shows that 60% of 2016 equipment spending will go towards LCD-dedicated fabs, with the rest going to AMOLED or dual-use AMOLED-LCD facilities. By 2017, the ratio of LCD to AMOLED fabs will be equal. China is forecast to account for 70% of total equipment spending in 2016 and 2017; South Korea will be responsible for most of the remainder.

The FPD equipment market is in the midst of one of its highest up-cycles ‘in years’, says IHS, a sharp contrast to the declining panel market. This is not unusual, due to the long lead times required to build new facilities.

Annis added, “A major industry concern in this cycle is [that] the market may be slow to rationalise itself… Chinese government policies insulate Chinese panel makers from some financial concerns and investment in flexible AMOLED is not really related to the supply-and-demand issues. If this slow rationalisation depresses panel maker profitability much longer, it eventually will negatively affect not only panel makers, but their suppliers as well.”