Forecasts have been on my mind this week after my Display Daily on Tuesday and the subsequent comments by DSCC’s Bob O’Brien. I then saw an interesting report with a forecast for the display market in my news feed this morning – and it looked like one of those ‘syncrhonicity’ moments.

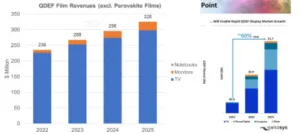

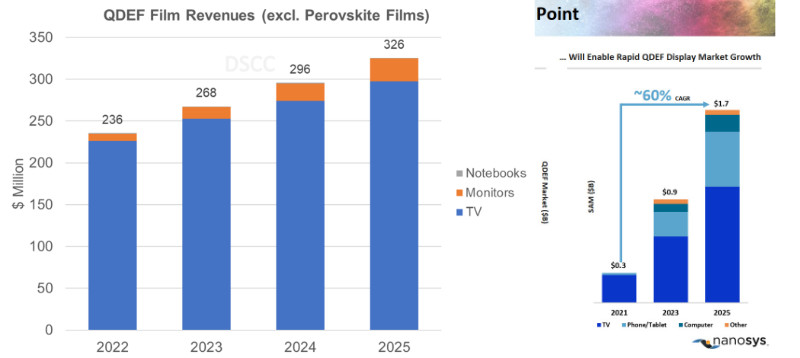

On Tuesday, I wrote about the future of QDEF films (QDEF to Boom or ‘Steady as She Goes’?) and in the article, I compared two very different forecasts for QDEF – one, the forecast put out by DSCC last week on its blog and another that was shown by the CEO of Nanosys, Jason Hartlove and that was attributed to Touch Display Research (TDR). They varied a lot. DSCC had a forecast for a market valued at $326 million by 2025, while the TDR report forecast $1.7 billion.

I was pleased that DSCC commented on the article and confirmed that after reviewing its forecast, it was happy to stick with it. The forecast showed steady growth in value of the market. Now, given that Nanosys has positioned its latest technology as dramatically reducing the cost of the technology, to keep revenue rising the volume in the market has to include a big boost. So, although the value forecast rises steadily, to take into account the drop in cost, the volume had to rise a lot.

DSCC also pointed out that, at the level of cost of the other forecast ($5/m²), to achieve the $1.7 billion number, the material would have to be on every single display produced in 2025 including OLEDs and more, as the total area of the display industry in its forecast is less than the 340 million m² that the other forecast would indicate. Hmmmm….

That got me thinking about how this kind of forecast is made. In the volume display market, the key figure for how the market will develop is the supply/demand balance – that’s what sets the profitability of the industry and in turn drives the investments in new factories. So, to understand what is going to happen, you need to understand both supply and demand.

Supply Forecasting

The volume display industry (I’m ignoring niche applications and products) is built on huge scale with enormous fabs that take massive investments. The technology is also very difficult and new factories take years to ramp up to full production. All of these factors mean that new factories take a lot of time to finance, build, start and then ramp up to full capacity. The factories are full of complex machinery and need a lot of raw materials or semi-finished supplies. In the case of displays, the fabs need a lot of glass and there are few companies that can make the glass – and one of them, Corning, dominates the glass market.

Now DSCC was founded by Bob O’Brien (who used to work in analysis and forecasting for Corning) and Ross Young. I have known Ross for several decades. Before DSCC, among other things, he founded DisplaySearch and that’s when I got to know him and his work. He had been working in the semiconductor equipment market, exploiting his knowledge of the Japanese language, to develop reports on that market. He noticed that a significant proportion of the semiconductor equipment was going into the FPD industry, which was new then. He realised that if he knew what equipment was being installed and in which factories, he could calculate the capacity of the industry which would mean that he had one side of the supply/demand forecast. That has been the research base on which DisplaySearch first, and then DSCC, were built.

One of the key variables that needs real understanding is the yield rate – that is to say, the amount of finished product that is good enough to sell from a given amount of input. Input capacity is set by the equipment used although it can be limited by other factors in the supply chain (e.g. glass or, at the moment, semiconductor driver chips). Understanding the yields and the way that makers reach full yield is a key bit of industry understanding to calculate the overall capacity.

Demand Forecasting

Demand forecasting is a bit trickier than supply because it depends on a lot of factors. TV is the big market for displays (based on area) and so the level of TV sales of different types is really important to understanding the supply/demand balance. That’s a bit harder to forecast than the supply side. It depends on technology, macroeconomics and, most difficult to forecast, human behaviour.

As an example of the complications, I used to have a service forecasting the European TV market. The market forecast was based on factors including the number of homes in each country and the number of sets in each home. There were big differences in the number of TV sets in each home, with some countries having three or more sets on average, while others had just one. One of the assumptions that we had, based on the trends over time, was that the number of sets per home would gradually get closer, with countries that had fewer sets gradually getting closer to those with more. However, over the longer term, that didn’t happen when tablets arrived and people started using those devices to watch TV rather than having extra (generally smaller) sets. Before the iPad, that was difficult to foresee.

So, the demand side of the forecast takes a lot more thought and imagination than the supply side, at least, that’s what I found. If I knew the fab plans and the factories of the set makers, I could reasonably forecast the supply side (and at one time I kept a huge database of all the different fabs – others still do), but demand was much more about judgement and opinion.

I remember discussing with Ross some years ago the reasons why he sold DisplaySearch to NPD. One reason was that NPD had very good point of sale data for the TV market in the US and he felt that a better view of that demand information would really help him to understand the big picture of display supply/demand. NPD later sold the DisplaySearch business to IHS to become IHS Markit which then sold it to Omdia. Omdia still has a number of analysts from the DisplaySearch period.

So going back to the QDEF forecast – I’m pretty confident about DSCC’s forecast for the scale of the display market by 2025. To be significantly wrong, there would have to be huge unexpected investments not only by panel makers, but also by equipment and raw material supplier and those decisions would have to be made very soon. Given the firm’s understanding of all of those three, it would be surprising if it was wrong.

Not All Forecasters Are Reliable

One of the reasons that Display Daily tends to give prominence to particular researchers and analysts is that, over the last few decades, a number of them have turned out to be more right than wrong and have a good understanding of the kind of issues that I have outlined. But not all market researchers are of the same quality or knowledge.

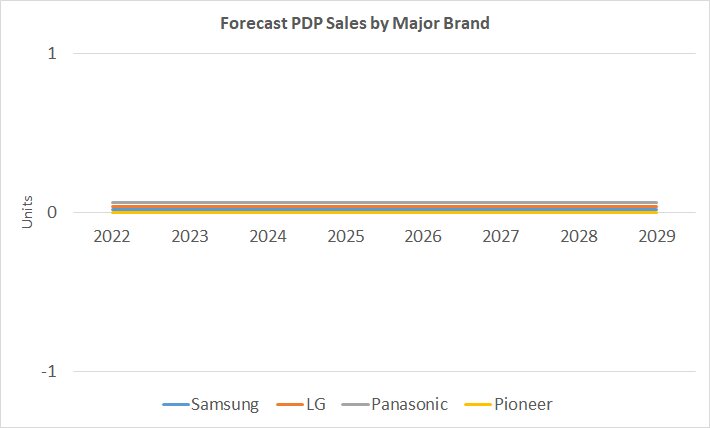

The synchronicity moment that I mentioned earlier happened this morning when I spotted on Google that there was a new market research report that offered to forecast the global market for PDP displays, analysed by major manufacturer. The title was “”Plasma Display Panel (PDP) Market Size By 2029 | Panasonic, Samsung (Korea), LG (Korea), Pioneer (China)”

Now, regular readers who follow the display market will know that the PDP market is extremely stable, although it saw strong growth during some periods in the past. There was no data released for this report, but I thought I could create my own estimate ( see below). An experienced analyst I used to know used to say ‘tell them the forecast quantity or the date, but not both”. In this case, I am extremely confident of the volume forecast, even as far away as 2029*. (BR)

* Those that are new to the industry may not be aware that this is me teasing – nobody makes PDPs any more!