“Take some memories. Leave only footprints.” That old traveller’s advice was on my mind this summer. Seemed as if everyone wanted to visit Portland. It was a hot sunny, California-like summer here with water! Such influx is not new: technology companies discovered the Beaverton-Portland area was a fertile ground for expansions, spin-outs and start-ups in the 1980’s. The mild weather and green forests made it easy to attract and retain engineers from other areas. But some rain was bound to ruin the parade eventually: Planar Systems, the longest surviving US display company is being acquired by Leyard Optoelectronic of China. (Planar to be Acquired by Leyard – subscription required)

As with many Portland-area firms, Planar was a Tektronix spin-out. I bet every engineer over 50 had a Tek oscilloscope on their bench, back in the day. Tek’s focus on instrumentation engendered development of many display technologies such as PALC and EL (electroluminescent) panels. In 1983, the EL development team was spun-out from Planar, and a fellow named Steven Hix was a key member. He went on to become, in my estimation, the most prolific FPD entrepreneur. Hix left his mark on other FPD enterprises such as InFocus Systems, Motif, Steridian and Sarif. Those last three firms may not be remembered widely. They lasted only two, three and nine years respectively. Such short life-spans illustrate the average life times of 74 US FPD makers from 1968 through 2014: 8 years. Adding Planar Systems’s 32-year life raises the historical average to 9 years.

On hearing the news from my apartment manager (an early player at Planar) I asked myself, “What made Planar special”?

Fancy Footwork

Planar was able to pivot; its footprints show steps, twists and back steps, I answered. The business began with a bold ambition to master the art of making EL panels (ELD), and that led Planar to pioneer ALD (atomic-layer deposition, known by IC folk as ALE) technology. Commercial markets outside aerospace-industrial applications developed slowly, however, and Planar turned its head toward its key market segment. By 1994, Tektronix was ready to divest more display-related businesses and Planar was ready to add more lines of business in the aero-industrial segment. Planar acquired Tek’s CRT and AMLCD avionics lines, but it was not done. Planar soon bought the AMLCD assets of Standish Industries (1989–1997), which in turn had just acquired Hamlin (an AMLCD pioneer: 1980–1987).

I recall seeing Japanese AMLCDs in airplane cockpits by the 1990s. Perhaps Planar recognised the problem also. It closed the AMLCD avionics business in 2000 and the CRT line in 2001. At the same time, Planar targeted the adjacent industrial space with acquisition of AllBright Technologies, which added ATM and kiosk display product lines. Pricing such lines competitively led Planar down the path of outsourcing. It started buying panels from Asian makers.

The next step into industrial markets led to acquisition of DOME Imaging Systems in 2002. That US-based, medical imaging business extended Planar’s path toward forward integration and rearward outsourcing. Planar closed its old EL lines as well as the AMLCD facilities acquired from Standish.

Planar stepped further into systems business with acquisition of Clarity Visual Systems (1995–2006) in 2006 and Runco International in 2007, which included Projectavision’s laser-projection assets. Thus, some 24 years after starting out, Planar’s momentum paralleled that of nearby InFocus (1986–2009). Both were projection display system integrators widening their technology portfolios. That did not go well, apparently. AMLCD TV sets and signage got a lot bigger, as I recall. Planar divested the former DOME medical imaging assets and impaired (wrote-down) both the Clarity and Runco assets in fiscal 2008.

By 2013, one of the few valuable technologies remaining was sold to Beneq (Beneq Brings Transparency to EL Displays – subscription required). That transaction ended the long path toward ALD fabrication of ZnS:Mn and Al2O3 films Planar had taken in the 80’s. The Beneq deal returned the ownership of ALD technology to its birthplace, in Finland. The deal also returned Planar to a business with one major product line… the next divestiture would include the company itself.

The core capability Planar retained after 2008 was building tiled AMLCD systems for advertising and signage. The company developed a smart way to package modules so they could be replaced from the front side quickly and easily. Signage contractors found such designs reduced life-time costs. I think this is the capability Leyard Optoelectronic of Shenzhen wants to own. Leyard is already active in the market for tiled iLED signage but their mechanical designs do not appear as sophisticated as Planar’s.

Leyard iLED Tile

Domestic Footprint

The path away from display making to system integrating concentrated Planar’s customer base in the USA. By 2014, 81% of Planar’s employees were based in the US, where more than two-thirds of all sales originated. Thus, Leyard will gain significant presence in the US signage market. Layard will also gain a wide range of technical capabilities that may advance its position in Asian markets.

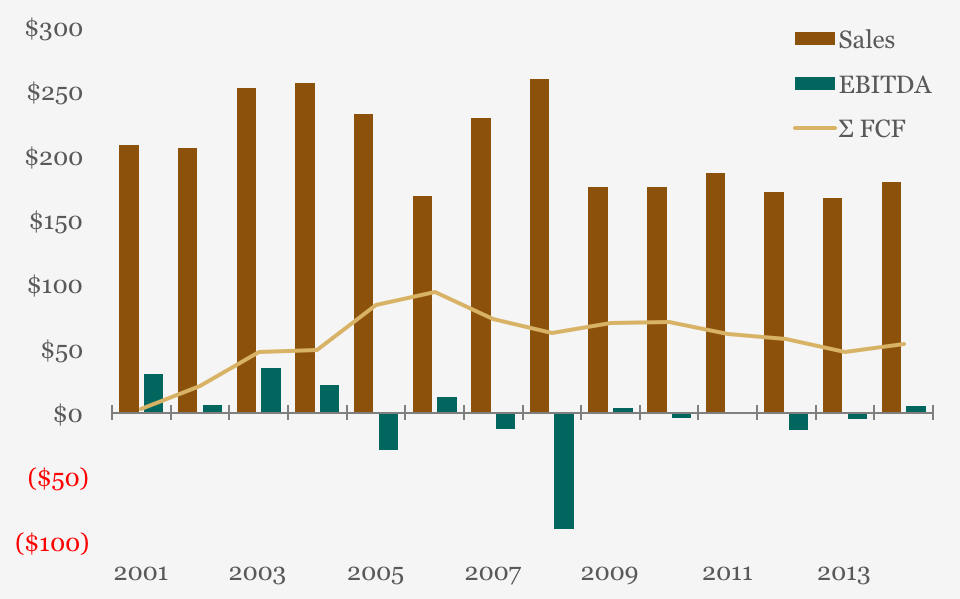

Planar’s track record may have disappointed some shareholders but it managed to accumulate $53 million of positive free cash flow (FCF) from 2001 to 2014. Note that is positive FCF because Planar managed to generate more cash from operations than it spent on new fabs. Thus, while I must note that Planar accumulated an operating loss of $167 million after the Clarity-Runco deals (2007–2014), the longer-term FCF generated is more than many display makers have achieved since 2001. The chart plots Sales revenue, EBITDA (cash operating profit before depreciation) and cumulative free cash-flow in millions of dollars. Some readers may recognize the plot style from my past presentations at SID conferences and recall poorer performance by Asian makers.

Investors might not grade on a curve and be so forgiving, however. In the end, while it managed to generate some cash, Planar did not keep pace with the global market. After twisting and turning for 32 years, Planar appears to have run out of room to manoeuvre.

But new US footprints were discovered recently. In August, only 16 days after the Planar announcement, FlexTech Alliance announced it won the bidding to create a Flexible Hybrid Electronics Manufacturing Facility sponsored by the US DoD. The facility will be located near San Jose, not Portland, but that makes sense given the range of materials and assembly expertise there (besides, they’ll probably move North in search of water). Such initiatives may foster emergence of another Planar, albeit one more focused on flexible electronics than on glass displays. If the past is any guide, the next generation of flex-based manufacturers may wander about for some time seeking paths to markets. I wonder what footprints they will leave to our children to find.

Editor’s Note

Leyard had an impressive display at IBC in Amsterdam this week and we’ll be reporting on that in Large Display Monitor, shortly. (BR)