What They Say

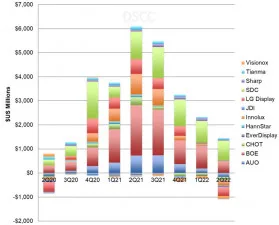

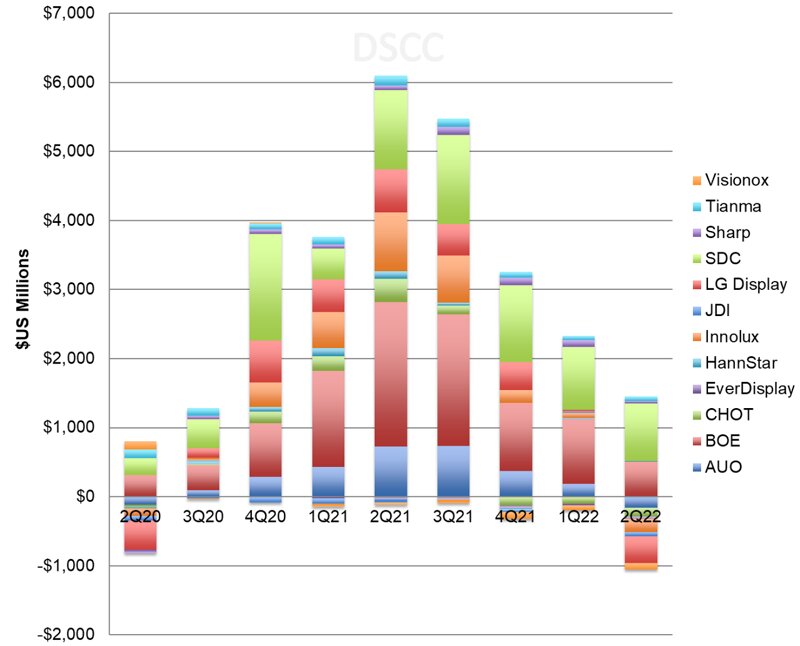

DSCC has updated its analysis of the state of the industry now that all the numbers are in for Q2. The great profits of last year have now turned to losses for many.

Total revenues decreased by 17% Q/Q and were down by 25% Y/Y at $27.8 billion, down 30% from their all-time high of $39.4 billion in Q4’21. After five quarters where BOE held the top position in revenue share on the strength of high LCD panel prices, Samsung Display regained the lead in revenue in the second quarter. Samsung revenues decreased by 8% Q/Q but it gained share from 20% to 22% of industry revenues. BOE revenues fell by 22% Q/Q and 35% Y/Y and BOE’s share dropped from 21.5% to 20.2%. LGD’s share held steady at 16% as its revenues declined 17% Q/Q in line with the industry total. Then there is a cluster of four companies between 7% and 9% share: AUO, Innolux, CSOT and Sharp, each with revenues in the range of $1.8 billion – $2.6 billion.

What We Think

There is commentary on the blog post covering margins, revenues, EBITDA, inventory and free cash flow (with charts) on the blog. The information is hardly news but is a useful summary of where we have got to. It’s not pretty, particularly as inventories were at double the level of Q2 2020 this year at $16 billion.

Year’s ago, I used to talk about the ‘whiplash’ effect for monitor makers. At the time, the revenues/sq metre for panels were lowest, so when there were shortages, their supply was most constrained, but when there was surplus, that segment saw the most dumping. The TV business is now in that position and, in particular, the LCD supply chain in China. So, the firms that profited most from the boost last year (and then got greedy) are the ones that are suffering now. I don’t wish suffering on anybody in the industry, but it does feel as though there is some ‘poetic justice’ here! (BR)