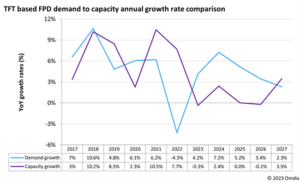

Capacity used to manufacture OLED and LCD panels will decline in 2023 for the first time in the history of flat panel displays (FPDs), according to Omdia’s recently released OLED and LCD Supply Demand and Equipment Tracker. Even though the 2023 decline is small, it is significant considering that FPD capacity expanded continuously at a compound annual growth rate (CAGR) of 22.6% between 2000 and 2022.

“As panel supply shifted from being extremely tight between 2H20-1H21 at the height of the pandemic-driven demand surge, to unprecedented oversupply in 2H22, FPD prices and panel maker profitability have cycled from record highs to record lows”, commented Charles Annis, Omdia’s Display Research Practice Leader.

With the FPD industry continuing to suffer from excess capacity, panel makers are now accelerating the consolidation of under-utilized legacy factories, as well as delaying new factory ramp-ups, and pushing out future investment plans in order to reduce operating costs and conserve cash.

Slowing capacity growth can cause trouble for FPD supply chain companies that rely on new factory construction for business, but at the same time, it enables the industry to self-correct to a healthy balance between panel supply and demand with more stable pricing and profitability.

“Area demand for active-matrix OLEDs, LCDs, and EPDs will increase by almost 61 million square meters from 2022 through 2027, a CAGR of 4.5%. This growth will be driven primarily by a continuous shift to larger display devices, particularly televisions. Over the same period, manufacturing capacity is forecast to increase by approximately 22 million square meters or a CAGR of 1.1%.”

These modeled differential growth rates will start to reduce the supply glut this year and mainly return the market for large-size FPDs to supply-demand equilibrium in 2025.

The slowdown in capacity growth reflects the maturing of the FPD industry. Regardless, the industry remains vibrant with continuous diversification of display applications and technologies.

Even as older LCD facilities are repurposed or shuttered, many new advanced manufacturing facilities are actively being planned. China Star and Tianma will expand or invest in new highly flexible LCD facilities in 2024. Samsung Display, BOE, and LG Display are all likely to build Gen 8.7 OLED factories targeting IT applications within the next two years. Longer term, these same leading producers as well as AUO, Visionox, Vedanta, and various other companies are evaluating capacity expansion strategies that are in line with the evolving display market. In addition to LCDs and OLEDs, this will include increased investment in, and continuous adoption of alternative technologies such as electronic paper, micro LED, and OLED on Silicon displays.