The semiconductor market experienced a decrease in revenue for five consecutive quarters from 2022 through to the first quarter of 2023. According to Omdia, this is the longest period of decline recorded since it began tracking the market in 2002. The revenue in the Q1’23 settled at $120.5 billion, down 9% from 4Q’22. This decline was preceded by a period of growth between the fourth quarter of 4Q’20 and 4Q’21, during which the market reached record revenues each quarter due to the increased demand triggered by the global pandemic.

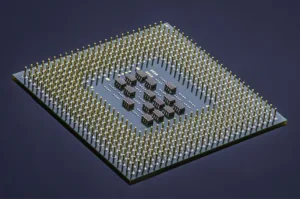

Two significant components of the semiconductor market, memory and microprocessor units (MPUs), have been major contributors to this recent decline. The MPU market size reduced to $13.1 billion in Q1’23, just 65% of its size from Q1’22 when it was $20 billion. The memory market was hit harder, with Q1’23 figures coming in at $19.3 billion, just 44% of the market in Q1’22 when it was $43.6 billion. The combined decline of these two markets was 19% in Q1’23, which greatly contributed to the overall 9% quarter-over-quarter (QoQ) decrease in the semiconductor market.

The market is currently suffering from a lack of demand that has led to decreasing average selling prices (ASPs) for many semiconductor components. Despite this, there is still demand for semiconductors in the area of generative AI. Nvidia, a company leading in this area, has experienced strong revenue growth, standing out in contrast to the general decline in the semiconductor market. However, other semiconductor companies have yet to make similar strides in this niche.

The downturn in the memory market over the last three quarters has led to a shift in the market share rankings among semiconductor companies. A year ago, three of the top five companies by revenue were memory companies: Samsung, SK Hynix, and Micron. As of the Q1’23, only Samsung remains in the top ten. The last time both SK Hynix and Micron were not included in the top ten rankings was in 2008, illustrating the current struggles faced by memory-focused semiconductor companies.

Nvidia and Infineon were two companies highlighted for their strong performance despite the market downturn. Nvidia’s financial results exceeded estimates due to the robust demand for their generative AI chips. Infineon also moved into the top ten rankings this year following an 11% increase QoQ, driven largely by its strength in the automotive sector.