Warranty Week has delved into the warranty reports of the top (non-US) consumer electronics companies – although the news is not hugely surprising.

As in past years, product warranty costs remain a minor expense for most of the top CE companies. Aside from notebooks and smartphones, the warranty expense rate for most CE products are generally not that high. For example, while most vehicle manufacturers see expense rates of between 2% and 3% of total revenue, three of the top four CE makers have never seen expense rates above 1% – and the only one that has (Sony) is the only one with a major presence in the notebook market.

The news begins with Panasonic, a top global CE brand. In the past decade, expense rates have been in the 0.6% and 0.7% range. In the most recent fiscal year, claims costs were sub-0.4%. Accruals (the money set aside to deal with warranty claims) were at a similar level. Accruals have been declining at Panasonic for five consecutive years.

Putting this data in context, Panasonic banks about $0.35 in warranty costs when it sells a $100 TV. However, Warranty Week found that Best Buy was selling a $200 32″ Panasonic TV, with an optional extended warranty for $25 for two years of coverage, or $40 for five years. That’s a good margin! Of course, this is dealing with tier one brands – lesser-known brands’ products may be liable to break more often.

Unlike TVs, smartphones and PCs – especially notebooks – have high warranty costs. These products are much more liable to break. In fact, Warranty Week writes, ‘we suspect that some of the smartphone protection companies have at times under-priced the risk, and lose money on their protection plans’.

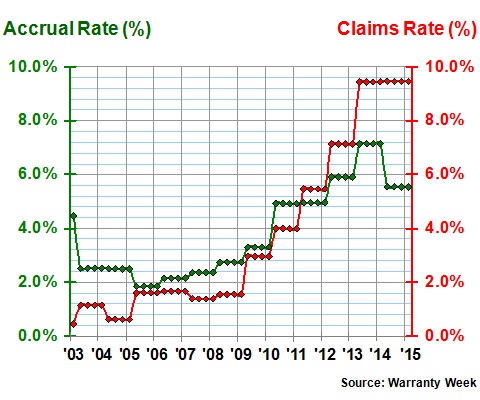

Sony Average Warranty Claims & Accrual Rates

Sony‘s warranty expenses are relatively high, compared to Panasonic’s – in the 1.5% range for both claims and accruals. This is because the firm makes smartphones and, until mid-2014, also produced notebook PCs. As the existing PCs that Sony is responsible for age out of their warranty coverage, the company’s costs is likely to fall back below 1%. This is the same thing that happened when IBM sold its Thinkpad line to Lenovo.

However, Sony Mobile Communications still produces smartphones – and was the only money-losing sector of the company in the last fiscal year. Sony blamed the net loss on the write-off of goodwill and high ratio of US dollar-denominated costs. Unit sales were flat, however, so it is likely that much of the increase came from repair costs.

Looking at Canon, which has never been a part of the smartphone business and left PCs many years ago, its warranty expenses peaked in 2008 and 2009 – although even then, they were only between 0.6% and 0.75%. Currently, expenses are around 0.4%. Canon’s total revenue fell slightly in 2014, and its accruals rose by about 17%. Currently, Canon’s claims rate is at its lowest point since 2004, but accruals are at their highest point since 2010.

Hitachi is another success story in cutting warranty costs. Claims and accruals have fallen to below 0.2%, and have been there since 2012. Little of Hitachi’s revenue these days comes from ‘true’ CE, such as projectors – instead, it is focused on enterprise systems, such as servers and scanners; and a host of heavy industry products, such as automotive systems and wind turbines. About 7% of sales come from home appliances.

Blackberry Average Warranty Claims & Accrual RatesAnother company known for its appliances is Electrolux – although these appliances are increasingly controlled by electronics. The company rarely spends more than 1% of revenue on warranty expenses – far lower than its US rival, Whirlpool. Accruals were slightly higher in 2014, but the claims rate is continually around the 0.8% mark.

Blackberry Average Warranty Claims & Accrual RatesAnother company known for its appliances is Electrolux – although these appliances are increasingly controlled by electronics. The company rarely spends more than 1% of revenue on warranty expenses – far lower than its US rival, Whirlpool. Accruals were slightly higher in 2014, but the claims rate is continually around the 0.8% mark.

The final company is Canada’s Blackberry, formerly RIM. Warranty Week reports that Blackberry has finally seen its ‘escalating warrant crisis at least plateau’. Hardware sales are down, but warranty expenses have fallen by a similar amount, so claims have stayed about the same – just under 9.5% (still very high compared to other companies on this list, but remember that Blackberry is focused on the smartphone market). Accruals did fall slightly in the recent fiscal year, from 7.1% to 5.5%.

Blackberry embodies Warranty Week‘s point: as the footprint of CE shrinks, warranty costs rise. Notebooks cost more than desktops, and handhelds are the most expensive of all.