The European smartphone market declined by 11% year-on-year in Q2 2022, according to the latest research from Counterpoint Research’s Market Monitor service, registering the lowest quarterly total since the early part of the COVID-19 pandemic.

A deteriorating economic climate and ongoing geopolitical uncertainty continued to hamper both Europe’s and the world’s recovery from the COVID-19 pandemic and chip shortages.

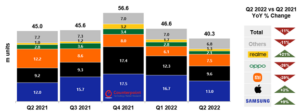

Q2 2022 European Smartphone Shipments and Growth

Source: Counterpoint Research Quarterly Market Monitor, Q2 2022.

Note: OPPO includes OnePlus since Q3 2021.

Counterpoint Research’s Associate Director, Jan Stryjak said, “it was a mixed bag of results in Q2 2022, and year-on-year comparisons mask complex market dynamics. Much has changed in Europe compared to last year and even last quarter, both from an industry and macro perspective.”

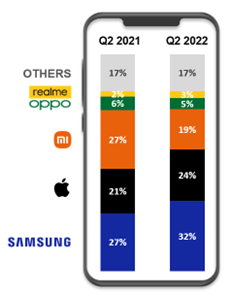

Q2 2022 European Smartphone Shipments Share

Source: Counterpoint Research Quarterly Market Monitor, Q2 2022.

Note: OPPO includes OnePlus since Q3 2021.

Samsung remained Europe’s number one vendor and grew both shipments and market share over the year, but this was mostly thanks to Q2 2021 being Samsung’s lowest European shipments total in over a decade due to factory shutdowns in Vietnam. Compared to Q1 2022 though, Samsung’s European shipments dropped by almost a quarter due to its withdrawal from Russia.

Apple also grew both shipments and market share year-on-year in Europe – largely due to the launch of the 5G-enabled iPhone SE – but it declined drastically quarter-on-quarter for the same reason as Samsung.

Xiaomi declined from a peak in Q2 2021, which was its best quarter in Europe ever, having been hit particularly hard by supply issues. However, Xiaomi made the most of Samsung and Apple’s Russian withdrawal and gained significantly quarter-on-quarter, especially in Eastern Europe.

Rounding out the top five, OPPO was hit by supply and manufacturing issues in China, while realme continued its impressive performance in Europe with double digit year-on-year shipment growth (although growth has stalled a bit in recent quarters).

Commenting on the outlook for the rest of the year, Stryjak added “the situation in Europe unfortunately remains bleak. Many countries in Europe are slipping closer to recession, and domestic political tensions in numerous countries beyond Russia and Ukraine are rising, for example in France, Germany and the UK. We remain hopeful, though, that the bottom has been reached and the trajectory should turn upwards soon, but the recovery will likely be long and slow.”