2021 was another rollercoaster year for the European smartphone market. Promising early signs suggested that the market was recovering from a difficult 2020, during which the COVID-19 pandemic hit the region hard causing both supply- and demand-side issues. However, COVID-19 impacts continued into 2021, and then Europe faced a new challenge: the global component shortage hit the region towards the middle of the year.

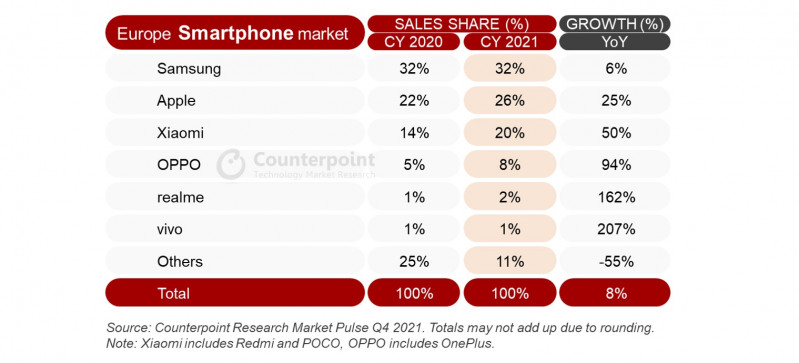

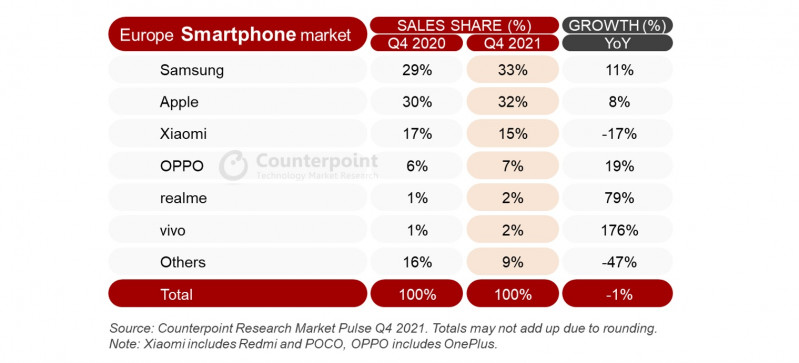

So, while the total European smartphone market managed to grow by 8% in 2021, this was only a partial recovery.

Counterpoint Research’s Associate Director, Jan Stryjak said, “It is great to see the European smartphone market growing in 2021, but that only tells half the story; COVID-19 impacts resulted in a 14% annual drop in sales in 2020, which means the market is still well-below pre-pandemic levels.”

Full year European Smartphone Sales Market Share and Growth

Stryjak added, “a major factor to consider, though, is the decline of Huawei. Huawei’s sales dropped by almost 90% annually in Europe in 2021, leaving it on less than 1% market share and in 8th position (down from 4th in 2020). But while Huawei had another year to forget in Europe, other vendors, especially some of the Chinese challengers, certainly had a year to celebrate.”

A year of ups and downs in Europe

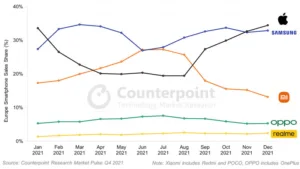

A major theme carried over from 2020 was vendor competition, and 2021 saw the most intense competition yet. Leadership of the European smartphone market changed hands four times throughout the year, while some brands enjoyed their best year for sales in Europe ever.

Market leadership changed hands four times in 2021

Riding the wave of the launch of its first 5G iPhone, Apple started the year on a high with a market leading 34% share. In February, Samsung launched its Galaxy S21 series which, at least initially, sold well, helping Samsung’s sales grow by 24% compared to January and pushing it to the top spot in February 2021. Samsung then suffered significant supply issues starting in May due to COVID-19 related factory shutdowns in Vietnam, which opened the door for Xiaomi to become number one in Europe for the first time, in June 2021 (helped by good growth in Russia, Spain and Italy).

Xiaomi’s leadership was short-lived, though, as Samsung retook the lead in July 2021 off the back of strong A series sales. Samsung then extended its lead with the launch of its popular Galaxy Z foldable smartphones, while Xiaomi was hit badly by component shortages. Samsung continued to lead the market for the next few months, despite the best efforts of Apple, whose iPhone 13 launch stumbled in October 2021. However, a traditionally strong end of the year finally gave Apple the lead in November 2021, a lead which Apple extended to reach it’s highest ever share in Europe in December 2021.

Despite its difficulties in the second half of the year, Xiaomi finished 2021 with its highest annual smartphone sales ever in Europe, a feat shared by other relatively new entrants OPPO (boosted by its merger with OnePlus in June 2021), realme and vivo.

These brands all have big plans for Europe this year, with some impressive flagship devices expected to launch in the region in the next few months. Meanwhile, Samsung will hope its latest flagship S22 device will perform better than the S21 and S20, and the rumoured iPhone SE should give Apple a mid-season boost. And with Motorola, Nokia HMD and HONOR all seeing resurgences in Europe in recent months, 2022 could see the most intense competition in Europe yet.