Smartphone sales in Q1’15 rose 19.3% YoY, to 336 million units, says Gartner. Emerging markets – excluding China – led growth, with the fastest-rising regions named as emerging APAC, Eastern Europe, the Middle East and North Africa. Sales in emerging markets rose 40% YoY over the period.

Local brands and Chinese vendors were “the clear winners” in emerging regions, said Gartner’s Anshul Gupta. These companies recorded 73% smartphone sales growth, and their combined market share rose from 38% to 47%.

Apple continued to perform strongly, particularly in China. iPhone sales rose 72.5% YoY in Q1, boosting Apple to the top spot in China’s smartphone market – just ahead of Xiaomi – for the first time. Greater China was the company’s largest market by volume. Apple’s extension to more countries in Asia helped it to close in on Samsung in the global market; last year’s difference of 40 million units has been halved, to just over 20 million.

Samsung’s sales and share continued to decline YoY, although it achieved 11% QoQ growth. Gartner expects Samsung’s decline to be slower than that seen in recent quarters, thanks to its new flagship Galaxy S6 and a good response to its Galaxy Alpha line.

| Worldwide Smartphone Sales to End Users by Vendor in Q1’15 (000s) | ||||

|---|---|---|---|---|

| Vendor | Q1’15 Units | Q1’14 Units | Q1’15 Market Share | Q1’14 Market Share |

| Samsung | 81,123 | 85,507 | 24.2% | 30.4% |

| Apple | 60,177 | 43,062 | 17.9% | 15.3% |

| Lenovo | 18,888 | 16,721 | 5.6% | 5.9% |

| Huawei | 18,102 | 13,450 | 5.4% | 4.8% |

| LG | 15,428 | 11,200 | 4.6% | 4.0% |

| Others | 142,335.6 | 111,697.8 | 42.4% | 39.7% |

| Total | 336,054.4 | 281,636.8 | 100.0% | 100.0% |

| Source: Gartner | ||||

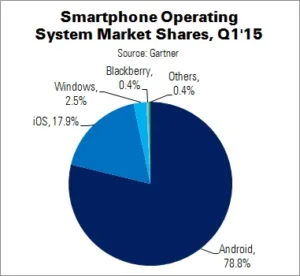

Looking at operating systems, Android fell 1.9 percentage points, while iOS achieved growth for the third quarter in a row. In volume terms, Android was down 4% YoY in China for the first time. Windows Phone was flat, mainly due to a weak ecosystem and a strong, established and competitive smartphone market. Predictions are good for Windows 10, but developer response remains to be seen.

460.3 million mobile phones (smartphones and feature phones) were sold in Q1’15: a 2.5% YoY rise. Thanks to strong smartphone sales, Indian and Chinese vendors increased their share over the period; six of them were in the top 10.