20.8 million PCs were shipped in EMEA in Q4’15 – an 18.2% decrease YoY, says IDC. Shipments were strong between summer 2014 and January 2015 thanks to Microsoft’s Bing promotion, so comparisons were unfavourable. Since then, hardware manufacturers and their channel partners have focused on lowering stock levels. Shipments were down 18% for the year as a whole, to 76.3 million units.

The end of Windows XP support drove commercial PC shipments in 2014, as well as the need to renew the first Windows 7 portables, four years after their deployment. Bing promotions, as mentioned, drove the consumer market. Channel partners were also led to ‘gamble’ on cheap products in Q4’14, due to the strengthening US dollar.

The above factors meant that 2015 became a costly year, as inventory clearing took 11 months and required big promotions and price cuts. The introduction of Windows 10 and new CPUs in 2015 failed to reverse the poor YoY comparisons. However, there are some signs of stabilisation, and the 2015 results will lead to more positive comparisons with 2016.

“[I]f you take Bing out of the comparison, the consumer market would end the year [2015] flat, which is an encouraging sign of stabilisation”, said IDC’s Chrystelle Labesque.

All three EMEA sub-regions contracted in 2015. Western Europe (WE) was down by 13.1%. Central and Eastern Europe (CEE) fell 24.7%, while the Middle East and Africa (MEA) fell 28.9%.

The UK market reported the best result in WE. Shipment volumes in the commercial segment, across the sub-region but especially in Austria and Italy, were supported by some public spending. A sharp fall in oil prices, together with political and currency instability, affected the CEMA region. A slow-down in the Chinese economy is having an impact on the business outlook of export-oriented WE countries.

For the year as a whole, WE declined 13.8% YoY, and CEMA by 24.6%. Market consolidation became more obvious, as the top three players (HP, Lenovo and Dell) took 54% of the market, compared to 50% in 2014.

Speaking about CEE, IDC associate VP Stefania Lorenz said, “The region was negatively affected by the devaluations of local currencies and high PC inventory levels left from 2014. The worst impact on purchasing power was felt in the Eastern part of the region: Russia, Ukraine, Kazakhstan as well as the ‘Rest of CEE’ subregion. Other factors that prevented the market from rebounding in the commercial space included government budget freezes.”

The top performer in CEE in Q4’15 was Hungary, with 11.5% growth thanks to last-minute public sector deals. Other CEE countries reported PC declines – again, partly due to poor YoY comparisons. This resulted in a sharp decline in Poland, the Czech Republic, Bulgaria and Croatia.

In 2015, the MEA region was down 22.8% YoY, affected by political and economic instability, as well as currency fluctuations, low oil prices and a lack of projects and IT spending. Q4’15, the market contracted 28.9%. The largest markets (Turkey and ‘Rest of Middle East’) reported the worst results, declining 43% and 51%, respectively.

| Top 5 Vendors’ EMEA PC Shipments, Q4’15 (Preliminary) (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q4’15 Unit Shipments | Q4’14 Unit Shipments | Q4’15 Share | Q4’14 Share | YoY Change |

| HP | 4,932 | 5,961 | 23.7% | 23.4% | -17.3% |

| Lenovo | 4,032 | 5,019 | 19.3% | 19.7% | -19.7% |

| Asus | 2,218 | 2,160 | 10.7% | 8.5% | 2.7% |

| Dell | 2,106 | 2,390 | 10.1% | 9.4% | -11.9% |

| Acer | 1,804 | 2,412 | 8.7% | 9.5% | -25.2% |

| Others | 5,718 | 7,494 | 27.5% | 29.5% | -23.7% |

| Total | 20,809 | 25,436 | 100.0% | 100.0% | -18.2% |

| Source: IDC | |||||

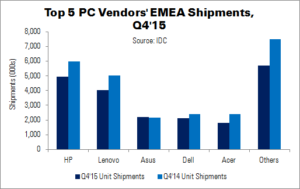

In vendor terms, consolidation continued across EMEA. The top five vendors now represent more than 72% of the total market.

HP performed above the market average, and gained share to end at 23.7%. The vendor was especially strong in desktops. Lenovo maintained its second place spot, focusing on inventory depletion, although it suffered in MEA.

Asus reached third place and exhibited strong growth, particularly in WE. Overall, results were good after a weak 2014. Dell followed in fourth place, growing faster than the market and gaining share. Finally, Acer’s performance was softer than last year. The company focused on clearing inventory, while gaining traction on its Windows 10 consumer products.

Apple ranked sixth, outperforming the market. Toshiba came in at seventh and Fujitsu, although performing above the market, maintained its eighth place spot. MSI and Wortmann AG finished off the top 10.

| Top 5 Vendors’ EMEA PC Shipments, 2015 (Preliminary) (000s) | |||||

|---|---|---|---|---|---|

| Vendor | 2015 Unit Shipments | 2014 Unit Shipments | 2015 Share | 2014 Share | YoY Change |

| HP | 17,915 | 20,652 | 23.5% | 22.2% | -13.3% |

| Lenovo | 15,224 | 17,033 | 19.9% | 18.3% | -10.6% |

| Dell | 8,138 | 9,201 | 10.7% | 9.9% | -11.6% |

| Asus | 7,152 | 8,161 | 9.4% | 8.8% | -12.4% |

| Acer | 6,808 | 9,906 | 8.9% | 10.6% | -31.3% |

| Others | 21,113 | 28,190 | 27.7% | 30.3% | -25.1% |

| Total | 76,350 | 93,143 | 100.0% | 100.0% | -18.0% |

| Source: IDC | |||||