25.5 million PCs were shipped in the EMEA region in Q4’14, according to IDC: a 2% YoY increase. The market remained positive for the third consecutive quarter, thanks to strong consumer demand. Over the course of the year, the region experienced 5.5% YoY growth with 93.3 million units shipped.

Regional differences were pronounced. Consumer demand in Western Europe drove growth, with shipments rising 10.7%, while CEE contracted 18.7% and MEA rose 2.6%.

Vendors stocked up ahead of end-of-year and January sales, and before the change to low-cost Bing promotions in February, which will exclude 15″ notebooks. The result was a 5.3% rise in portable PC shipments across EMEA. Desktop shipments shrank 3.5%.

Northern Europe, Russia and other countries in the CEMA region were hit by currency fluctuations. Additionally, investments were held back by an unstable political situation and macroeconomic weaknesses. The trends across EMEA show a ‘strong’ need for renewals in mature markets, while highlighting the struggling emerging economies.

Shipments ahead of pre- and post-Christmas promotions underpinned Western European growth. Central Europe saw no major uplift, but France and the UK experienced double-digit rises. Southern Europe (Spain, Greece, Portugal and Italy) continues to recover after several years of decline.

Promotions have been important, driving demand and boosting consumer portable PC and desktop shipments by 18.2% and 13.2%, respectively. With Windows XP replacements drawing to a close, their positive impact on desktop shipments has ended, which explains the 3.9% fall in commercial shipments. There was also a drop in sell-in of business desktops, due to pockets of inventory remaining across the region. Commercial demand remained high for portables, however, with 12.6% growth posted. Overall shipment growth in Western Europe was 1.6% for desktops and 15.9% for portables.

Maciek Gornicki, senior research analyst, commented that the upcoming change to Windows 8.1 with Bing led to portable PC inventories building up through Q4, “contributing further to higher levels of stock in the supply chain, which might translate into deceleration in consumer shipments in the first half of 2015″.

The CEE region experienced a 14% YoY fall for 2014 as a whole – the second year of double-digit declines, most affected by events in the eastern part of the region. Excluding the east, central Europe’s PC market rose 7.9% in Q4 (compared to an 18.7% fall for CEE).

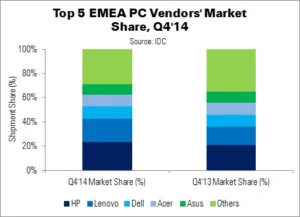

The top three vendors in EMEA represent more than half the market, and the top five more than 70%.

| Top Five EMEA PC Vendors’ Preliminary Shipments, Q4’14 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q4’14 Units | Q4’13 Units | Q4’14 Market Share (%) | Q4’13 Market Share (%) | YoY Change (%) |

| HP | 5,952 | 5,198 | 23.3% | 20.8% | 14.5% |

| Lenovo | 5,020 | 3,828 | 19.6% | 15.3% | 31.1% |

| Dell | 2,491 | 2,376 | 9.8% | 9.5% | 4.8% |

| Acer | 2,487 | 2,552 | 9.7% | 10.2% | -2.5% |

| Asus | 2,201 | 2,276 | 8.6% | 9.1% | -3.3% |

| Others | 7,399 | 8,818 | 29% | 35.2% | -16.1% |

| Total | 25,549 | 25,048 | 100% | 100% | 2% |

| Source: IDC | |||||

HP, the market leader, outperformed the market and had a 23% share. Strong gains were made in portable PCs (up 29%) and the vendor led both portable and desktop segments, despite a small contraction in the latter category.

Lenovo again experienced the strongest growth of the top vendors, reaching almost a 20% share across the region in Q4. The company’s growth was particularly high in southern Europe.

Dell rose faster than the market and gained share, performing well in portable PCs and the CEE region. Acer, meanwhile, recorded a softer performance – partly due to its strong showing last year. Asus, the fifth-place vendor, continued to grow aggressively in the desktop space (albeit from a small initial base). Asus’ success in tablets appears to have come at the expense of portable PCs, which fell slightly.

Outside the top five, Apple (sixth) benefited from strong consumer demand. Toshiba (seventh) did not fully exploit consumer trends due to a focus on the commercial market; Fujitsu (eighth) also focused on the commercial space. MSI came in ninth and Wortmann in 10th.