The Europe, Middle East, and Africa (EMEA) traditional PC market, (desktops, notebooks, and workstations) grew 12.7% YoY in 2021Q3, for a total of 24.4 million units, according to International Data Corporation (IDC). A strong commercial performance throughout the region is the main driver of this growth, offsetting a slowdown in consumer, which could not keep up with the unfavorable growth rates seen in 2020Q3.

The Western European PC market enjoyed solid growth (15.8% YoY). Desktops continued their upward trend and increased 21.8% YoY — outgrowing notebooks (+13.1%) for the first time in six quarters. Desktop growth can be attributed to strength on the commercial side, as employers look to equip and refresh their increasingly populated offices. Notebooks also saw solid commercial shipments but were stifled by component shortages, primarily in IC boards and panels.

“Though the ongoing component supply issues are set to continue well into next year, shipments in the Western European market — especially on the commercial side — are still strong,” said Simon Thomas, research analyst for IDC Western European Personal Computing Devices. “Lockdowns have concluded and offices have reopened, meaning less consumer spending and higher expenditure from businesses.”

The consumer market in Western Europe saw its first decline in six quarters, posting a slight decline of -0.2% YoY (6.6 million units shipped). As expected, the end of lockdowns led to consumers spending more on leisure and less on PCs, which temporarily slowed the transition from one device per household to one device per person. Both desktop and notebook had a flattish performance (+0.0% YoY and -0.3% YoY respectively).

The Western European commercial market posted substantial growth of 30.6% YoY, driven by a 41.6% YoY rise in desktops — a strong recovery after six consecutive quarters of decline. Notebooks grew by 25.8% YoY. The reopening of offices has led to devices being refreshed and the acquisition of devices to be used in hybrid working schemes.

Overall PC shipments in both CEMA regions, CEE and MEA, continue to be positive despite ongoing component shortages, reporting an increase of 0.5% and 15.9% YoY respectively.

“The commercial segment in CEE recorded growth of 18.0% YoY, benefitting from delayed projects and large education deals taking place in a few countries in the region. Also, demand was strong due to the ongoing new hybrid way of working as well as the easing of social restrictions with companies investing and renewing their products,” said Nikolina Jurisic, associate director, IDC Europe. “A slowdown was witnessed in the consumer segment [-10.5% YoY] after five quarters of strong market performance. The MEA region, like CEE, was driven exclusively by the commercial space, reporting two extraordinary education deals of nearly 400,000 units shipped in the region.”

Vendor Highlights

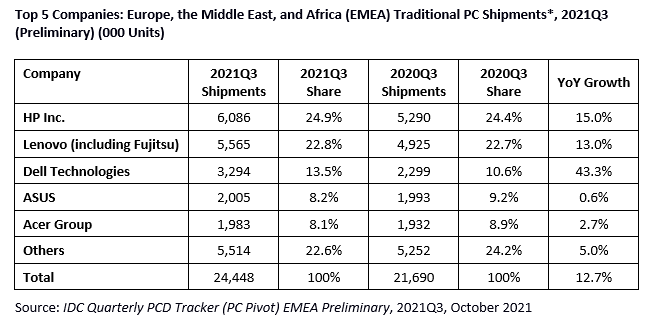

The consolidation of the traditional PC market slowed again as the top 5 vendors’ share slipped in 2021Q3. The top 5 players accounted for 77.4% of total market volume, falling from 80.4% in 2021Q2.

-

HP Inc. regained first position, with a market share of 24.9% (+0.5% points YoY). The vendor saw overall growth of 15.0%, driven by a strong commercial performance (+28.1% YoY).

-

Lenovo (including Fujitsu) fell to second position, with a market share of 22.8% (+0.1% points YoY). The vendor lost first position despite double-digit growth in both desktops (+17.3% YoY) and notebooks (+10.6% YoY).

-

Dell Technologies held third position with a market share of 13.5% (+2.9% points YoY). Strong commercial growth (54.2% YoY) offset a consumer decline (-12.8% YoY).

-

ASUS rose to fourth position, with a market share of 8.2% (-1.0% points YoY). The vendor grew 0.6% YoY overall, driven by a 3.4% rise on the consumer side.

-

Acer Group fell to fifth position and held a market share of 8.1% (-1.4% points YoY). The vendor saw a rise in shipments of 2.7% YoY, driven by a 5.7% YoY increase on the desktop side.