The Europe, Middle East, and Africa (EMEA) market for gaming PCs posted another quarter of solid growth in 2021Q2, growing 10.8% YoY and recording 2.5 million units shipped, according to International Data Corporation (IDC). Approaching the end of 2021, growth is expected to continue, albeit at a lower rate than in recent quarters.

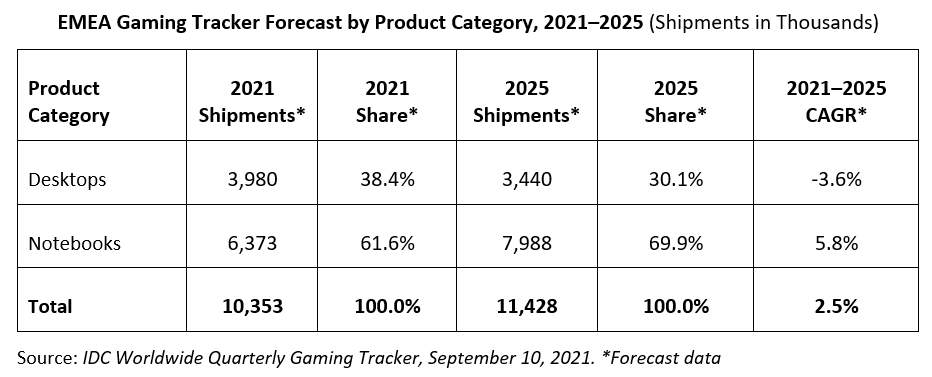

2021Q3 is predicted to grow at 6.1% YoY, while 2021Q4 has an anticipated rise of 4.8% YoY. While the momentum is stabilizing, long-term growth is still expected. In 2025, the PC gaming market is forecast to rise to 11.4 million units, with a five-year compound annual growth rate (CAGR) of 2.5%.

In Western Europe, 2021H1 saw demand in the market driven by consumers working from home, despite the loosening of lockdowns. With upcoming game releases in 2021H2 expected to increase graphical requirements, more gamers will be looking to refresh their PCs to game at the highest level. Therefore, acceleration of new/returning gamers is expected to continue in 2021. However, with component supply and logistics problems continuing, gaming PC production will be impacted too.

Due to the constrained availability of components and the backlogs, suppliers have increasingly reoriented to gaming desktops to satisfy demand. This has resulted in an increased YoY growth of 14.7% in desktops, while notebooks saw a softer increase of 4.9% YoY. Gamers will likely carry on with refreshing their rigs with new high-end GPUs, although the price increase of components may drive some consumers to postpone their purchasing decisions.

In addition to the pandemic, the growth in gaming demand can also be attributed to streaming and esports, both of which are becoming increasingly popular.

“Esports is breaking records in terms of number of consumers,” said Marko Mihailovic, senior research analyst, IDC Western Europe. “Lots of viewers on Twitch, YouTube, and even cable television networks are trying gaming themselves, which is powering PC gaming demand as well. During the lockdown measures, gaming stores such as Steam and Epic Games are taking the place of social networks, bringing people together and not just in terms of buying games and streaming but also for socializing with gamers with similar interests.”

The PC gaming market in the CEE and MEA regions continued to increase, with solid, double-digit growth in the second quarter of 2021 and annual increases of 10.9% and 17.9% respectively.

“Gaming PC shipments in CEE and MEA have performed differently, with desktops experiencing a decline and notebooks growing year over year. Demand for gaming notebooks in 2021Q2 continued to be driven by multiple in-house needs for home working, elearning, and entertaining, as well as better availability of components for gaming-ready NBs at factories,” said Dmitry Ilyin, senior research analyst, IDC. “One of the big effects of the lockdowns following the COVID-19 pandemic has been record-breaking audiences and consumption of computer games. Some deceleration in gaming sell-in performance is expected in the next quarters due to a high YoY base, market saturation, and expected general component shortages. In the long term, gaming PC share will continue to grow, though at a slower pace.”

IDC’s Quarterly PCD Tracker provides unmatched market coverage and forecasts for the entire device space, covering PCs and tablets, in more than 80 countries — providing fast, essential, and comprehensive market information across the entire personal computing device market.