DSCC has released its OLED Smartphone Cost Report for the second quarter of 2018, highlighting a number of issues in the market. The report illuminates the huge impact of fab utilisation on fixed costs per panel and the substantially lower cost of rigid OLED panels compared to their flexible counterparts. Rigid OLED panels, competing in the market with LTPS LCD, are solidly profitable for both Korean and Chinese panel makers.

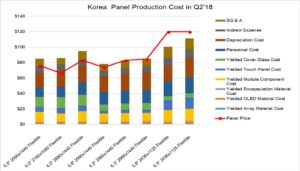

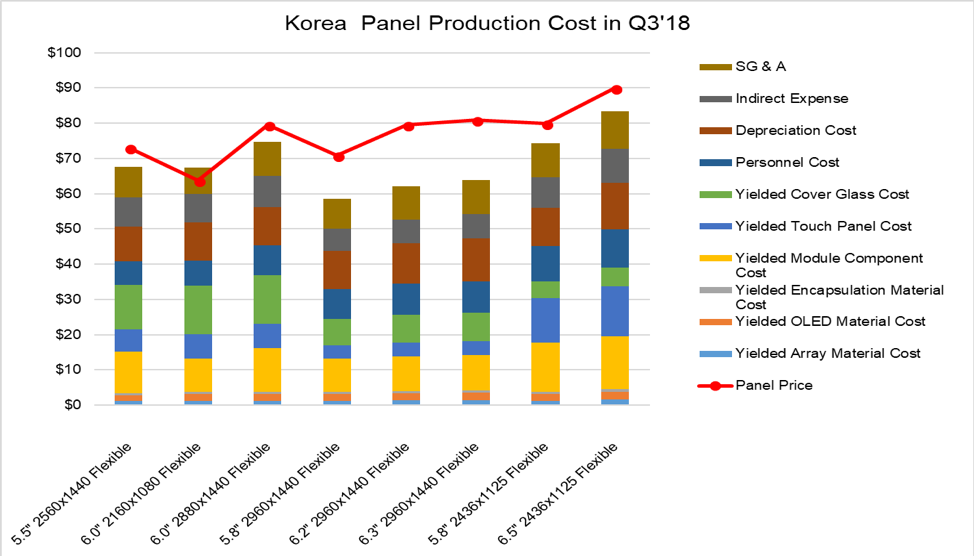

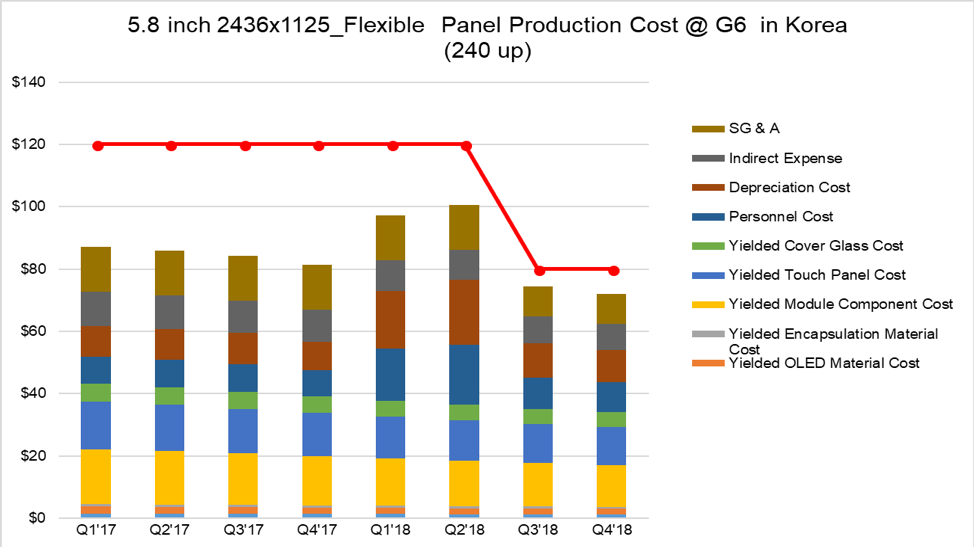

The impact of utilisation can be seen in the charts below, which show Korea panel production costs in the second and third quarters of 2018 for selected flexible OLED products. Samsung’s flexible OLED fab utilisation declined to 40% in the second quarter of 2018 but DSCC predicts it will recover on the strength of Apple orders and seasonality, growing to 76% in the third quarter. Even with price reductions in the third quarter, the dramatic reductions in fixed costs per panel will improve Samsung’s profitability considerably.

Source: DSCC

Source: DSCC

Source: DSCC

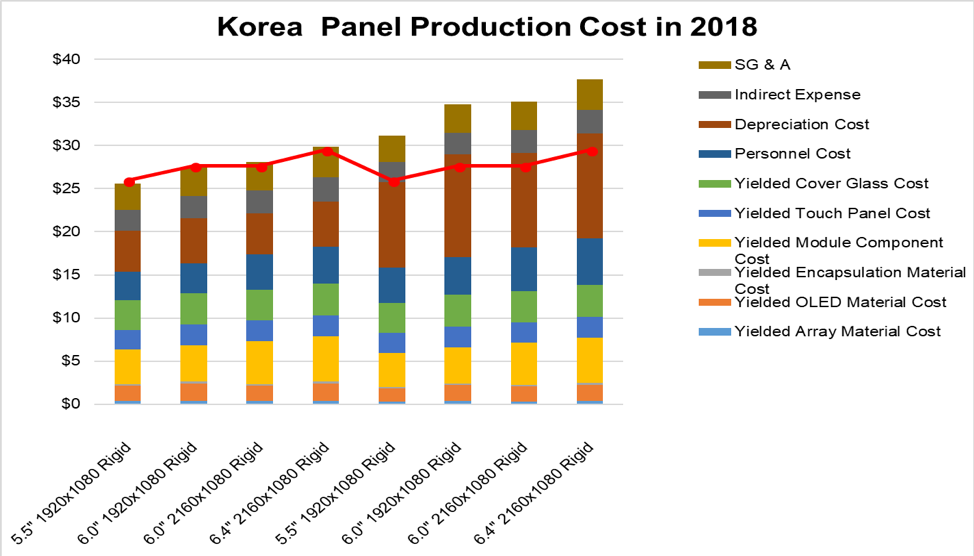

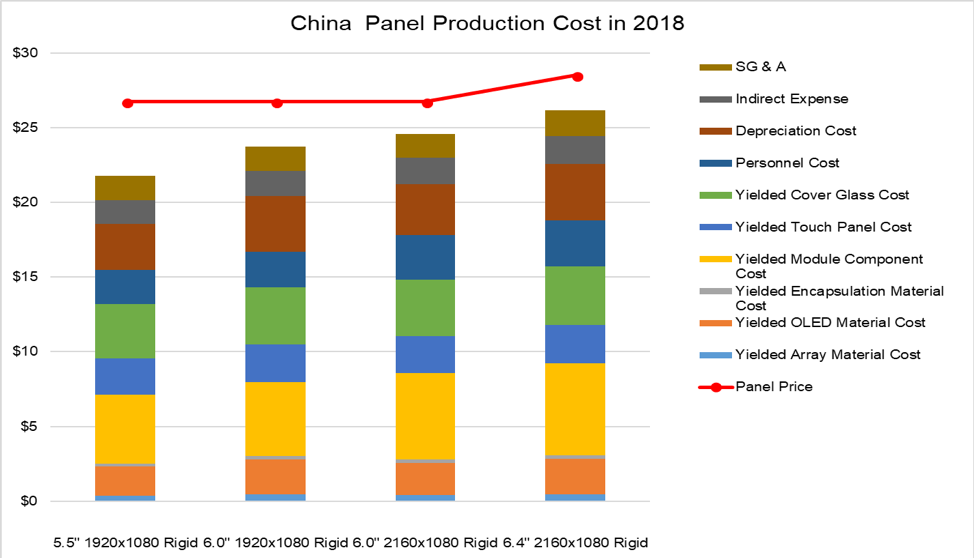

The report also highlights the extensive advantages of Chinese panel makers in achieving lower costs and, therefore, better profitability. Chinese fabs have reduced their investments by 50% based on government subsidies and further government support allows for 50% lower costs for personnel and indirect expenses.

Even SG&A costs for Chinese panel makers are lower than in Korea, at 6% of the panel price versus 12%. All of these advantages allow China panel makers to achieve profitability on rigid OLED panels, despite substantially lower yields as shown in the charts below.

Source: DSCC

Source: DSCC

Source: DSCC

Source: DSCC

DSCC estimates that average total yield for 6” 2160 × 1080 rigid OLED panels will be 70% in 2018 for China panel makers, versus nearly 90% in Korea. This gives Korea a significant advantage in yielded material costs but in the total cost analysis, this advantage is overwhelmed by lower fixed costs for China fabs.

The report also includes detailed costs for important products. The chart below show the 2017-2018 costs for Korean production of 5.8” flexible OLED panels used in the iPhone X. Even with low flexible OLED utilisation in the second quarter of 2018, this product was profitable for Samsung, despite low production volumes. Continuous improvements in material prices and yields keep the product profitable, despite a $30 price reduction.

Source: DSCC

Source: DSCC

The report also covers the anticipated upgrade product for the iPhone X Plus, a 6.5” flexible OLED with 2436 × 1125 resolution, as well as comparable Samsung Galaxy panels, which include several innovative cost reduction features, such as chip-on-plastic and in-house production of 3D cover glass, that allow it to achieve a lower cost than iPhone X panels.