DSCC has a new report that looks at the financial health of different segments of the display industry.

Ross Young of DSCC said “This report was a monumental effort as we captured all financial data, industry metrics and forward looking guidance from 60 companies in 5 different languages across 6 different countries over 15 quarters as we went back to Q1’13.

Some highlights from this report include:

- The revenues for all the companies in this report rose 9% Q/Q and 2% Y/Y to $472B in Q3’16 and should approach $2 trillion for the year. Contributing to the quarterly growth was seasonal strength for OEMs, up 21%, rising panel prices for panel manufacturers resulting in 18% sequential growth and record equipment spending for equipment manufacturers with FPD equipment revenues up 15%. On a Y/Y basis, FPD equipment spending was up 38%.

- Equipment manufacturers had the highest gross margins at 43% followed by brands, glass suppliers and materials suppliers with OEMs in single digits.

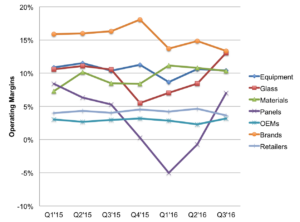

- Operating margins in Q3’16 were in a relatively tight band of 3% – 13% with panel suppliers improving the most on significant price increases and rising from -1% to +7%. In fact, a panel supplier had the highest operating margins of all 60 companies. If we looked at display divisions or business units rather than corporate wide results, FPD glass operating margins were the highest at over 20%.

- Brands had the highest net margins at 10% thanks to Samsung and Apple. However, each layer of the supply chain was profitable thanks to panel price increases, which put an end to three consecutive quarters of quarterly losses at panel suppliers.

- Days of inventory declined at panel suppliers on tight supply conditions while increasing in most other segments on the seasonal build for the holiday season.

- Liquidity was healthy and stable except in materials as multiple materials suppliers had over 100% debt/equity ratios.

- Only panel suppliers had negative free cash flow, due to their high capex. However, panel suppliers did generate billions in cash flow from operations.

- Panel suppliers set a record for quarterly capex at over $5.7B, which should be broken in Q4’16 and in Q1’17.