In DSCC’s Quarterly Display Capex and Equipment Market Share Report, we provided quarterly and annual display equipment market share results for 2020 for 70 different market segments. In addition, we also provided an early look into winners and losers for each segment in 2021 and beyond.

This report allows users to see:

- Equipment supplier bookings by quarter;

- Equipment units and revenues on a delivery (move-in) basis by quarter;

- Equipment units and revenues on an install basis by quarter;

- Spending by each panel manufacturer by fab by phase by quarter.

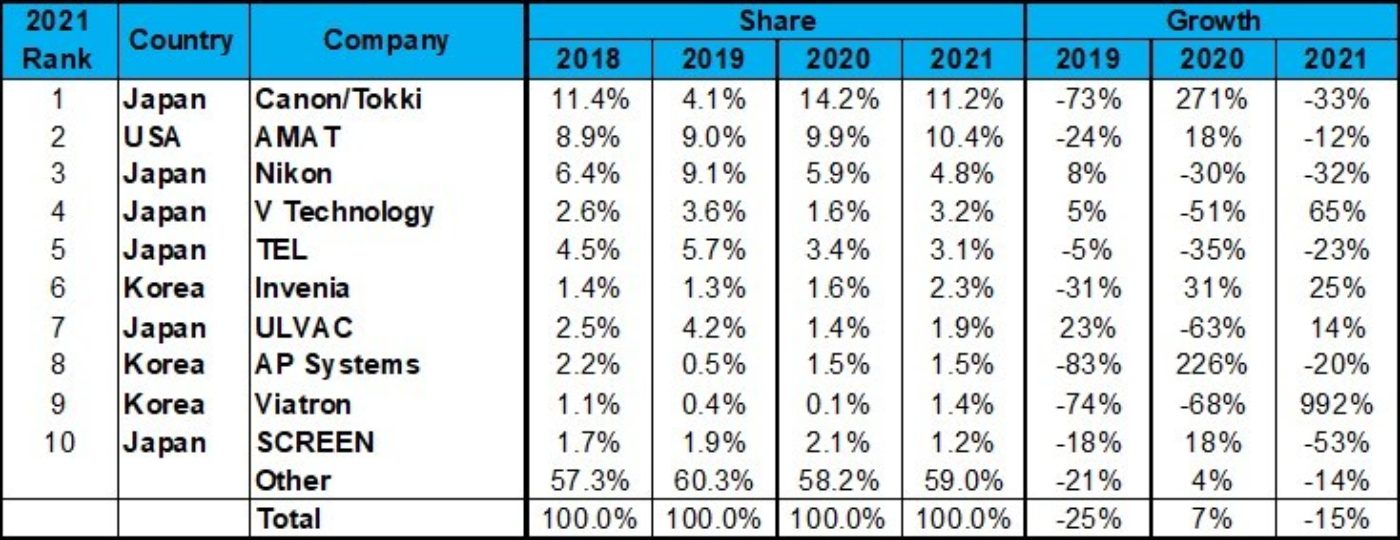

For 2020 on a move-in basis, we show the following:

- Canon reclaimed the top position in 2020 on 271% growth with 541% growth in evaporation equipment and 150% growth in exposure equipment helped by gains in CF litho.

- AMAT gained market share for the 4th straight year with an 18% increase in revenues on its strong position in both LCDs and OLEDs.

- Nikon lost market share on a 30% decline in revenues but remained ahead of Canon in litho.

- TEL maintained the #4 position, although it lost market share in both coater/developers and dry etch.

- Wonik IPS rose to #5 on a 109% increase, as its furnace and dry etch business each gained market share in OLEDs.

- Also gaining market share in the top 20 were SCREEN, Iruja, Invenia, AP Systems, SEMES, ICD, Narae Nanotech and Kateeva. Most of the companies gaining market share are stronger in OLEDs. Losing market share outside of the top 5 were V Technology, ULVAC, Orbotech and LG PRI. Of the top 25 suppliers in 2020, there were 11 from Korea, 8 from Japan, 3 from the US and 3 from China.

2020 Display Equipment Supplier Rankings, Share and Growth (Move-in Basis)

Based on the 2021 orders issued and estimated so far on a move-in basis, we see Canon continuing to lead, followed by AMAT, Nikon, V Technology, TEL, Invenia, ULVAC, AP Systems, Viatron and SCREEN rounding out the top 10. AMAT will gain market share for the 5th straight year while TEL will see a Y/Y revenue decline for the 3rd consecutive year and drop from #4 to #5. With the market falling by 15% in 2021, few suppliers will see growth. The exceptions in the top 10 include:

- V Technology on HKC H5 CF exposure and repair business.

- Invenia on HKC H5 dry etch business.

- ULVAC on increased sputtering business at Sharp and Tianma.

- Viatron on its BOE B12 wins.

Of the top 25 suppliers, we expect 10 from Korea, 9 from Japan, 3 from the US, 2 from Taiwan and 1 from China.

Preliminary 2021 Display Equipment Supplier Rankings, Share and Growth (Move-in Basis)

Lithography or exposure is the largest display equipment segment accounting for $1.8B and a 23% share of TFT backplane spending in 2020. Over the past few years, we have seen Nikon dominating LCD spending and Canon dominating OLED spending. However, in 2021, it is expected to reverse, with Nikon leading in OLEDs taking a majority of the business at BOE B12 and Tianma TM18 and Canon leading in LCDs on its wins at HKC. As shown in the figure, Canon’s LCD share on a $US basis is expected to grow from 21% in 2020 to 64% in 2021, while Nikon’s OLED share is expected to rise from 28% in 2020 to 64% in 2021. In terms of total exposure share in 2020 and 2021, Nikon had a 50% to 49% edge over Canon in 2020 on a revenue basis, but Canon is expected to lead with a 54% to 46% revenue advantage in 2021.