DSCC released the inaugural issue of its Quarterly Advanced Smartphone Features Report last week and it packs a tremendous amount of insight about the AMOLED smartphone market.

In addition to reporting on shipments by brand and model by display parameters such as:

- Panel Size

- Panel Resolution

- Pixel Density

- Form Factor – Rigid or Flexible

- Aspect Ratio

- Panel Supplier

This report also reports on other display parameters and smartphone attributes as well such as:

- Cover Glass – 2D vs. 2.5D vs. 3D vs. 3.5D

- Refresh Rate – 60Hz vs. 90Hz vs. 120Hz vs. 144-240Hz

- Notch Type – Hole/Pill/Notch/Tear/UPC/None

- Touch Type – Add-on vs. TFE

- 4G vs. 5G

- mmWave vs. Sub-6GHz

- # of Main Cameras

- Chipset Supplier

- Chipset Model

- Minimum Chipset Design Rules

- Memory

- Storage

- Battery Capacity

- Smartphone Price

- Smartphone Price Band

- Smartphone Revenues

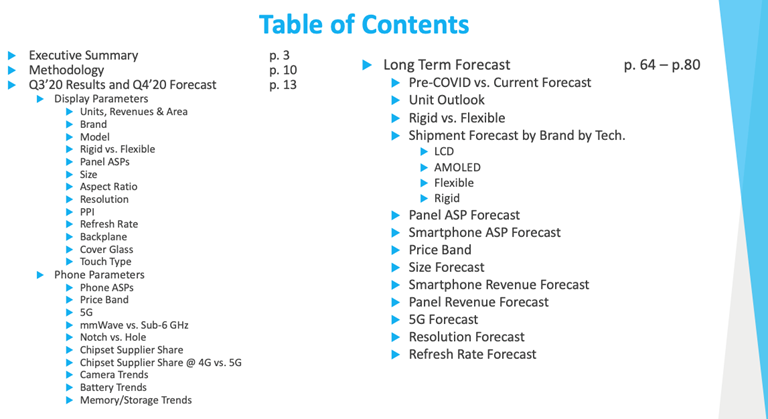

The report table of contents can be seen below. As indicated, it is an 80-page report with all the data provided in a pivot table.

Some of the highlights include:

- In Q3’20, AMOLED smartphone panel shipments were down Y/Y for the 2nd straight quarter due to weakened demand from the COVID-19 pandemic and delays in Apple’s iPhone 12 launch.

- Q4’20 looks to be a record quarter by a wide margins however due to:

- Apple’s all OLED launch, much of which was delayed into Q4.

- A stronger launch for Apple than usual due to 5G.

- Samsung pulling in its S21 launch into early Q1 with panel shipment starting one month earlier.

- 5G momentum, mostly outside of the US.

- Pent-up demand after a weak Q2 and Q3 with some economies recovering.

- Panel revenues were down 11% Y/Y but are expected to rise 77% Q/Q and 63% Y/Y in Q4’20 to $10.5B, a record high by 33%.

- AMOLED smartphone revenues fell 7% Y/Y in Q3’20 and are expected to grow 55%, 39% higher than any other quarter.

- AMOLED display area was down 13% Y/Y in Q3’20, but is expected to surge 44% Y/Y in Q4’20, 33% higher than any other quarter.

- Brand Share

- Samsung led the AMOLED smartphone market with a 36% share in Q3’20, but Apple’s all OLED launch is expected to allow it to reach #1 in Q4’20 with a 39% share. On a $US basis, Apple should reach 53% in Q4’20.

- Model Data

- The iPhone 12 was #1 in Q3’20 and is expected to lead in Q4’20 as well. Apple is expected to occupy the top 4 spots in Q4’20 on both a unit and revenue basis.

- In rigid models, Samsung had the top 3 spots in Q3’20 and 6 of the top 15 models.

- Flex vs. Rigid

- Flexible overtook rigid in Q3’20 with a 55% unit share and the flexible share is expected to reach 60% in Q4’20.

- Flex vs. Rigid Brand Share

- Apple was #1 in Q3’20 in flexible AMOLEDs while Samsung was #1 in rigid. Both companies will hold those positions in Q4’20 as well.

- Panel Supplier Share

- SDC’s share fell from 75% to 74% in Q3’20 but is expected to reach 80% in Q4’20 on strong Apple demand.

- LGD’s share rose from 5% to 7% in Q3’20 and is expected to grow to 8% in Q4’20.

- BOE’s share fell from 11% to 9% in Q3’20 and is expected to fall to 5% in Q4’20.

- Size

- The average size is declining as brands increasingly emphasize smaller sizes. The average size peaked in Q1’20 at 6.4” and is expected to fall to 6.26” in Q4’20.

- Aspect Ratio

- 19.x:9 and 20:9 have become the leading aspect ratios as panels continue to get taller and narrower to reduce costs due to improved panelization resulting in more panels per substrate at a given panel size.

- Resolution and PPI

- FHD+ has been gaining share as manufacturers somewhat de-emphasize higher resolution displays to lower cost. The QHD+ share has fallen from a high of 19% in Q1’20 to an expected 4% in Q4’20.

- 401-450 PPI is the leading category although 450-500 is expected to gain significant share on the iPhone 12, Pro and Mini which are all over 451-500 PPI.

- Refresh Rate

- High refresh rate panels are taking share in 2020, accounting for as much as a 35% quarterly revenue share on a on the strength of the S20 and P40 launches. However, with Apple sticking with 60Hz panels on the iPhone 12, the high refresh rate share will decline in Q4’20. For the year, we show 60Hz with a 73% revenue share and an 82% unit share.

- Cover Glass

- 2.5D has been dominating the AMOLED cover glass market with over an 80% share in Q2’20. However, Apple brought back 2D and introduced ceramic shield with the iPhone 12 reporting better drop performance. As a result, the 2.5D share is expected to fall below 50% in Q4’20. 3D rose from an 18% share to a 23% share in Q3’20 but is expected to lose ground in Q4’20 on the iPhone 12. 3.5D is limited to a few Huawei models of late.

- Touch Type

- Touch on TFE continues to gain ground as flexible OLEDs gain share and more suppliers offer it. It accounted for a 30% share in Q3’20 and is expected to reach 33% in Q4’20.

- 5G

- 5G has rapidly penetrated the AMOLED smartphone market as OLEDs can offset the additional power, thickness and weight from the added related 5G ICs. 5G is expected to account for a 66% share of AMOLED smartphones in Q4’20. For all of 2020, the 5G share is expected to reach 47%, up from 10% in 2019. AMOLED panel shipments for 5G smartphones are expected to reach 228M on a panel shipment timeline.

- Chipset Suppliers

- Qualcomm led the AMOLED smartphone market in chipset share in Q2’20 and Q3’20, but Apple is expected to lead in Q4’20 on its strong Q4’20 outlook. Qualcomm was #1 in 5G and #2 in 4G in Q3’20. For the year, Qualcomm is expected to lead Apple with a 24% to 23% share with Samsung at 16% and HiSilicon and Mediatek at 12%.

- In 5G, HiSilicon led from Q4’19 to Q2’20 with Qualcomm leading in Q3’20 and Apple expected to lead in Q4’20. For 2020, we show Apple leading. At 4G, Mediatek led in Q2’20, Samsung led in Q3’20 and is expected to lead in Q4’20.

- 5-7nm design rules accounted for 52% of the Q3’20 market and in Q4’20 it is expected to reach 67% of the market on the Apple’s A14 Bionic surge.

- Batteries

- 4000-4500 mAh batteries have been the leading segment for the past 4 quarters. However, in Q4’20, <3000mAh is expected to lead due to the iPhone 12, 12 Pro and Mini using <3000mAh batteries.

- Cameras

- Triple and quad cameras are dominating accounting for a 74% share in Q3’20 but are expected to fall to 62% as dual cameras jump from 10% to 24% on the iPhone 12 and Mini surge.

For DSCC’s forecast for these and other parameters by brand and model through 2025, please see our Quarterly Advanced Smartphone Features Report.

About DSCC

Display Supply Chain Consultants (DSCC) was formed by experienced display market analysts from throughout the display supply chain and delivers valuable insights through consulting, syndicated reports and events. The company has offices in the US, Europe, Japan, Korea and China.