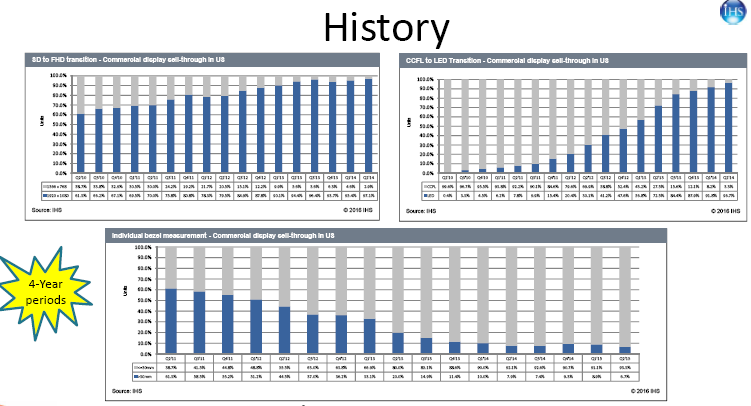

Todd Fender is from market research behemoth, IHS. He began by saying you need to be careful with growth data. Often there are big percentages quoted, but if you have a small market, then percentages are not difficult. Nothing happens very quickly in the public display market; transitions such as analogue to digital, resolution transitions and bezel size have all taken years – it’s not as fast as consumer space. It took four years to switch from CCFL to LED backlights, for example, in the professional market.

IHS’s Fender said that it can take years for the professional market to change. Click for higher resolution.

IHS’s Fender said that it can take years for the professional market to change. Click for higher resolution.

Fender then covered OLED and said that manufacturing is very difficult and yields will stay low for some time. That means prices are high and there are problems with image retention. OLED TVs at 65″ to 77″ are still 3X to 4X more expensive than LCD and IHS believes that by 2020, penetration will not have reached 5%.

There are some new opportunities that will be enabled by OLED and high end retail will probably be one.

QD is seen as the ‘poor man’s OLED’ and may see some take up in the commercial space. HDR is an interesting market as many think we should have better pixels, rather than more. Fender said that accurate colour might be important for brands that want to be sure that their logos are correct.

In 2015, 3% of TVs were WCG and that rises to 27% in 2021 according to the IHS forecast.

Turning to transparent displays, there are lots of demos at trade shows, but not much in the real world. OLED may be a better choice for transparent, but there is a big premium. The market could be worth around $1.5 billion, but it’s very niche at the moment.

Mirror displays might go the way of 3D and IHS has no forecast at the moment because it’s really too early in a small market.

2.5% of all LCD TVs shipped are curved globally, up from 1% in 2015, although 76% of OLED TVs are curved, but this is down from 99% in 2014. Fender believes there might be room for curved displays on the desktop.

95% of all sell through is at up to 700 cd/m². Outdoor is interesting for quick service restaurants (QSRs). Day parting – that is breaking up the day with breakfast, lunch & dinner menus changing – was QSR 1.0, but QSR 2.0 is for drive through, Fender said. He thinks there should be more signs in drive throughs, not just at the point of order. There’s more chance to influence the purchase if you give the customer data earlier, while they are queuing. There are some opportunities for high brightness in stadiums and outdoor facilities. With optically-bonded displays, higher contrast gives the impression of higher brightness.

There is little evidence of strong high brightness sales at the moment, although there will be some growth in the forecast.

Finally for stretched displays, there is a move back to the market, but sales globally have been very low, although there may be opportunities in Asia and Europe in public transport applications. There are a number of new suppliers, but it’s not clear how the market will develop. Global unit annual sales are in the thousands.

In questions, Fender said that while professional displays were developed for 24/7 use, TVs were a long way behind. However, the industry found that there was room for another category in the middle with 16 hours per day operation.

Turning to content, there was agreement that few people are developing much more than template-based Digital Signage.

Analyst Comment

Although I was aware that there were not many ‘stretch’ displays being sold, as I have access to data in Europe, I had assumed that the amount of activity meant that there was a market somewhere else. However, it seems that it really is a tiny market. I also spoke to some who have worked with QSRs in high brightness quite a lot, and they expressed the view that the QSRs are not ready to make the investment. In many places, the owner is very reluctant to invest without very clear evidence of a clear and quick financial benefit. (BR)