The fourth session of the day was on market trends and was moderated by Clive Couldwell of AV Magazine.

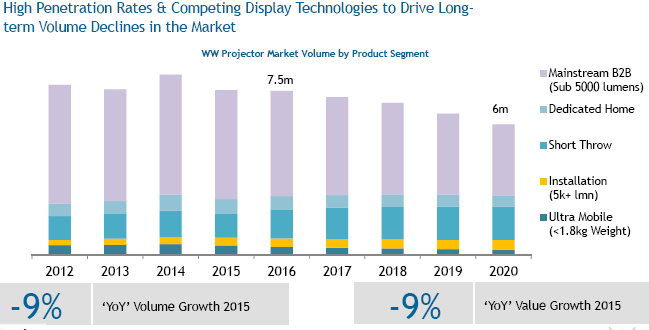

The first presentation was by Chris McIntyre-Brown of FutureSource Consulting. After introducing his firm, he said that in recent years many of his customers have re-organised around vertical markets, rather than around technologies. Projection remains a $7.2 billion market in 2015, 41% of the total professional large screen market – not bad for a technology that is said to be on its way out, he said. Consumer markets are tough, so many companies are looking at professional use.

1080P has been on the rise for a long time. Corporates are wrapping A/V budgets into IT budgets and that is affecting decision making. Even high end projectors are starting to be bought online and in consumer resolutions. When the market was growing, there was less of an issue with resolution upgrades, but this is changing and UltraHD is expected to take share more rapidly than in the past. Solid state light sources are really useful for helping projection into digital signage. This can be good in retail as projection is genuinely flexible compared to FPDs and FPP LEDs. The 5,000 lumens and below segment is a ‘bloodbath’, but everybody is trying to develop higher brightness projectors.

The projection market is in volume decline and will lose around 20% in volume, but it’s the low end that is disappearing. However, in higher value segments there is value growth in segments such as short throw, installation and high brightness.

The number of SKUs with high brightness in 6K to 7K has gone from 257 SKUs in 2013 to 359 SKUs in 2015. Epson has done a good job in taking share in installation projectors, McIntyre-Brown said.

Interactive White Boards will peak in 2017 and there will be demand to replace the first wave of IWBs. The UK IWB market saw 81% of purchases being LCD last year, rather than projectors, and was a pioneer market.

The Microsoft Surface Hub offers the interactivity needed by business and the firm believes that Vestel could be significant although it hasn’t done much outside the Fatih project, although it has attended a lot of events.

The market for public display has developed to allow many segments to develop. Entry level products are selling more in the developed markets where users are more sophisticated, rather than in less developed regions. Displays should become more intelligent over time.

The Chinese were developing in FPP LED, then moved to a disruptive phase working to build the market, but the Chinese vendors are now buying international brands e.g. Leyard buying Planar. FC believes that 19% of the video wall segment will be FPP this year and increasing to flatten the growth in narrow bezel LCD.