On Wednesday of AR/VR Week (excuse me, Display Week), the OLED Association and Veritas et Visus presented an AR/VR Conference as part of the SID Business track. There were about 22 speakers in four sessions, including introductory remarks by Helge Seetzen, SID President-Elect and two panel discussions. One of the first things all of the speakers at the Augmented Reality/Virtual Reality (AR/VR) business conference and, for that matter, in the Technical Symposium, did was give an introduction to AR and VR.

Since AR and VR is new to the Display Week attendees (and almost everyone else), this was necessary, I suppose. But after hearing the fifth or fifteenth introduction to AR/VR, I kept wishing the speaker would get to the point. (Note: The times given for the sessions were the scheduled times – the program did not come off exactly on schedule and one scheduled speaker was a no-show.)

Session I: Immersion – Marketplace Dynamics (8:30 – 10:30)

The first session, titled “Immersion – Marketplace Dynamics,” included three speakers who focused on the business aspects of AR/VR, including sales forecasts going forward. The fourth speaker gave a keynote speech with an overview of AR and VR.

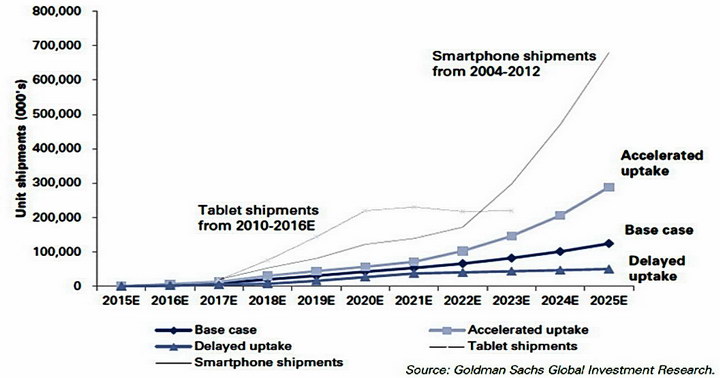

The first speaker was Wanda Meloni, CEO & Senior Analyst at M2 Insights, who presented her company’s forecasts for VR. She compared the forecast growth of VR to the growth of both the smartphone and the Internet. According to her and the data she used from Goldman Sachs Research, growth of AR/VR will be slower in the 2017 – 2025 than growth of the smartphone over the 2004 – 2012 time period, as shown in the figure.

AR/VR Unit Shipments Through 2025 (Image Source: M2 Insights)

AR/VR Unit Shipments Through 2025 (Image Source: M2 Insights)

While she did not give a specific revenue forecast for AR/VR head mounted displays (HMDs), she said she expected price declines comparable to the price declines for other electronic products, which ranged from a -8.6% CAGR for LCD TV to -5.1% CAGR for smartphones.

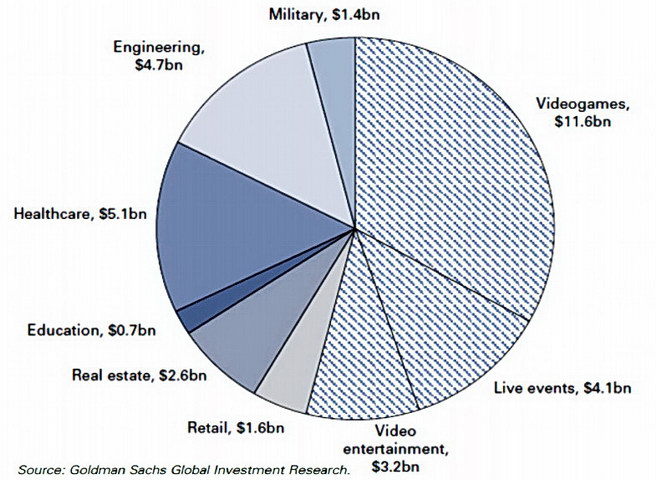

According to Meloni, gaming is the biggest portion of the AR/VR content market today market today and that will continue through 2025, as shown in the figure.

AR/VR Software Revenues in 2025 (Image Source: M2 Insights)

AR/VR Software Revenues in 2025 (Image Source: M2 Insights)

One of the things that allows the growth of VR videogames is the availability of game engines. The image shows logos of five commercially available game engines discussed by Meloni. These game engines can be used not just for gaming, but as frameworks for other types of AR/VR software. After all, many of these applications resemble gaming and require the same functions such as handling 360° video and real-time inputs from both the user and other sources.

Five commercially available VR game engines. (Image Source M-2 Insights)

Five commercially available VR game engines. (Image Source M-2 Insights)

Dr. John Feland, Founder and CEO of Argus Insights, focused his attention not on hard numbers but on how the consumer feels about VR and, to a lesser extent MR and AR. His input data were the tweets, on-line reviews and other social media mentions of VR/AR/MR and VR/AR/MR products. He found very high consumer interest in VR/AR/MR. For example, he found an average of about 75K tweets a day about VR/AR/MR topics, compared to about 50K/day tweets for the Internet of Things (IoT). The vast majority of these tweets were for VR, not AR or MR. One thing he found in his analysis of on-line product reviews was that the displays in VR headsets disappoint many users. That’s not a surprise, since I find the VR displays I’ve seen, even the very best of them, disappointing.

Peddie Shows a Range of Forecasts

Jon Peddie, President of Jon Peddie Research and author of Augmented Reality – Where We Will All Live, recently published by Springer, gave a presentation titled “Augmented Reality: Trends and Opportunities.” As expected, he focused on AR and not VR. First he gave about 40 titles and modifying adjectives used by marketing people to describe AR and VR, with a warning to not allow yourself to be confused.

AR market forecasts are another subject of confusion. Peddie did not offer any of his own but gave portions of AR forecasts from eight other research firms. To put it mildly, these differed significantly from each other, by a factor of more than 10x. Peddie said, “Pick the forecast you like best – alternative facts.” One forecast he cites in detail is the 2016 forecast from Digi-Capital that had the AR market in 2020 at $90B. One of the reasons for the variations between different forecast was they were forecasting different things. Some forecast revenue from AR HMD sales, others forecast revenue from the entire industry. Of course, defining the “AR Industry” is not, by itself, an easy task.

His discussion of AR displays focused on four display types, helmets [7+], contact lens displays [7], headsets and smart glasses [57] and HUDs [10+]. The numbers in brackets indicate the number of suppliers or developers he has identified in each display category. In terms of the number of suppliers, especially for smart glasses, he says, “Does the word CRAZY come to mind?” The short answer is yes and the long answer is that it looks like there is a need for a market shakeout. One of the things Peddie fears with AR is information overload, as shown in the image. This could include both advertisements from “free” AR apps and information AR users really, really believe they must know immediately. (for more on Peddie’s view, see our report on his talk from Laval Virtual – AR Will be Big, but Not Easy)

AR Information Overload in the future (Source: Jon Peddie Research)

AR Information Overload in the future (Source: Jon Peddie Research)

Ronald Azuma, Principal Engineer and Research Manager at Intel Labs, wrapped up the “Immersion—Marketplace Dynamics” morning session of the AR/VR Business Conference with a keynote speech titled “Immersive Experiences: The Challenges for Display Technologies.” This was primarily a technical and human factors background on AR and VR and the material would be familiar to anyone who had looked into the topic. To someone new to the field, who wanted to understand the forecasts and hype discussed in the previous three talks, it would have been useful. If this had been first and the other speakers had been given an advance copy so they knew they wouldn’t need to repeat basic, introductory stuff, the conference would have been better.