A hat tip to Sixteen:Nine.net for publishing the latest data from IHS Markit on the global public display market. A report is available to members of the Digital Signage Federation as part of their membership.

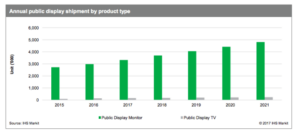

IHS sees Signage TV as only a small segment which surprised us. We assume the number only includes sets that are specifically targetted at professional applications.

For the first quarter of 2017 (Q1 2017), public display monitor shipments increased 2.6%, with shipments reaching over 804,000 units.

Public display TV shipments recovered from the previous quarter’s drop with an increase of 13.6% based on the lift in shipments by LGE and Sharp of 24.4% and 16% quarter-on-quarter (QoQ), respectively. Samsung’s public display TV shipments continue to decline this quarter as RMD and RHE series are discontinued, with an additional 51.7% QoQ dip in its public display TV shipments.

IHS Markit expects public display monitor shipments will exceed 4.8 million units by 2021, while public display TVs will surpass 240,000 units by 2021.

For Q1 2017, the most popular sizes continue to be 43-inch, 49-inch, and 55-inch sizes for public display monitor shipments, increasing 19.2%, 31.8%, and 10.7%, respectively, over the previous quarter. Shipments of 85-inch public display monitor shipments showed significant growth this quarter, more than doubling its share relative to the previous quarter by 152.9%, reaching just over 2,600 units.

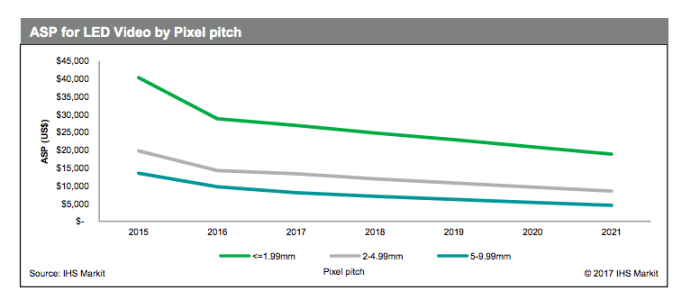

ASP LED by pitch – we assume that this measurement is per m² as we believe that in terms of cost per pixel 2.5mm is currently the cheapest. IHS does not see the price of this segment coming down very rapidly and fine pitch (<=1.99mm) will stay expensive over the forecast period.

ASP LED by pitch – we assume that this measurement is per m² as we believe that in terms of cost per pixel 2.5mm is currently the cheapest. IHS does not see the price of this segment coming down very rapidly and fine pitch (<=1.99mm) will stay expensive over the forecast period.

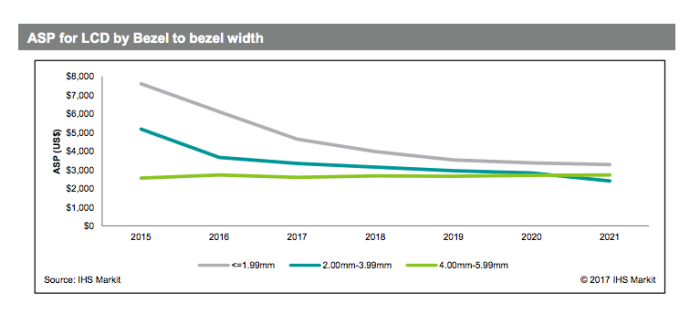

Another chart reproduced in the blog was the pricing for different bezel types.

It’s intriguing that the ASP by bezel width will become less for very slim bezels than for mid-range products by the end of the forecast period.

It’s intriguing that the ASP by bezel width will become less for very slim bezels than for mid-range products by the end of the forecast period.

Other data items that the site reported include:

- The ASP (Asking Street Price) for LED video displays are naturally higher than LCD, however, bezel-less displays is a chasm LCD technology cannot cross. When comparing the ASPs for both technologies, it is essential to look at larger format super narrow bezel width LCD displays and finer pixel pitch LED video for a fair comparison.

- ASPs for narrow bezel products continue their drop, bezel width less than 1.99 mm decreased 20% YoY in 2016, and is forecast to drop 46% by 2021. Similarly, for bezel width between 2 mm and 3.99 mm, ASPs has decreased 29% YoY in 2016; they are forecast to reduce 34% by 2021.

- LCD narrow bezel (less than 1.99mm) products currently are available in a limited number of screen sizes: 49–55 inches. The latter currently is generating most of the revenues, while 49 inches is forecast to surpass 55 inches in revenue and lead growth in 2019.

- ASPs for LED fine pixel pitch products (less than 1.99mm) show a similar level of decline, -29% YoY; they are forecast to reduce by 35% by 2021.

The final item looks like a typo.

- Narrow bezels revenue is forecast to be multiplied by 10 by 2021, reaching over $773,000.

We believe this should say $773 million