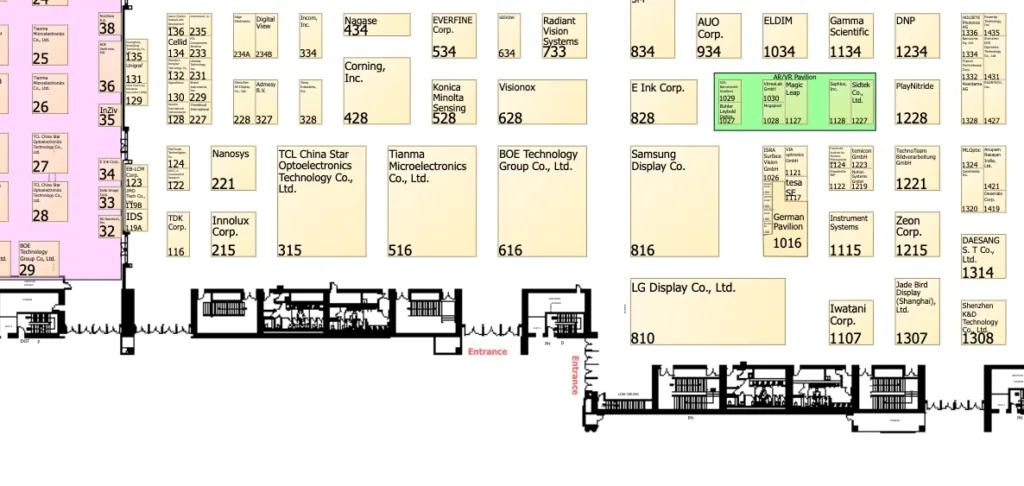

I did this thing where I read through as many South Korean articles that lead with general Display Week 2024 coverage and the same for the mainland Chinese press. It is a lot more straightforward for the Korean press, they just have Samsung and LG to focus on. The Chinese press had a lot to think about particularly as BOE, TCL CSOT, and Tianma dominated the show floor in San Jose.

What happened in San Jose, California, this week was about flexing, and the Chinese certainly seem to have out-flexed their Korean competitors. While Display Week is the place to flex for the global display industry, the number of opportunities for Korean and Chinese companies to show off in their home territories is significant, and maybe even grander than anything SID can offer. SID doesn’t really register on the US government’s radar, whereas the display industries of China and South Korea register in a big way on their respective governments. I would have loved to have gone to some of the trade shows in South Korea and China that all these companies go to because there’s nothing like watching a team play to a home crowd. In the US, at Display Week, the companies were taking part in a cup tournament with knockout rounds.

So, companies come to Display Week looking to show the industry their full bag of tricks. For Samsung Display, LG Display, TCL CSOT, BOE, and Tianma the show is a place to keep competition at bay by being able to say, if you want it, we already have it, and then we have all this other stuff that no one else can afford to have. Hence, every conceivable innovation in every niche, from TVs to laptops to smart glasses and automotive is rolled out. That makes for great press and nice pictures, but not necessarily business. I don’t think anyone is going to Display Week to sign purchasing agreements. If only it were that simple.

Probably a good way of looking at it is to view the show as being about every major display manufacturer showing Apple that it can replace any of its suppliers at the drop of a hat. Because, decisions on purchasing and sales have already made and the lead times for getting anything done in the business are very long.

The Chinese flex had one simple advantage: they had already beaten all comers at LCD, and they could show off there, too. Who else could say that? Which made flexing on OLED even more threatening. TCL CSOT’s IJP OLED and BOE’s ramp up of OLED capacity are just two examples of a surging Chinese manufacturing base that has galvanized its resources to catch up with the Koreans with the consistent threat that, we beat up on you on LCD, and we are getting ready to beat up on you with LCD.

For their part, Samsung and LG didn’t lag and mostly because they do have certain technological advantages, and continue to invest to keep their lead. They may have learned their lesson from LCD, but they had to be wary. Then there is Apple and Samsung’s own dominance in smartphone, and premium TVs; the South Koreans have a moat around their display businesses. There may be a time when TCL and Hisense can charge a premium for their TVs, and Chinese phone vendors are growing at a crazy pace, but Samsung and LG hold the higher ground. For now.

None of this is actually spurring demand or growing the industry, by the way. It is shuffling the deck. The casualties are going to continue among all those manufacturers that can’t muster a few billion in capex investment, and the crowds of MicroLED vendors, all as the top five or six companies consolidate their positions, and sop up capacity. At this particular point in time, the business is driven by a handful of multi-billion dollar companies that can afford to invest multiple billions of dollars in display fabs, and supply the big buyers, whether in smartphones, IT, or automotive want. If there were buyers at Display Week, they were probably there for the flex, too. They like their suppliers to have a solid build and look the part.

| Chinese Press Coverage | Korean Press Coverage | |

|---|---|---|

| Overall Theme | Emphasis on innovation, global expansion, and sustainability in the display industry. | Focus on next-generation technologies and maintaining technological leadership. |

| Major Companies | BOE, Tianma, TCL CSOT | Samsung Display, LG Display |

| Highlighted Products | BOE: 110-inch 16K glasses-free 3D display, AI-powered OLED displays, electric flexible cockpit product. | Samsung: Quantum Dot Light-Emitting Diode Display, glasses-free 3D technology, RGB OLEDs on Silicon. |

| Tianma: New display technologies to understand customer needs and expand global presence. | LG: Advanced Thin OLED for vehicles, OLEDoS for VR, large-sized OLED panels, automotive display solutions. | |

| Sustainability | Strong emphasis on eco-friendly products and power efficiency, especially from BOE. | Not specifically mentioned in the provided content. |

| Technological Innovations | BOE: Combining AI with display technology to enhance OLED displays, various new display technologies including 3D and light field displays. | Samsung: QDLED, eye-tracking Light Field Display for glasses-free 3D, Fine Silicon Mask for VR. |

| Rapid advancements in LCD and OLED technologies, with significant global market share. | LG: OLEDoS for VR and smartwatches, high-resolution and brightness improvements, glasses-free 3D technology. | |

| Global Market Presence | BOE: Significant overseas market share, presence in North and South America, Asia, and Europe, manufacturing bases in Mexico and Vietnam. | Samsung and LG: Emphasis on technological leadership and continuous R&D for global competitiveness. |

| Industry Leadership | BOE: Highlighted as a global leader with 30 years of experience, significant R&D investments, and a large international workforce. | Samsung and LG: Emphasis on maintaining technological leadership through innovative product introductions. |