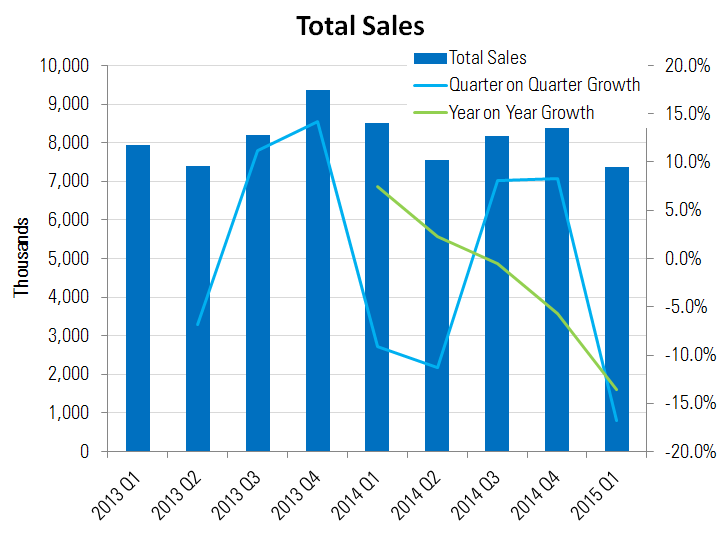

The European Desktop Monitor market had a weak Q1 in 2015 with a 12.6% drop in volume on a year on year basis according to Meko’s DisplayCast market research service.

“There were a number of factors that contributed to this result”, said Bob Raikes, principal analyst at Meko. “The PC market was positive in Q1 last year, with a boost caused by the end of support for Windows XP, which put pressure on some corporates to upgrade. Macroeconomic factors including the weak Euro dampened demand this time, but the major factor was sales in Russia which were down 56%”.

“Q1 is usually the strongest for MEA as well”, Raikes continued. “This year, there was growth from Q4 to Q1, but on a year on year basis, sales were down significantly because of the economic results of low oil prices as well as political issues in the region”.

Samsung remains the largest brand in volume terms, with Dell and HP. Dell was up year on year, and took top position in the value rankings, as it has a product mix that is strong in higher specification and corporate-focused products, such as the continuing 24″ 16:10 format segment.

“Monitor and LCD panel makers are doing a lot to try to innovate in the desktop space”, Raikes said. “Our analysis segments have grown from just four when we started tracking CRT monitors back in 2000 to more than 30 now. There are new sizes, new resolutions, new aspect ratios as well as features such as curved displays. That’s generally a positive move”, Raikes concluded, “although there may be too many options now!”.