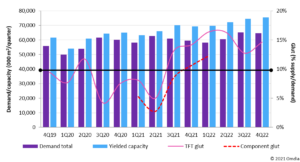

A combination of tight capacity for thin film transistor (TFT) display screens, along with key material and component supply bottlenecks, is fuelling a panel shortfall, which is increasing demand further, as set manufacturers rush to buy more panels to fulfill demand in 2021.

In the second half of 2021 TFT supply / demand is forecast to trend above 10% almost reaching similar glut levels to 20219.

Material Supply Bottlenecks

It is not just the FPD industry that is struggling from high demand and disrupted supply chains. Semiconductors, autos, consumer electronics, and many other segments have been experiencing similar issues.

he supply of display driver ICs (DDICs) for FPDs remains highly restricted and will continue to be the main bottleneck in the supply chain for most of 2021. DDIC for mobile applications are expected to remain insufficient until 2H21, while DDIC for large-area applications are forecast to be inadequate until at least the end of 2021.

An unfortunate and untimely string of accidents has created a historic tight glass market and caused a very unusual industry average price increase of several percent. The lack of investment in polarizers and base films in 2019 caught the industry off guard when demand turned around in 2020. Aside from these three main components, multiple other materials are also in tight supply and are affecting different makers in different ways, supporting inflationary price trends.

Impact on panel makers

Panel makers have enjoyed an incredible reversal of fortune with panel prices rising over the past year. The industry’s weighted average operating profits reached nearly 11% in 4Q20. With large-area LCD margins modeled to rise well above 20% by 2Q21, average panel maker operating income is expected to follow a similar trend, setting 2021 up for record high profits.

At the same time, tight supply, high factory utilization rates, and high profitability are encouraging many panel makers to increase their capacities. There were already multiple Gen 8.6 and Gen 10.5 factories in China that were accelerating capacity ramp-ups in 2021 and 2022 after COVID-19 delayed them in 2020.

Additionally, almost all Chinese panel makers are doing everything they can to incrementally increase their current factories’ capacities through productivity enhancements and new equipment purchases for debottlenecking or capacity expansions. For the same reasons, South Korean panel makers continue to delay shutting down their domestic LCD TV factories. Large-area FPD capacity is now forecast to grow 9.1% in 2021 and another 8.3% in 2022.

Demand outlook

Meanwhile, demand has been almost unbelievably strong and resilient over the past year. The common assumption is that demand just cannot continue to increase at such high rates and that high demand now will pull in future opportunities. Demand trends remain uncertain and are still closely linked to the pandemic, but current assumptions include the following:

• Concerned about a drop in demand in 2H21, panel makers are rushing to push out as many products as possible in 2Q21 while they still can take advantage of COVID-19-driven demand and high prices. This will pull in demand from 2H21.

• At the same time, as the US and other advanced economies begin to reap the benefits of highly aggressive vaccination programs, consumers can be expected to shift spending back toward out-of-home leisure, thereby weakening TV demand.

• High panel prices are beginning to cause set price inflation, which will also negatively affect demand. In addition, TV set brands will not be able to aggressively continue promoting TVs because of high costs and a lack of margin flexibility.

On the positive side, average TV panel sizes continue to increase. Between 2019 and 2022, weighted average LCD and OLED TV size is expected to increase from 45.6 inches to 50.2 inches. IT demand is also expected to remain robust and well above pre-pandemic assumptions.

Charles Annis, Practice Leader for Display Manufacturing, Technology and Cost at Omdia, commented:

Although multiple caveats remain about how both supply and demand will trend over the coming months, the modeled glut level is a leading indicator that the next cycle is now on its way, which implies falling prices, utilization, and profitability. Industry players should consider the implications when planning business strategies for the next two years.