The MicroLED Display industry received shocking news at the end of February when ams OSRAM announced an unexpected cancellation of a cornerstone MicroLED project. The press release noted that they have to re-assess strategy particularly for the new 8-inch LED facility in Kulim (Malaysia), and a non-cash impairment charge of EUR 600 to 900 million is expected based on preliminary estimates. According to published industry information, ams OSRAM was the key MicroLED chip supplier for the Apple Watch Project. Apple’s brand power was extremely important for the new MicroLED display technology.

Apple’s decision to adopt OLED display panels for iPhone in 2017 and for IT starting from 2024 has resulted in enormous investments for OLED and created new opportunities for the technology in the market. For the Apple Watch project, Apple was planning to develop its own MicroLED display technology. The cancellation news, even though creating turbulence and uncertainties in the near term, may open up new opportunities for the MicroLED display industry in the long run.

Apple’s MicroLED Display Project

Apple’s interest in MicroLED started in 2014, when it acquired LuxVue. According to the article posted on March 1st, Yole Group’s Principal Analyst Display, Eric Virey stated that “At Yole Group, we estimate that at this point, Apple had spent more than $2.6B to develop MicroLED displays, to which one must add $420M for the acquisition of LuxVue in 2014. Apple’s partners, including LG, Osram, and Kulicke & Soffa, had already spent close to $1.3B to start ramping up manufacturing for the first MicroLED Apple watch in 2026”. Analysts at Yole Group believe that “Osram was on track with process development and qualifications, but Apple was still struggling with downstream manufacturing: mass transfer, an essential process to achieve cost-effective manufacturing, was still not ready”.

In the last few days Kulicke and Soffa has also announced that its own Project W is cancelled, following a project cancellation by a strategic customer, likely Apple as reported by MicroLED-Info. According to DSCC’s blog on March 4th by Dr. Guillaume Chansin, Director of Display Research, “It is believed that ams OSRAM was tasked to produce 8 μm vertical chips for Apple. These would have been significantly smaller than other MicroLED chips previously demonstrated, potentially resulting in a low cost per chip on an 8″ wafer. However, sources said that the yield was too low. With the target release date already out of reach, Apple probably decided to cut its losses and cancel this project”. As Chansin wrote in the article, Apple initially planned to launch a MicroLED watch in 2025, which would have marked the 10-year anniversary of the Apple Watch. The project kept on getting delayed.

According to the very in-depth blog by Omdia’s Senior Director Display Research, David Hsieh on January 30th, “Apple is co-developing Micro LED displays with EPISTAR and ams OSRAM (epi wafer/chip), LuxVue (singulation and transfer), LG Display (LTPO TFT backplane), TSMC (transfer and CMOS backplane), and ITRI (micro-assembly). Hsieh pointed out that:

- LuxVue has a series of patents on the singulation and mass transfer of Micro LED chips. LuxVue’s mass transfer concept is based on electrostatic microelectromechanical sensor (MEMS) technology, which can control each pick-up head individually. It is believed that the electrostatic power can degrade the P-N junction of the Micro LED permanently or damage the contact electrode. LuxVue has also suggested a manufacturing process for vertical LED chips and a method for their mass transfer. However, Apple has applied flip LED chips and a carrier substrate, an easier process than LuxVue has proposed.

In his blog on March 7th David Hsieh from Omdia wrote:

- Apple may delay or cancel its Micro LED smart watch plan because the current Micro LED technology might not be economically viable. However, ongoing R&D in Micro LED technology indicates that Apple may revisit this concept for the Apple Watch in the next five years, especially if the other Micro LED technology (such as without Micro IC or RGB stacked LED) becomes more viable. Apple certainly still has a strong need for technology and feature differentiation.

MicroLED Display: Developing & Emerging

MicroLED display is an emerging technology with very high brightness, high contrast ratio, high color gamut, higher reliability, better flexibility, high transparency and longer lifetime. The technology has been improving over the years in terms of chip efficiency, mass transfers, yield and manufacturing capabilities. Yet, the technology has not reached the high-volume consumer application market. MicroLED displays are making slow but steady progress towards commercialization. That is why the industry had high hopes for Apple. Most expected the smart watch application to be only a stepping stone for Apple, with the ultimate aim to have MicroLED smartphones in the future.

The technology is still facing several manufacturing challenges, yield issues and high costs, making it difficult to enter high volume consumer applications. High-speed transfer, assembly technologies, yield and defect management need to improve and supply chains need to be established before large volume commercialization in consumer products can be done. According to Omdia’s estimates as pointed out in David Hsieh’s Jan 30th blog, “Apple Watch’s Micro LED 2.13/2.2-inch screen with 556×452 resolution will be manufactured at $115 in 2024. The touch and cover lens will be added, costing an additional $10. Compared with the average price of a 2.0-inch flexible OLED, which is $38–40, Micro LED display costs will triple. The key cost elements are not just the Micro LED chips but also the LTPO backplane, the mass transfer, the modulation, the driver IC, the testing and repair, and the final assembly.”

New Opportunities for MicroLED Display Industry

Delay or cancellation of Apple’s smart watch project may open up new opportunities both for Apple and for other suppliers by encouraging them to develop more cost-effective solutions for smart watches and other consumer products. It may even open up new opportunities for collaborations. A broad range of prototypes was shown (LG Display, AUO, PlayNitride, Tianma, Innolux, Porotech, JBD and others) at Display Week exhibitions last year and more are expected to be shown at DisplayWeek 2024. A series of MicroLED prototypes was shown at CES 2024. As per industry information, AUO has started pilot production of its own MicroLED smart watch display panel for Tag Heuer.

According to the March 1st article by Principal Analyst, Eric Virey and Activity Manager, Imaging & Display, Zine Bouhamri from Yole Group, “The number of MicroLED patents filed over the last three years by companies such as BOE, TCL-CSOT, and Vistar is absolutely staggering. …BOE recently spent $300M to acquire LED makers HC-Semitek, with all the proceeds of the transaction going toward building a 150 mm MicroLED fab. Vistar, an offshoot of OLED maker Visionox, has started on the construction of a $413M TFT MicroLED fab, with the first $150M phase scheduled to ramp at the end of 2024”.

In my recent interview, VueReal’s founder & CEO Reza Chaji said, “Micro LED will create a paradigm shift. It is a new approach to manufacturing and a new approach to system integration. It is more of a future-proof technology.” He recognizes that OLED display is tough competition for MicroLED and getting better. Still, he believes “if designed properly and designed well, MicroLED can outperform OLED display. Adding other integration functionality makes it even more valuable for product development”. He thinks the MicroLED transfer process is a major issue, as it directly impacts costs. According to him, “You can have the best LED, but if you can’t transfer at the right rate, size, and pitch, you cannot have display cost competitiveness.”

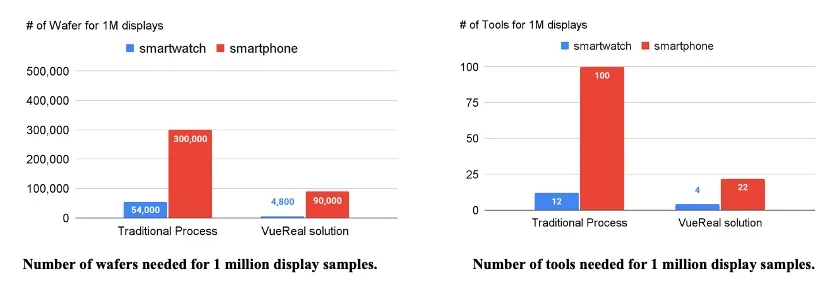

That is why VueReal has developed Micro Solid Printing that allows a reduction of the size of MicroLED to less than 10 microns without a major impact on the yield.. According to the company, VueReal’s MicroLED production does not suffer from unnecessary complexity that can cause defects and yield loss. Multi-device cartridges enable fast transfer of several device types at once while pre-screening of cartridges avoids transferring defective MicroLEDs into the substrate. The company is looking to collaborate with tool and device vendors and others to set up the eco-system together.

At the DisplayWeek 2023 symposium in their invited paper, VueReal demonstrated a solution for MicroLED smartwatches and smartphones that offers lower costs without compromising the performance expected from MicroLED. Reza Chaji still expects MicroLED display based smart watches and wearables to be commercialized in the next year or so. For smartphones he said, “It is something doable in the future. Based on market trends and growth in supply chain readiness it will be doable in 2028”. The MicroLED display industry, although facing uncertainties and turbulence in the near term, can have higher growth opportunities in the future with its unique capabilities.

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com.