Increasing shipments of full-screen smartphones will boost the panel-driven IC industry, according to Cinno Research, which is based in China. Deputy general manager Yang Wende believes that the launch of the iPhone X will move smartphones forward into the full-screen era. In the second half of this year, Apple is heavily rumoured to be launching three iPhones—5.8″ and 6.5″ OLED versions, and a 6.1″ LCD version—all with a full-screen design.

Chinese smartphone brands such as Oppo, Vivo, Huawei and Xiaomi are all releasing smartphones in this design. However, increasing screen proportion is one of the biggest challenges smartphone makers face, often from the change in the package form of the driver IC.

Traditionally, the COG method (chip-on-glass) has been adopted in a 16:9 screen aspect ratio design, with the driver IC directly bonded through the glass substrate circuit. Later, in order to increase screen proportions, in conjunction with COF (chip-on-film) packaging technology, a large number of mobile phone manufacturers began to use touch controller and display driver integration (TDDI). With the increase of TDDI promotion efforts by manufacturers such as Greater China-based driver IC makers Duntai and Lianhe, the speed of IC price decline has also contributed to the increase in penetration rate.

Xiaomi’s Mi Mix 2S has a 5.99″ LCD screen with an 1080 x 2160 resolution,

Xiaomi’s Mi Mix 2S has a 5.99″ LCD screen with an 1080 x 2160 resolution,

an 18:9 aspect ratio and an ~81.9 screen-to-body ratio.

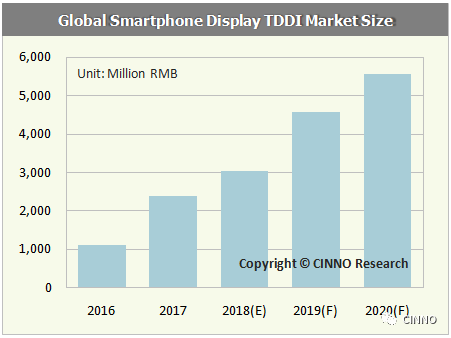

Cinno Research predicts that this year’s TDDI shipments will exceed 300 million and annual growth rate will exceed 70%. The proportion of smartphones using TDDI will also officially exceed the 20% mark. It is estimated that by 2020, the overall market size of TDDI will reach the scale of CNY 5.5 billion ($871.8 million).

Although Samsung is still the unrivalled leader in AMOLED panel shipments, Chinese panel makers, led by BOE, are gradually taking share of flexible AMOLED production capacity. Cinno Research believes that, in 2018, the smartphone penetration rate of AMOLED panels will continue to increase, with market share growing to nearly 27% and flexible AMOLED panel share exceeding that of rigid panels for the first time. However, Samsung still maintains over a 90% share of AMOLED panel shipments and its AMOLED panel driver ICs are mainly supplied by the company’s own Samsung LSI and MagnaChip.

Meanwhile, Oppo’s brand new A7 smartphone, released this month, has a 6.23″ LCD display with a 1080 x 2280 resolution and an ~82.5% screen-to-body ratio.

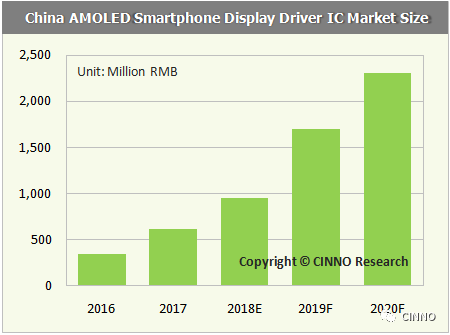

Opportunity is also a challenge. BOE and other panel makers are starting to cooperate with non-Samsung driver IC factories and giving Chinese panel-driven IC makers an opportunity to overtake. The increase in shipments from Chinese AMOLED panel manufacturers will also help increase the market share of non-Samsung AMOLED panel driver ICs.

Cinno Research believes that the AMOLED mobile panel driver ICs in China and Taiwan will reach CNY 2.3 billion ($346.6 million) in 2020.

While in the TV and computer markets, growth momentum is limited or even in recession, the global smartphone market still maintains a small amount of growth. Rapid changes in mobile phone technology has also led to the speedy development of industrial technology such as TDDI and AMOLED driver ICs that will allow for further growth. It has become an important application trend for panel-driven IC manufacturers to restart their growth trajectories.