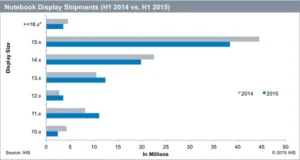

Conventional 15″+ notebooks have become less popular with global consumers, whose attention is instead shifting to smaller products, says IHS. In the first half of 2015, 15″-15.9″ panel shipments fell 14% YoY, from 44.5 million to 38.4 million units. However, driven by Chromebook popularity, panel shipments in the 11″ range (i.e. 11″-11.9″) rose from 8 million to 11 million units.

Affordable prices and a complete ecosystem of hardware and app choices, as well as a user-friendly environment, helped the Chromebook user base to expand, said IHS analyst Jason Hsu. As well as the ‘traditional’ customers (small-medium business and education), Chromebooks are now entering the mainstream consumer market. In addition, they have expanded from the USA to emerging countries. More products are also expected being launched in the 12″ range, such as Microsoft’s Surface 3 and Apple’s widely-expected iPad Pro.

According to IHS, total notebook panel shipments to HP and Lenovo fell 27% MoM in June, from 6.4 million units to 4.7 million. Overall set production grew 13%, from 5.4 million to 6.1 million. These leading notebook brands have moved to regulate panel inventory, to guard against excess product pre-stocking.

“The currency depreciation in [the] Euro zone and emerging countries earlier this year jeopardised consumer confidence and slowed the purchase of consumer electronics, including notebooks”, said Hsu. “Moreover, in April, Microsoft leaked the announcement of its new Windows 10 operating system. Despite Microsoft’s claims that a free upgrade to the new operating system would be available to Windows 8 users, many consumers still deferred purchases, which increased the brands’ set inventory. Notebook manufacturers could decide to lower set production in the third quarter, after the end market becomes sluggish in May and June”.

Notebook panel prices are still low, leading to profitability issues. Panel makers are facing pressures to maintain fab loading and gain market share. Continuous oversupply damages profitability, and could confuse real panel market demand in Q4’15 and Q1’16.

“It’s time for panel makers to revise their production numbers, and curb capacity utilisation, to keep pace with actual market demand”, Hsu concluded.