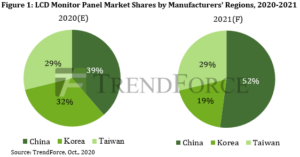

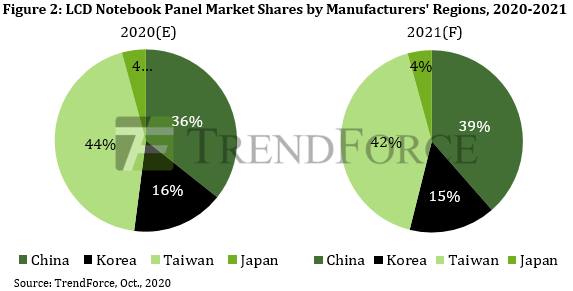

Chinese manufacturers are expected to raise their market share from 39% this year to 52% next year in the monitor panel market, and 36% to 39% in the notebook panel market, according to TrendForce’s preliminary shipment forecast of panel makers for 2021.

As such, these manufacturers are expected to maintain their plans of transitioning some production capacities from TV panel manufacturing to IT panel manufacturing in spite of the TV panel shortage in 2H20 caused by various factors such as the closedown of SDC’s LCD panel manufacturing operations, the rise of the stay-at-home economy, and the stimulus policies instituted by governments worldwide.

TrendForce indicates that, with regards to the standing of Chinese manufacturers in the IT panel industry, BOE has long established itself as the market leader, while CSOT and HKC are each also catching up fast. After acquiring SDC’s Suzhou-based Gen 8.5 fab, CSOT will possess even more production capacities for monitor panels. At the same time, HKC currently maintains three Gen 8.6 fabs, located in Chongqing, Chuzhou, and Mianyang, and plans to capture additional shares in the monitor panel and notebook panel markets.

As TV panel manufacturing transitions to Gen 10.5 fabs, Gen 8.5 and Gen 8.6 capacities will be used for monitor panel manufacturing

Chinese panel makers have been gradually transitioning their current panel capacities to monitor panel production. Most significantly, as more Gen 10.5 production lines become available, TV panel production will most likely take place in Gen 10.5 fabs instead of Gen 8.5 fabs in the future, while the existing Gen 8.5 and Gen 8.6 production lines will be reallocated to monitor panel production in order to expend the excess capacity made available after TV panel production moves to Gen 10.5 fabs. In addition, after SDC’s forecasted closing of LCD panel manufacturing operations at the end of this year, CSOT and HKC will look to capture the resultant supply share of SDC’s absence in the market. On the other hand, since both TCL, which is CSOT’s parent company, and HKC possess monitor ODM operations, should the two companies decide to vertically integrate by making panels for their own monitor products, they will be able to effectively optimize their cost structures.

CSOT targets mid-range and high-end LTPS notebook panel market, whereas HKC will primarily focus on the entry-level and mid-range notebook market

Although CSOT’s Wuhan-based T3 LTPS Gen 6 production line is primarily dedicated to smartphone and notebook panel manufacturing, the considerable reduction of LTPS smartphone panel demand from Huawei caused by U.S. sanctions means CSOT is expected to make plans for an increase in notebook panel shipment in order to make up for the shortfall. As well, thanks to high demand for TV panels this year, HKC’s production lines have been operating at maximum capacity utilization rates, in turn slowing down its notebook panel business. However, in light of the fact that the COVID-19 pandemic has brought about a rapid surge in TN notebook panel demand, HKC is therefore looking to TN panels as a new commercial opportunity in the notebook display market and subsequently prioritizing TN panel development over IPS panel development as its product strategy. Not only will this reprioritization allow HKC to align its strategy with the current market trend, but it will also quickly raise the yield rate of HKC’s Mianyang-based fab, which had never manufactured NB panels, by instead having the fab manufacture TN panels, which have a relatively simpler manufacturing process.

Chinese panel makers will face challenges in their production plans as they enter the IT panel market

TrendForce analyst Jeff Yang indicates that, despite Chinese panel makers’ strong intention to enter the IT panel manufacturing business, success in the IT panel market is not solely decided by a company’s production capacity. For instance, with regards to monitor panels, CSOT’s technical competency is mostly focused on VA panels, meaning the company is constrained in its product mixes due to its lack of mainstream IPS offerings. Although HKC is equipped with both IPS and VA technologies, it lacks experience in manufacturing curved VA panels, leading its clients to take on a wait-and-see approach before placing additional orders. For notebook panels, although CSOT is primarily focusing on the mid-range and high-end LTPS notebook panel market, it faces intense competition from Samsung’s OLED notebook panels, which are gradually extending from the high-end segment to the mid-range segment as well. Likewise, HKC will have to take time in order to make headways in the notebook panel market, since it has not reached any production milestones, and it requires time to cultivate a significant client base.