The global TV market is experiencing a dramatic transformation as Chinese manufacturers TCL and Hisense challenge Samsung’s two-decade dominance through aggressive pricing and strategic focus on large-screen MiniLED technology. While TV panel revenues surged 19% year-over-year in 2024, the market faces headwinds from intensifying price competition and shifting consumer preferences toward ultra-large displays.

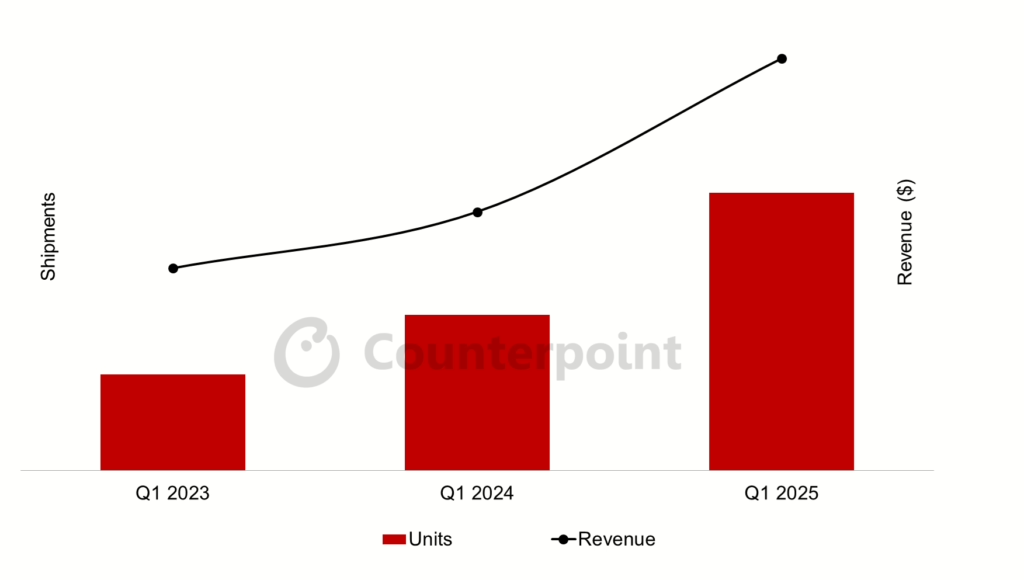

TV panel revenues increased 19% YoY in 2024, contributing significantly to the broader flat panel display market’s 11% growth. This growth was primarily driven by increased demand in the large-screen segment, which improved overall average selling prices (ASPs).

The market is experiencing a clear shift toward larger screens, with 75-inch and larger Advanced TVs seeing shipments increase 79% YoY and revenues up 59% in Q1 2025. This “bigger is better” trend is reshaping competitive dynamics and driving revenue growth despite unit volume pressures.

Chinese Ascendancy

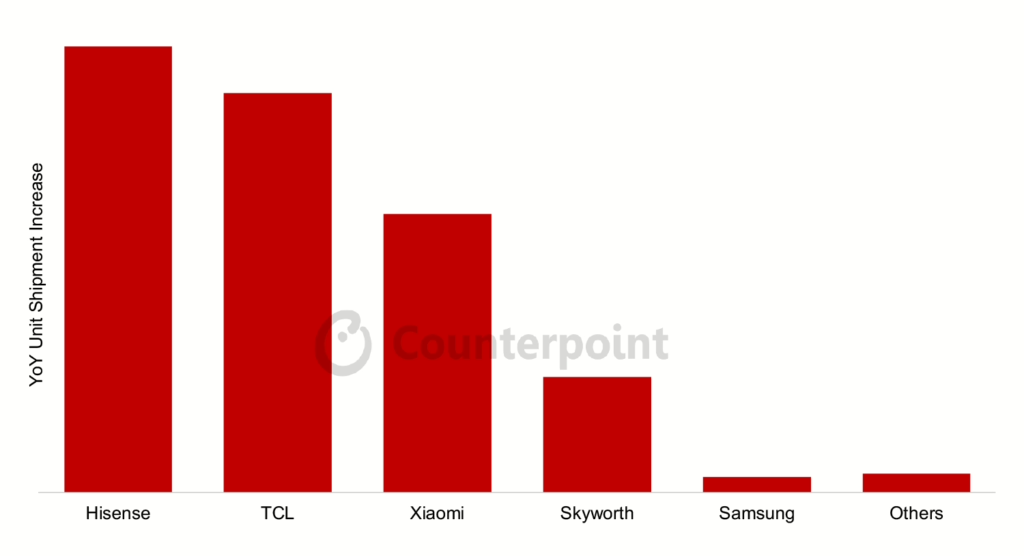

TCL and Hisense have emerged as formidable competitors, with both companies achieving triple-digit percentage increases in shipments in Q1 2025. Hisense’s market share jumped from 14% to 20% in units and from 13% to 17% in revenue share year-over-year, while TCL’s unit share increased from 13% to 19% and revenue share from 13% to 16%.

For the first time in decades, Samsung faces a legitimate threat to its TV market leadership. The company’s focus on OLED technology has left it vulnerable to Chinese competitors who are leveraging China’s LCD manufacturing dominance to offer larger screens at competitive prices.

Both Samsung and LG have seen their market positions erode as Chinese brands gain share through aggressive promotion of large-screen MiniLED LCD models, making OLED less central to the overall premium market.

MiniLED TVs have gained significant traction, with shipments and revenues surpassing OLED in Q2 2024 and continuing to increase market share each quarter since. This technology typically competes at price points similar to OLED but offers consumers a choice between smaller OLED displays or larger MiniLED screens.

An increasing number of consumers are choosing MiniLED TVs over OLED, driven by the value proposition of larger screen sizes at comparable prices. TCL pioneered MiniLED in 2019, but Samsung’s 2021 entry initially dominated the category before Chinese brands regained leadership.

OLED TV units increased 8% YoY and revenues grew 3% YoY in Q1 2025, but the technology faces strong competition from MiniLED LCD TVs. The slower revenue growth compared to unit growth indicates pricing pressure in the OLED segment.

China as Growth Engine

China emerged as the main driver of Advanced TV growth in Q1 2025, with revenues surging at triple-digit percentages. Government incentives encouraging consumers to trade in older TVs for new models, combined with aggressive promotions from domestic brands, fueled this growth.

Chinese brands’ success extends beyond their home market, with share gains in other key regional markets contributing to their global growth trajectory.

Despite 2024’s strong performance in the TV panel market, the growth trajectory faces significant near-term headwinds that suggest the current momentum may not be sustainable. Industry analysts characterize 2024’s growth as a “reset” rather than the beginning of a long-term trend, with intensifying price competition expected to pressure panel revenues after 2025. The overall market dynamics indicate that the steep growth experienced in 2024 is unlikely to continue at the same pace.

Looking ahead, the long-term trajectory presents a mixed outlook where TV panel units and screen size areas are expected to continue growing, but revenue growth will be increasingly constrained by price competition. The market appears to be entering a period characterized by unit growth accompanied by significant average selling price pressure, creating a challenging environment for manufacturers seeking to maintain profitability while expanding market share.

From a strategic perspective, Chinese brands have demonstrated remarkable effectiveness in leveraging their LCD manufacturing dominance to compete on screen size rather than directly challenging Korean manufacturers’ strengths in OLED technology. This approach has allowed companies like TCL and Hisense to offer compelling value propositions in the large-screen segment, capitalizing on consumer preferences that increasingly prioritize screen size over display technology premiums.

The success of these Chinese manufacturers reveals a fundamental shift in market positioning, demonstrating that consumers are willing to trade premium display technologies for larger screens at competitive prices. This trend creates significant opportunities for manufacturers who can deliver large displays cost-effectively while simultaneously putting pressure on traditional market leaders to adapt their strategies. The competitive response from established players may require greater emphasis on manufacturing efficiency and cost optimization to remain competitive in this evolving landscape.eater focus on cost competitiveness and larger screen offerings to maintain market position.

The TV market is undergoing its most significant competitive shift in decades, with Chinese manufacturers successfully challenging established Korean dominance through strategic focus on large-screen MiniLED technology. While 2024 showed strong growth, the market faces a period of intensifying competition that will likely pressure revenues despite continued unit growth. The ultimate winners will be those who can best navigate the balance between screen size, display technology, and price competitiveness in an increasingly size-conscious market.