According to DSCC, in the fourth quarter of 2023, Chinese TV manufacturers TCL and Hisense achieved notable growth in the Advanced TV market, according to DSCC’s latest Quarterly Advanced TV Shipment and Forecast Report. This growth was facilitated by their aggressive pricing and promotion strategies for MiniLED LCD TVs, enabling them to capture a larger share of the premium market.

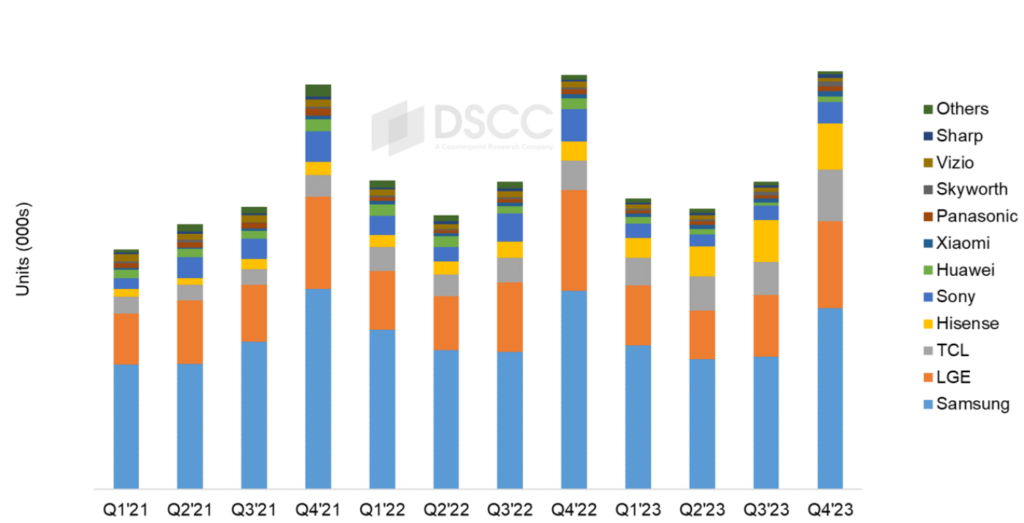

The report indicates a slight increase in Advanced TV shipments by 1% year-over-year in Q4’23, totaling 6.9 million units. This increase was mainly attributed to a 10% rise in Advanced LCD TV shipments, which amounted to 5.0 million units, contrasting with a 17% decline in OLED TV shipments to 1.9 million units.

Revenue in the Advanced TV sector decreased by 3% year-over-year to $7.6 billion, marking the eighth consecutive quarter of decline. OLED TV revenues fell by 18% to $2.8 billion, while Advanced LCD TV revenues grew by 9% to $4.8 billion, counteracting the effects of price reductions through an increase in units and a more diverse product mix.

The competition among brands saw shifts, with Samsung retaining its lead in unit shipments and revenue despite a decrease in performance. Samsung’s shipments dropped by 9% to 3.0 million units, and its unit share decreased by 5%. Revenue for Samsung also fell by 5%, and its revenue share diminished slightly to 42%. The company’s dominance in the MiniLED segment is challenged as Chinese brands intensify their efforts, with a 34% decrease in Samsung’s MiniLED shipments.

LG’s performance also declined, with a 14% decrease in shipments and a 3% reduction in unit share to 21%. Its revenue decreased by 22%, resulting in a 5% loss in market share. LG maintains a strong position in the OLED TV market but has a minimal presence in the MiniLED sector, holding only a 3% share.

TCL and Hisense made significant gains, with TCL’s shipments increasing by 77% and Hisense’s by 135%. This growth allowed TCL to overtake Sony in revenue share, securing the third position with 11%, while Hisense advanced to fourth in both shipments and revenue. Sony experienced a 33% decline in shipments and a 35% reduction in revenues, dropping to fifth place in both metrics.