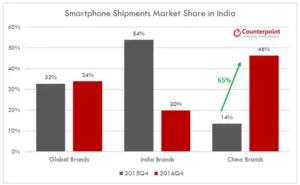

According to Counterpoint Research, Chinese brands have substantially increased their share of the mobile phone market in India, reaching 46% in total. Samsung is top brand, but Vivo, Xiaomi, Lenovo and Oppo take the next four places. In November, the brands reached 51% of the market.

The market for smartphones grew 18% over the year and for the first time, no Indian brand was in the top five. The company reported that:

- Mobile phone shipments declined 17% QoQ during Q4 2016.

- Feature Phone shipments grew 4% YoY as the feature phone to smartphone transition slowed in the second half of 2016 due to the strength of ultra-low cost brands, such as iTel.

- More than 83 million smartphones in 2016 were “Made in India”. In Q4 2016, 3 out of 4 smartphones were manufactured domestically. However, the local value addition remains close to 6%.

- More than 7 out of 10 smartphones shipped in India were LTE capable.

- Demonetization has widened the usual seasonal decline from an estimated 12% to 19% YoY.

- Apple achieved a landmark, crossing 2.5 million units in a calendar year, with a third of its total shipments coming from the record fourth quarter driven by seasonality and the launch of iPhone 7.

- Apple captured 10th position in the smartphone rankings during Q4 2016 but led the premium segment (above $450) with 62% market share.

- Chinese brands raced to capture a combined 46% of the total smartphone shipment in Q4 2016, up from 14% a year ago. Furthermore, November 2016 saw Chinese brand share reach an all-time high, accounting for 51% of the total smartphone market.

- Chinese brands Oppo, Vivo, Lenovo and Xiaomi continued to grow at the expense of Samsung and Indian brands. Their success was attributable to a variety of factors including strong marketing and channel push, as well as better access to components that were in limited supply. As a result Chinese brands captured close to 50% market share.

- One in three smartphones sold during the quarter were through ecommerce channels, a segment which grew 24% in CY 2016.