Cinno Research has done an August update on production trends in mainland China. The G8.5, G8.6, and G10.5 panel fabs achieved their highest utilization rates for the year in July. The G10.5 lines operated at an impressive average of close to 95%. However, this production intensity decreased in August, as the average utilization rates for G8.5 and G10.5 dropped, while G8.6 remained consistent with July numbers. Manufacturers scaled back their production rates and Cinno predicts that controlled production will become more pronounced after September, tightening up supplies and raising prices.

Rising panel prices post the 618 shopping event have cast a shadow on sales projections for top brands for the latter half of the year. The escalation in panel costs and its effects on TV sales highlights how there are no effective replacement markets for excess inventory, usually in the IT products segment which is suffering its won pain points right now.

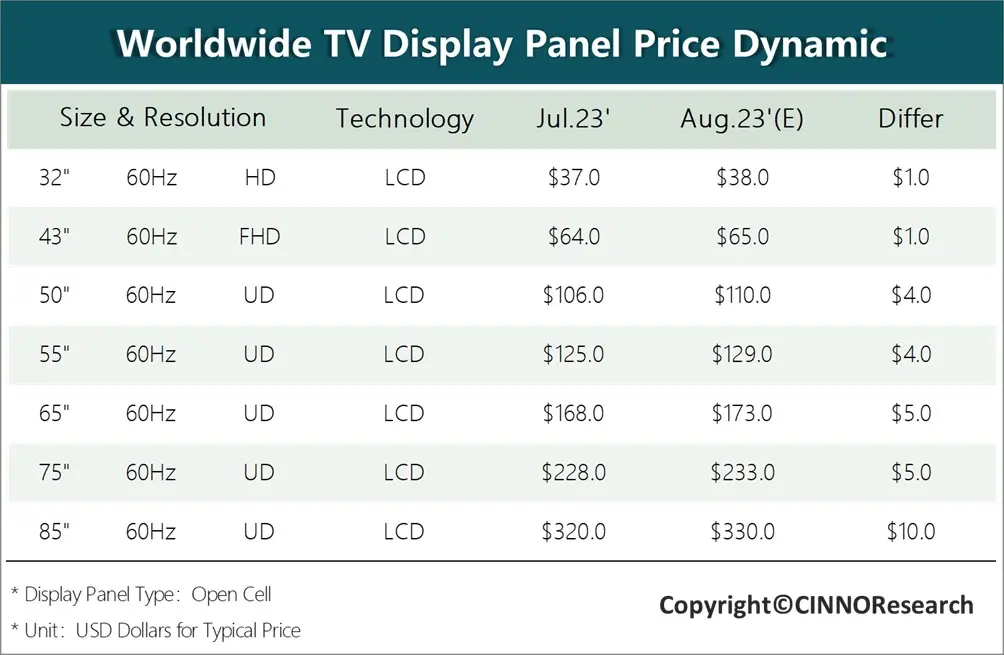

TV manufacturers are also showing a preference for larger-sized panels. This has inadvertently led to a supply shortage for these large-size panels, keeping their prices on the higher side. As a result, in August, the price of 32” panels is rose by $1, with a final price of $38. 43” panels saw a marginal incremental increase of $1, also, bringing their price up to $65. For the 50” panels, there was a $4 rise in prices, leading to a final price average of $110, while 55” panels also experienced a $4 increase, going as high as $129 for the final display.

The larger format, and more in demand panels – such as the 65″, 75″, and 85″ panels – are on track for more noticeable price adjustments. They’re expected to climb by $5, and $10, respectively, culminating in prices of $173, $232, and $330. But, similar to their smaller counterparts, the pace of these price hikes is projected to slow down in upcoming quarters.