In the second quarter of 2023, consumer-grade virtual reality (VR) product sales in China’s domestic market reached 155,000 units. That’s an anemic annual growth of 1%, but a quarterly drop of 10%. According to Cinno Research, this fluctuation in sales performance can be attributed to a dip in April and May, followed by a surge owing to the 618 e-commerce festival.

In the same period, the average price of consumer-grade VR products rose to 3,214 yuan ($448), buoyed by improvements in technology and an escalating demand for interactive and immersive experiences among consumers. Upcoming VR products, poised to be equipped with sensors such as visual simultaneous localization and mapping (VSLAM) and eye tracking, will contribute to a further rise in price. Consequently, sales are expected to see a revival in the third quarter.

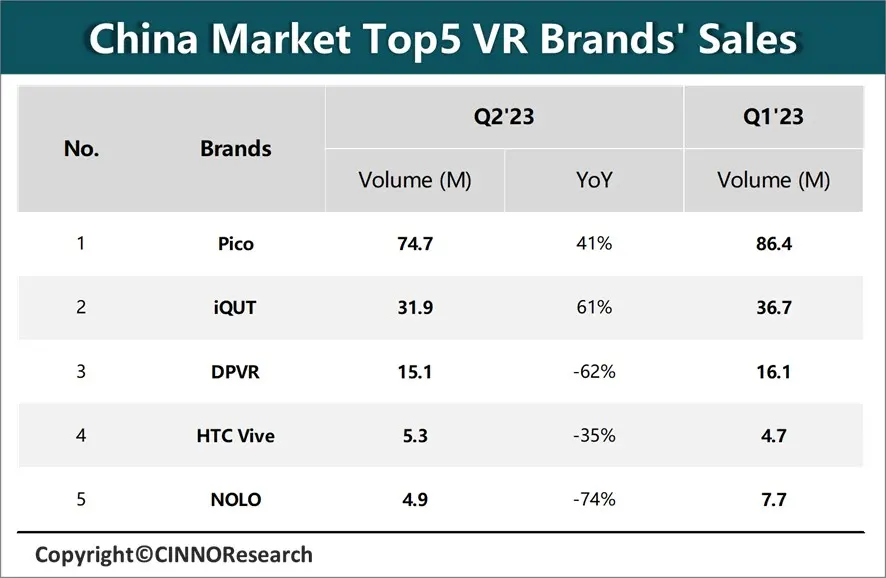

Observations from Cinno Research highlight the domestic market structure’s concentration, with the Top 5 players representing about 85% of the overall market share in Q2’23, albeit a 3% drop from the previous quarter.

Leading the pack is Pico with a market share of 48%, affirming its strong position and competitiveness in the short-term future. Despite internal restructuring and layoffs leading to a slight dip in domestic and overseas sales in 1H’23, the brand is poised for a recovery in Q3’23, thanks to organizational optimization and an aggressive product launch strategy. The top three best-selling models – Pico 4 256G, Neo3 256G, and the newly launched Pico 4 Pro – are all from Pico’s stable.

Second in line is iQut, which recorded a robust 61% YoY growth in sales in Q2’23. Leveraging the technological and content resource advantages of the iQiyi platform, iQut has carved out a unique position in the industry. Its recent partnership with JD.com has further boosted the online sales of its VR products. The brand’s Mix VR all-in-one machine, launched in January, has sold over 18,000 units up to the end of June, falling just short of Pico 4 Pro’s sales figures.

DPVR secures the third position, largely owing to its consumer-grade E4 product which contributes 76% to the brand’s share. Leveraging its enterprise-level VR product capabilities, DPVR is expanding into the consumer segment. The brand completed a financing round exceeding 100 million yuan ($14 million) in March, which is expected to spur investment in core technology and product R&D, and facilitate global expansion.

In the high-end VR product market, priced above 4,000 yuan ($560), HTC Vive stands out with a 19% market share in Q2’23. Nolo, having entered strategic collaborations with the three major operators, has seen a rapid climb in sales to secure the fifth spot. Along with China Mobile and Qualcomm, Nolo recently launched the CM1; its availability across several offline business outlets and a lowered price threshold makes it an attractive choice for consumers seeking entry-level VR products.