According to Counterpoint’s 618 sales report, China’s smartphone market experienced an 8% year-on-year (YoY) decline in sales during the 618 sales period in 2023 (June 1 to June 18). This decline can be attributed to weak customer demand amid economic challenges.

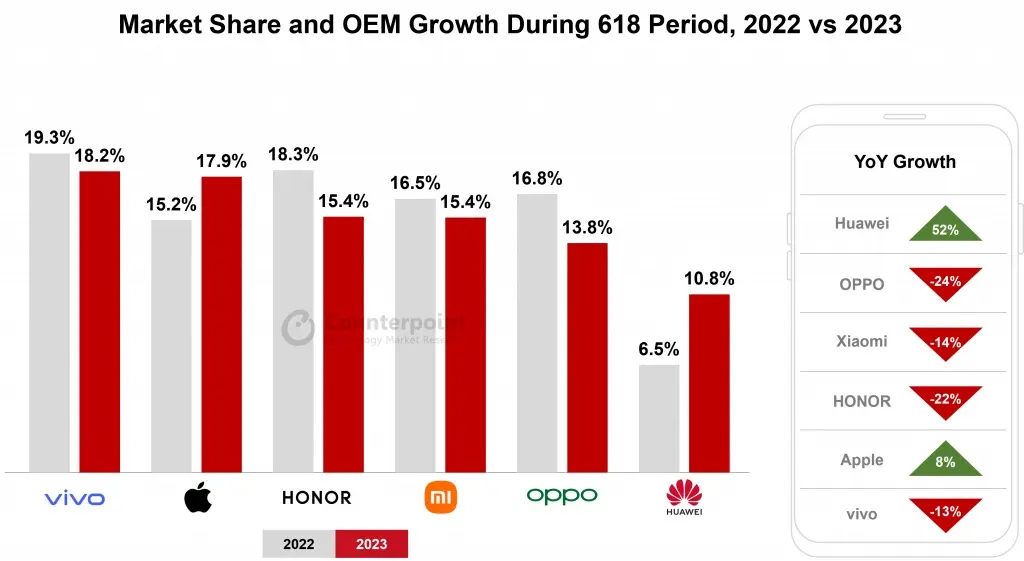

During this sales period, vivo emerged as the leading smartphone brand, capturing 18.2% of the market share. Apple secured the second position with 17.9% market share, while Honor followed closely at 15.4%. Notably, Apple performed well in the premium segment, witnessing an 8% YoY increase in sales without facing significant competition. To stimulate iPhone sales during the 618 period, e-commerce platforms offered discounts of approximately 20%.

Huawei, despite facing various challenges, demonstrated significant growth with a remarkable 52% YoY increase in sales. The company successfully resumed normal product launches in 2023, introducing a range of smartphones across different price segments, such as the Mate X3 and Enjoy 60 series. Huawei’s accelerated pace of product launches is expected to contribute to its sustained rapid YoY growth in the second half of 2023.

Price cuts implemented by original equipment manufacturers (OEMs) played a vital role in recovering the market from the low smartphone sales observed in May and April. During the June 1 to June 18 period, the total market sales increased by around 30% compared to the preceding 18 days.

Among the smartphone brands, Xiaomi witnessed the highest sequential growth this year, primarily driven by its online-centric approach. Xiaomi offered significant discounts on select high-memory products and expanded its product portfolio by introducing the K60 16GB+1TB variant at a competitive price of 2,899 yuan (~$400).

However, despite the efforts of Android OEMs to attract consumers with price cuts, the weak sales during the 618 period fell short of earlier expectations. Consumers displayed increased caution in their spending, particularly on durable goods like smartphones, due to the uncertain economic outlook.

Considering these factors, Counterpoint has revised its 2023 forecast for the China smartphone market from flat growth to a low single-digit YoY decrease.