According to the IDC Worldwide Quarterly Mobile Phone Tracker, 80.8 million smartphones were shipped in China in 3Q21, down 4.7% year-on-year (YoY). The decline was the result of higher average selling prices and a continued lack of products that dramatically stimulated demand. Nevertheless, the top five smartphone companies all managed to achieve double-digit share amid a consolidating market.

“Honor again grabbed the spotlight by gaining two spots from the previous quarter. Despite the fierce competition, the company was able to quickly establish a well-rounded product portfolio along with a stronger channel and supply chain,” said Will Wong, Research Manager for Client Devices at IDC Asia/Pacific.

Top 5 Smartphone Company Highlights:

• vivo remained in its top spot in 3Q21. The new X70 series and iQOO models helped strengthen vivo’s position in the US$600-800 segment. In the online channel, the X70 Pro+ model was able to attract consumer attention with its self-developed ISP chip.

• OPPO’s market share fell from 1H21 as no key products were launched in the quarter. Although its A series and Reno 6 series managed to support its share in the mid-range (US$200<400) and mid- to high-end (US$400<600) segments respectively, the company still saw an impact in other price bands.

• Honor rose to the third spot with its market share now up to 17.3%. Its main product, the Honor 50 series, and its new products, the X20 and Magic 3 series, improved its channel partners’ confidence and strengthened its supply chain partnerships.

• Xiaomi faced a supply shortage in the quarter, especially with key products like the Redmi Note 10. Nevertheless, the newly launched MIX 4 and the Redmi 9 series supported Xiaomi’s market share via the US$600-800 and <US$150 segments respectively.

• Apple grew nearly 50% from the same period last year. The new iPhone 13 series launched with its usual timing in September this year, accounting for about 40% of Apple’s shipments. Its competitive pricing strategy in China also led to a higher mix of the Pro version compared to the iPhone 12 series.

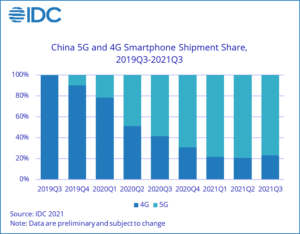

5G smartphones are already mainstream in the Chinese market, accounting for 77.0% of total shipments in 3Q21. The unit share of 4G smartphones, however, rebounded slightly this quarter due to continued demand from consumers and the increased 4G shipments from Huawei amid the US trade ban.

“The increase in 4G unit share is undoubtedly a short-term fluctuation amid the rapid penetration of 5G handsets,” said Xi Wang, Research Manager for Client System Research at IDC China. Xi adds, “But this is also reflective of consumer demand for a budget-friendly product.”