Complementing the quarterly shipment tracking we do on smartphones, foldables and TVs, DSCC has released the first issue of its Quarterly Advanced IT Display Report which tracks OLED and MiniLED competition in the tablet, notebook PC and monitor/AIO market.

The new report:

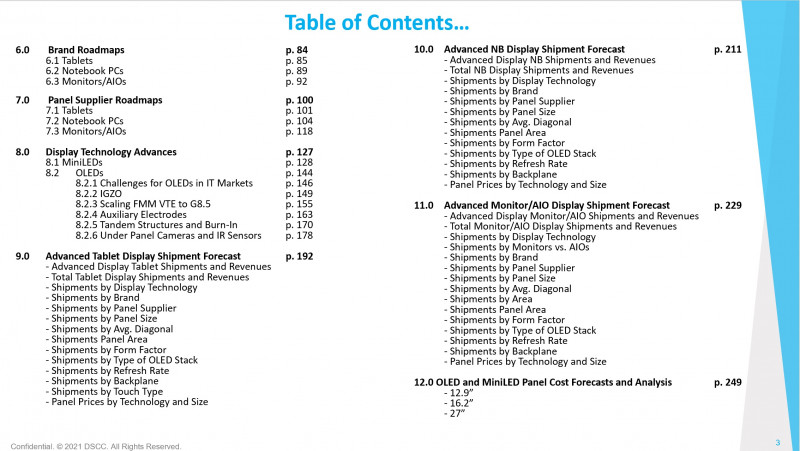

- Tracks OLED and MiniLED panel shipments by application by brand by model by size/resolution/panel supplier/frontplane/backplane/refresh rate and more;

- Shows OLED and MiniLED panel penetration into the overall tablet, notebook and monitor/AIO markets by quarter and year;

- Reveals OLED and MiniLED brand and panel supplier roadmaps;

- Includes an analysis of OLED and MiniLED display technology advancements to improve performance and lower cost;

- Reveals bill of materials forecasts for MiniLED BLUs, MiniLED panels and OLED panels for tablets, notebooks and monitors indicating which technology is most cost competitive for each application. Examines multiple MiniLED BLU implementations and OLED solutions.

Not surprisingly, the report shows great promise for OLEDs and MiniLEDs in IT markets.

- Advanced displays, consisting of OLEDs and MiniLEDs, are expected to grow at a:

- 45% CAGR in tablets to reach 32M units and a 15% share of the 214M unit tablet market in 2026. Advanced tablet display revenues are expected to grow at a 51% CAGR to $3.8B;

- 79% CAGR in notebooks to reach 37M units and a 15% share of the 252M unit notebook market in 2026. Advanced notebook display revenues are expected to grow at a 68% CAGR to $4.8B;

- 82% CAGR in monitors/AIOs to reach 17M units in 2026 and a 9% share of the 181M unit monitor/AIO market in 2026. Advanced monitor/AIO display revenues are expected to grow at a 56% CAGR to $3.4B;

- From 2020 to 2026, advanced displays are expected to grow at a 62% CAGR to 85M while revenues are expected to grow at a 63% CAGR to $12B.

- Some other key takeaways include:

- Apple’s MiniLED panels are currently significantly more expensive than OLEDs at the same size in tablets and notebooks due to the very high number of zones. DSCC does see significant cost reduction opportunities in MiniLEDs as yields improve, MiniLED costs fall, # of MiniLEDs decline, discrete LED drivers are bonded simultaneously with MiniLEDs and/or more dimming zones are added per LED driver IC.

- While Apple devices have led the way in # of zones to improve performance, we see most MiniLED monitors pursuing fewer zones and lower costs to increase attractiveness and penetration in the price sensitive monitor market. Apple will likely be the exception with its iMac Pro’s coming out in 2022.

- Apple’s MiniLED supply chain is also revealed.

- OLEDs will look to boost performance through tandem structures which can double efficiency while increasing lifetime by 4X. To reduce power in IT applications, we see panel makers adding auxiliary electrodes which can reduce power by 30% or more in larger displays at the expense of an additional FMM step. High efficiency blue OLED emitters will also help when they are eventually commercialized. We also expect panel makers to implement under panel cameras and IR sensors which will give OLEDs an advantage over MiniLEDs in terms of bezel width.

- To reduce costs, we expect to see leading OLED manufacturers introduce G8.5 IGZO OLED fabs using vertical FMM VTE tools to enable similar performance as we see in smartphones. This technology has better potential for penetration into IT markets due to similar panelization as we see in LCDs resulting in lower costs than from G6 and smaller fabs along with higher brightness and resolution than we see in OLEDs focused on the TV market. Depreciation can be cut by over 30% through fewer masks and improved panelization resulting in lower costs per square meter.

- The report also discusses Sharp’s IGZO technology roadmap now at IGZO7 achieving mobilities of 40cm2/Vs and <20Hz driving. It reveals where Sharp expects to be with its IGZO8 technology and when.