Although smartphone sales rose in Q1’16, compared to the same period last year, the results were not all encouraging. Sales increased just 3.9% to 349 million units, and Apple registered its first double-digit decline.

Smartphone sales represented 78% of all mobile phone sales in Q1’16, driven by demand for low-cost units in emerging markets and affordable 4G models.

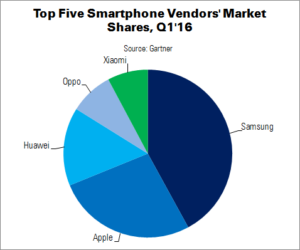

The smartphone market is slowing down and large vendors are experiencing growth saturation. Emerging brands are causing market disruption and increasing their share, said research director Anshul Gupta. Chinese brands are becoming the new top global phone makers. Two such brands appeared in the top five in Q1’16, with an 11% share, but this increased to three brands (Huawei, Oppo and Xiaomi) and a 17% share a year later.

Oppo performed the best of any brand in Q1, with unit sales rising 145%. Growth was highest in China (the same was true for Huawei and Xiaomi), taking share from players such as Samsung, Lenovo and Yulong. Huawei also saw growth in Europe, the Americas and Africa, while Xiaomi and Oppo’s sales in APAC rose by 20% and 199% YoY, respectively.

| Worldwide Smartphone Sales to End Users by Vendor, Q1’16 (000s) | ||||

|---|---|---|---|---|

| Company | Q1’16 Unit Shipments | Q1’15 Unit Shipments | Q1’16 Share | Q1’15 Share |

| Samsung | 81,186.9 | 81,122.8 | 23.2% | 24.1% |

| Apple | 51,629.5 | 60,177.2 | 14.8% | 17.9% |

| Huawei | 28,861.0 | 18,111.1 | 8.3% | 5.4% |

| Oppo | 16,112.6 | 6,585.1 | 4.6% | 2.0% |

| Xiaomi | 15,048.0 | 14,740.2 | 4.3% | 4.4% |

| Others | 156,413.4 | 155,561.4 | 44.8% | 46.3% |

| Total | 349,251.4 | 336,297.8 | 100.0% | 100.0% |

| Source: Gartner | ||||

Samsung held on to its market lead and widened the gap between itself and second-place Apple, with a 23% share. The Galaxy S7 series and renewed portfolio positioned Samsung as a strong competitor in the smartphone market, and more so in emerging markets, said Gupta.

Apple’s iPhone sales were down 14% YoY, to 51.6 million units. However, the company’s upgrade programme in the USA has helped to ‘sweeten’ the pricing of its iPhone 6 and 6+, to drive sales in what remains Apple’s largest market. The company is also examining ways to refurbish second-hand iPhones in emerging markets.

Lenovo vanished from the top five entirely, as well as the top 10. Gupta said that the company’s worldwide mobile phone sales were down 33% YoY, and 75% in Greater China, where it faced strong competition from local brands. “Lenovo is also struggling to bring synergies with Motorola’s device business, managing lower costs and overheads of the two brands,” said Gupta.

In the OS market, Android regained share over iOS and Windows, to reach 84%. Google is expanding Android’s reach in other markets, such as cars and wearables, as the smartphone market approaches saturation.

“Despite the Android platform’s advancements and its dominant market share, the challenges of profitability remain for a number of Android players,” said Gartner’s Roberta Cozza. “This will have an impact on the vendor landscape where new or more innovative business models will increasingly become key to succeed.”

| Worldwide Smartphone Sales to End Users by Operating System, Q1’16 (000s) | ||||

|---|---|---|---|---|

| Operating System | Q1’16 Unit Shipments | Q1’15 Unit Shipments | Q1’16 Share | Q1’15 Share |

| Android | 293,771.2 | 264,941.9 | 84.1% | 78.8% |

| iOS | 51,629.5 | 60,177.2 | 14.8% | 17.9% |

| Windows | 2,399.7 | 8,270.8 | 0.7% | 2.5% |

| Blackberry | 659.9 | 1,325.4 | 0.2% | 0.4% |

| Others | 791.1 | 1,582.5 | 0.2% | 0.5% |

| Total | 349,251.4 | 336,297.8 | 100.0% | 100.0% |

| Source: Gartner | ||||

Gupta also commented on Nokia’s planned return to the smartphone and tablet markets (Microsoft Sells Off Feature Phone Business). He said that it will not be “an easy mission,” adding, “In today’s market it takes much more than a well-known brand to sell devices.” Good hardware will not be an issue, but consumers need a reason to remain loyal a brand.