According to IDC, the EMEA traditional PC market continued to improve in the second quarter of 2017, with a slight volume loss of 0.6% and a total of 15.9 million units being shipped. Notebook sales improved with rises of 3.1% in EMEA, 5.2% in CEE and 0.4% in Western Europe.

The investments in public and private sectors in CEMA, along with stronger economic confidence in major mature markets and back-to-school deals also fuelled commercial notebooks, which grew 18.6% in CEMA (described by IDC as ‘astonishing’) and 3.0% in Western Europe. Consumer notebook shipments increased 3.5% in CEMA but showed a drop of 2.0% in Western Europe.

Desktop shipments declined with an 8.3% decrease in EMEA. However, in CEE, they grew 7.8% after years of contraction. In CEE, the consumer segment grew 8.9% and the commercial segment grew 6.8%. Furthermore, the overall traditional PC market in CEE posted a 6.1% growth in the quarter, which is the second quarter of growth.

In Western Europe, the traditional PC declined 2.1% after two quarters of growth. Desktops fell 7.8%, while notebooks achieved ‘soft growth’. Southern Europe was above expectations, with rises in France of 1.9%, 11.6% in Spain and 16.7% in Portugal, when compared to the same quarter in 2016. Benelux rose 5.8%, but Germany and the UK contracted. Compared to the same quarter last year, the UK saw a fall of 11.8%. In the commercial segment, traditional PC shipments declined 1.3%, compared to the same quarter in 2016, while commercial desktops further eroded. Notebooks displayed growth of 3.0%, compared to the same quarter last year.

Portable volumes were supported by large and very large enterprise renewals as mobility adoption combined with Windows 10 was strong. For the consumer segment, desktop fell 6.6% and notebooks fell 2.0%, compared to the same quarter last year.

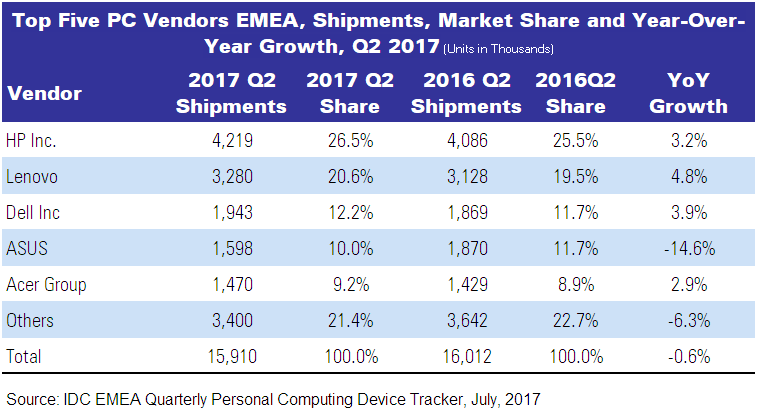

Consolidation by the top three brands continiues.

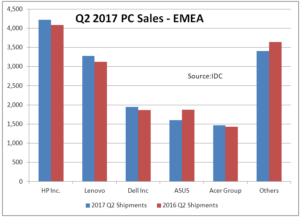

The share of the top three vendors continued to grow showing traditional PC market consolidation. The top three players accounted for 59.3% of the total market volume, compared to 56.7% for the same quarter in 2016.

HP held onto the top spot, with 26.5% market share, and solid notebook results, in both the consumer and commercial markets, combined with stronger consumer desktops, which boosted performance. Lenovo ranked second, recording a market share of 20.6% led by the double-digit growth of commercial notebooks. Dell’s market share reached 12.2%, with a strong performance in commercial notebooks. Asus, despite securing fourth position with 10% market share, continued its struggle to return to positive growth territory. The Acer Group maintained its growth for the third quarter in a row strengthening its position with 9.2% share, thanks to back to school shipments.