LGD’s problems have been well documented: too much large-area capacity for OLED TVs where the market is diminishing, too little small/medium capacity where the market is growing, and the inability to generate free cash to pay for an IT fab, the next growth area for OLEDs.

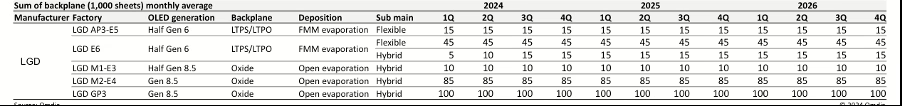

To compensate, LGD announced it is eliminating the Chief Production Officer (CPO) position and combining the medium and large manufacturing operations under the large business division. The changes will be implemented on Dec. 1. LGD has two Gen 8.5 OLED fabs with a total capacity of 185K substrates/month. The maximum annual production at 100% yield and 100% utilization is 13M 55″ panels/year, but LGD uses MMG to optimize the substrate when 65″ and larger panels are required, putting the maximum annual yielded production at 10M panels. LGD shipped 4.5M in 2023 and is expected to ship 6.0M in 2024. LGD has a Gen 6 capacity of 60K substrates/month for standard smartphone panels and 15K substrates/month for hybrid panels and ships everything it can build.

After two straight years of losses, LGD is like a modern version of the Titanic heading toward a gigantic iceberg (the Chinese display hegemony), driven by two underperforming large engines (Gen 8.5 OLED fabs) and the more modern thrusters (Gen 6 OLED fabs) that are too small to change direction. So the captain throws sailors and officers overboard in hopes of lightening the load. Meanwhile, the harbor pilot (Apple) has left the ship, looking for more attractive opportunities.

Rather than rearranging the deck chairs, LGD should be changing course to deal with the excess capacity and high cost of OLED TV panels, the limited capacity for small/medium displays, and lack of a response to their competition in IT displays.

By combining the small/medium and large area management, LGD may be attacking their fundamental structural issue, which is the difference between the architecture of the two production approaches:

- Gen 8.5 — Layered OLED Emitters (Non-pixelated) using an open mask (WOLED). These are tandem structures with blue, red, and green layer emitters supported by common layers using a color filter to create sub-pixels

- Gen 6 — FMM patterned, side-by-side RGB with either a single emitter or dual emitter configuration

An approach is for LGD to transition one of the Gen 8.5 fabs from open mask to an RGB side-by-side format by: 1) allocating a portion of the oxide substrates to a Gen 6 size, which would require some redesign and the use of higher performance oxides; 2) starting a test of the recently announced AMAT tool that uses lithography to pattern sub-pixels rather than FMMs; 3) taking advantage of the upcoming full amortization of the Gen 8.5 fabs left for TVs and exploring alternatives to lower prices, including replacing high-cost PH material with lower-cost blue material or using a green TADF material.

It should be understood that the highly touted PH blue is apparently no longer in panel maker plans due to the low lifetime of the material, reported to be <40% of FL blue.

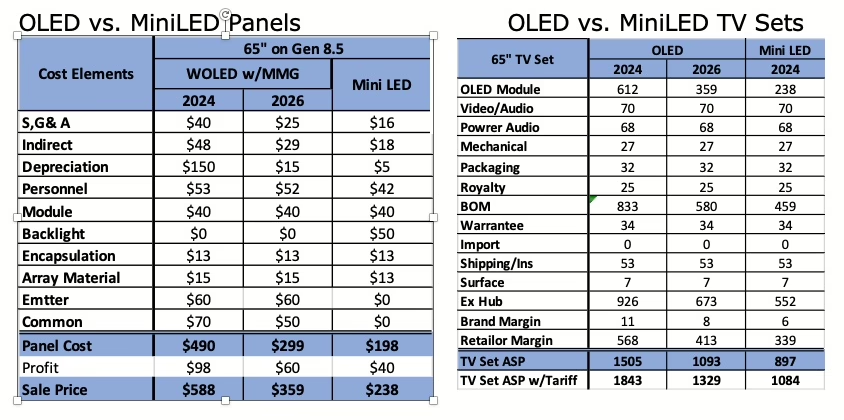

The next table compares the cost of production for an OLED panel with depreciation, one fully amortized versus a MiniLED. The panel price difference could be reduced from $350 to $120, without the change in materials, which could drop half the emitter cost. The effect on the TV set price is shown in the second table.

One side note is that the addition of Trump’s tariff would add $200 to $300 to the retail TV price if it was charged to the consumer.

Finally, the strategy would be a reduced-cost way to enter the IT market without having to invest $1B or $2B for a VTE/FMM tool.

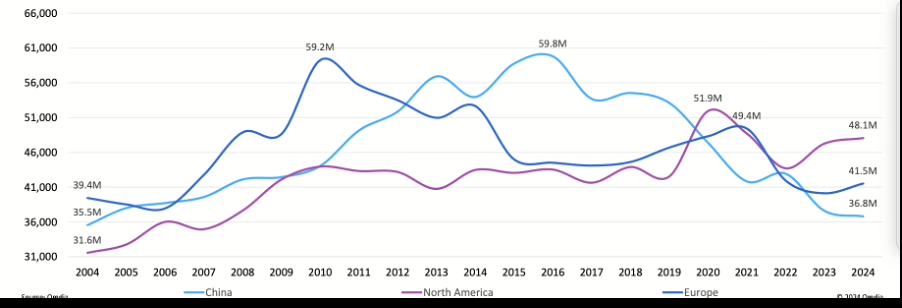

The second constraint on OLED TV sales, other than price, is the lack of penetration in the China market, which is the third largest. Besides the desire to buy local, the high-end TV market in China has led the world in its conversion to TVs 77″ and greater. Without a Gen 10.5 to compete with LCDs, LGD is at a serious disadvantage that may very well be a forerunner to the TV market in the rest of the world.

LG’s OLED Shipments are summarized as follows:

- ~100M flexible OLED panels in 2024 including 70M for iPhone models vs. 85.0M in 2023, 52.0M for iPhones

- 4.23M OLED TV panels in 2023, a decrease of 33.6% from 6.37M in 2022 and an estimated 5.5M in 2024

- ~0.6M OLED desktop panels in 2024, and 0.28M in 2023

- ~0.5M OLED panels for automotive in 2024, and 0.41M in 2023

- ~3.4M hybrid OLED panels for the 11-/13-inch iPad Pro in 2024; LGD did not ship OLED for tablet PC in 2023

- LGD is shipping 13.4-inch hybrid OLEDs with an RGB tandem stack for Dell’s notebook

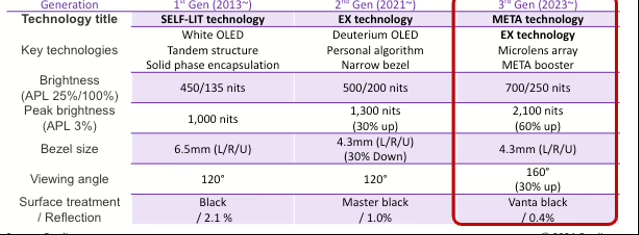

LG has made notable improvements in its OLED TV panels, with fundamental changes in 2023 adding META technology, including microlens that increased the luminance to competitive levels that were enhanced in 2024.

LGD is facing a catastrophe and needs to be aggressive in facing its challenges. Their engineering staff has been a technology leader in being the first to:

- Use IPS for LCDs

- Use oxides as a backplane technology for Gen 8.5 OLEDs

- Produce OLED TV panels after others gave up

- Implement MLA in TVs

- Develop MP rollable TVs

- Develop prototype rollable smartphone

Now it’s time for LGD management to replicate the leadership and creativity of the engineering talent.

Barry Young has been a notable presence in the display world since 1997, when he helped grow DisplaySearch, a research firm that quickly became the go-to source for display market information. As one of the most influential analysts in the flat-panel display industry, Barry continued his impact after the NPD Group acquired DisplaySearch in 2005. He is the managing director of the OLED Association (OLED-A), an industry organization that aims to promote, market, and accelerate the development of OLED technology and products.