Over the past few months the economic conditions for the consumer electronics market have been deteriorating, but there is a start of a normalizing correction in inventories, which had been built up throughout the supply chain over the past two years. Hopefully the inventory corrections will offset the economic deterioration in North America, which is in the early stages.

Negative signs include,

- Macro sentiment in the two largest markets—North America and China (currently at different stages);

- Waning demand for electronics, including certain B2B markets, and further deterioration in consumer product demand in China and downside for 2023 and the timing of a bottom),

- Weaker demand outlook on the distribution/brand-owner side accompanying the first two points, and the start of inventory/production corrections rooted in a lessening of the stress in distribution channels;

- Positive signs include

- Tapering of the tension affecting semiconductor supply-demand. Impact on automotive and B2B demand, which have been comparatively firm,

- The relationship between upstream and downstream operations and changes in the competitive landscape in each area.

While the start of a cyclical inventory correction is a positive, a recovery for the sector overall will be dependent on improved visibility demand, which could happen as early as November.

Looking specifically at products that affect OLEDs….

Smartphones and Peripheral Devices

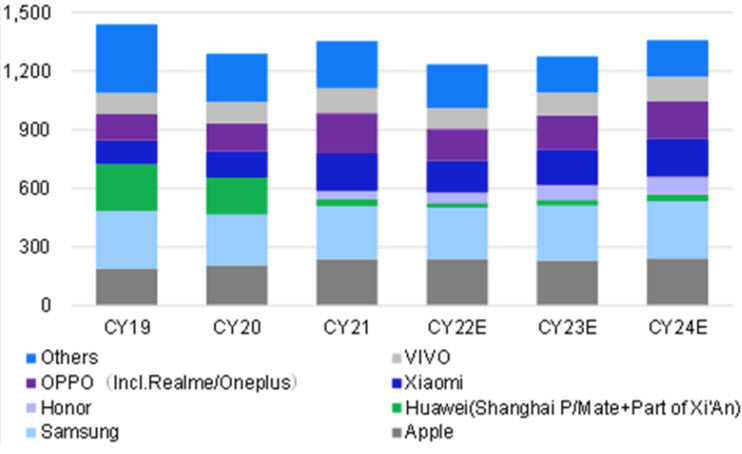

- Smartphone production forecast for 2022 has been reduced from 1.285 billion units to 1.236 billion units (down 8.8% Y/Y), as Chinese demand is expected to remain weak. A recovery is expected in 2023, with shipments of 1.275 billion units (up 3.2% Y/Y). Chinese sales of 274 million units are expected in 2022, more than 40% below the 2016 peak of 460 million units. and likely an anomaly. Even if the replacement period has lengthened, it is unlikely that it will persist at upward of five years, and a boost is expected from economic reopening.

- China shipments are expected to bottom out at 66 million units per quarter.

- In 2023, there is a downside risk from worsening US economic conditions and spill-over effects on other countries (e.g., economic conditions and dollar appreciation), but replacement and pent-up demand will emerge as economic activity resumes (particularly in Asia, including China and India).

- A gradual recovery in smartphone shipments should begin in with 1.275 billion (up 3.2% to 1.360 billion units in 2024 (up 6.7%), with a return to pre-COVID-19 levels in 2025 or later.

- Excess inventory reduction: Chinese brands should progress from sell-through, to shipments, to production, and on to procurement before the end of the year, and the bottom for the value chain could come perhaps as early as Q422. Momentum should pick up heading into 2023 after adjustment has been completed.

- Peripheral devices such as watches (smartwatches and quartz watches) and earphones should also benefit from Chinese reopening.

- Forecasts were lowered for high-end models in China by 22%, middle-end models overseas by 15%, and low-end models overseas by 15% to account for lower-than-expected demand in China and weakness in international markets. Relatively solid shipment volume is expected at other brands, including Google, TCL, Transsion (a Chinese company mostly active in Africa), and Motorola. For 2023, we expect a slight YoY decline for Apple and think it will underperform overall smartphone growth of +3% due to sluggish demand in Western markets and a likely strategy of prioritizing per-unit profitability (i.e., focus on new models and high-end models). We anticipate a stable trend for Apple, rather than a deterioration. In our view, companies in the value chain that handle products for new models, especially the Pro/Pro Max models, will be in an advantageous position, while those that are mainly focused on low-end models such as 11/SE will struggle.

Table 1: Annual Smartphone Shipments by OEM –2017-2022e

- Samsung Electronics’ shipments should increase due to rising sales centering on Europe and emerging economies under a strategy geared to a certain volume share.

- Huawei and Honor should expand sales of high-end models in China and middle-range models overseas. Expect high growth for Honor (+20%). China’s shipment volume in 2023 should increase by high single-digits for Xiaomi, Oppo, and Vivo as a result of sales growth in emerging economies and the benefits of a domestic market recovery.

Figure 1: Smartphone Shipments by Brand – 2019-2024e (million units)

PCs TVs and Monitors

Having risen sharply in 2020–2021, there is a pull-back occurring in 2022 and there are no regions likely to drive growth in 2023. In addition, major brands are being cautious about sales promotions, and while procurement has begun to adjust, inventory levels remain excessive, and it will likely take more time for distribution-stage and manufacturers’ inventories to normalize for notebook PCs than for TVs. Another risk is that the industry expects demand to remain flat or to grow slightly in 2023. PC shipment forecast for 2022 has been lowered from 222m to 199m and for 2023 from 206m to 188m.

- There is a risk of a larger-than-expected contraction in Europe, the US, and Japan, which are three areas where re-opening demand is already emerging. Least positive: Notebook PCs and TVs. In both these businesses, consumers bought forward their demand while they spent more time at home due to the pandemic in 2020–2021, and the adjustment of inventory for Europe and the US was a result of tight logistics supply (about 5-8 weeks’ worth of sales). There is no notable special demand for TVs outside of North America and Japan. The Chinese and Asian markets have been weak and bottomed after the turn of the year. Sales promotion activity by Chinese brands is needed to boost market share, which should be positive for demand.

- TV sales are likely to plummet in North America, having previously soared, but the key will be recovery in China and Asia, where higher prices prevented the emergence of stay-at-home demand, and sales have remained weak. While demand in China should bottom out in 2022 and then recover in 2023, it won’t offset the downturn in North America and Europe. Globally, there was no stay-at-home boost to smartphone demand, and the replacement period has lengthened in areas where demand was weaker than expected. China is an anomaly due to the pandemic and economic deterioration (the market being below 300m units cannot be explained unless replacement periods of around five years persist; the market in Japan is more than 30m units with less than 1/10 of China’s population), and expect a rebound from the reopening of emerging economies. Smartphone growth of 3% is expected in North America and Europe as re-opening demand fades and macro sentiment deteriorates. Risks include macroeconomic conditions (including forex; this is also still the case for China), and iPhone 14 pricing. If the price is $100 higher than the price of the iPhone 13, and the price increase is even sharper in Europe and China as a result of euro and yuan depreciation against the dollar, this would be bound to have some impact on demand in 2023, in my view.

Large Area LCD Production

The LCD demand bottom is still some way off. In response to lower demand, suppliers finally started to cut production of large LCDs in July and a recent survey in China put large area LCD utilization at 67%. Despite the lower utilization, supply continues to outstrip demand, as end demand for TVs and PCs is weak. Panel prices are nearing the bottom (at cash cost or even lower), but supply/demand won’t regain balance until demand is stimulated in China and emerging markets.

- The bottom is anticipated in the latter half of Q422, at earliest, but likely in Q123. There is a risk that LCD capex projects will face cancellation or further delays.

- OLEDs are still expected to continue Y/Y growth, as moves to build Gen 8 substrates for IT are set to gather pace. Ulvac is positioned for growth, even as semiconductor and SPE demand is starting to peak, due to market share gains in memory/logic, growing demand for OLED and power semiconductors, and expansion in new fields such as ?OLED and batteries).

End-user demand is deteriorating for many products, and the bottom is not yet in sight, but the situation differs by product and region. Assuming there is greater downside risk for products and regions that have been buoyant until now, the greatest risk to demand is for PC-related products.

With the exception of some areas where demand should increase even amid deteriorating economic conditions (such as game consoles, where a production downturn due to the semiconductor shortages caused an accumulation of pent-up demand. A macroeconomic downturn is also the leading risk outside of China. In addition, depreciation against the dollar in Europe, and other emerging markets could lead to price hikes in local currency terms.

Momentum will be stronger for high-end smartphones than for middle- and low-end smartphones and stronger for iOS devices than for Android devices. By brand, in 2022, volumes will exceed 2021 levels at Apple (mainly high-end smartphones with emerging markets accounting for a small portion of business).

There is a relative advantage among smartphone makers for Samsung Electronics (benefits from high-end 4G+ smartphones with in-house SoC), but there is weakness in low-end models. Among Chinese makers, Oppo, Vivo, and Xiaomi should drop Y/Y. Factors that could disrupt shipments include India’s policy measures to protect local brands. If Chinese brands with unit prices below $150 were to be shut out of India, Samsung Electronics and local brands would likely benefit.

The impact on Chinese makers would not be small: 50m–60m units with Chinese brands accounting for about 80% of the market, which would have neutral impact on overall demand in India. Huawei should maintain a current volume level despite chip procurement limitations, thanks to high-end 4G models in China and middle-end 4G models overseas. While shipments of Honor’s middle-end and high-end models are rising swiftly in China, expect delays in its sales abroad (less than 10% of total volume this year).

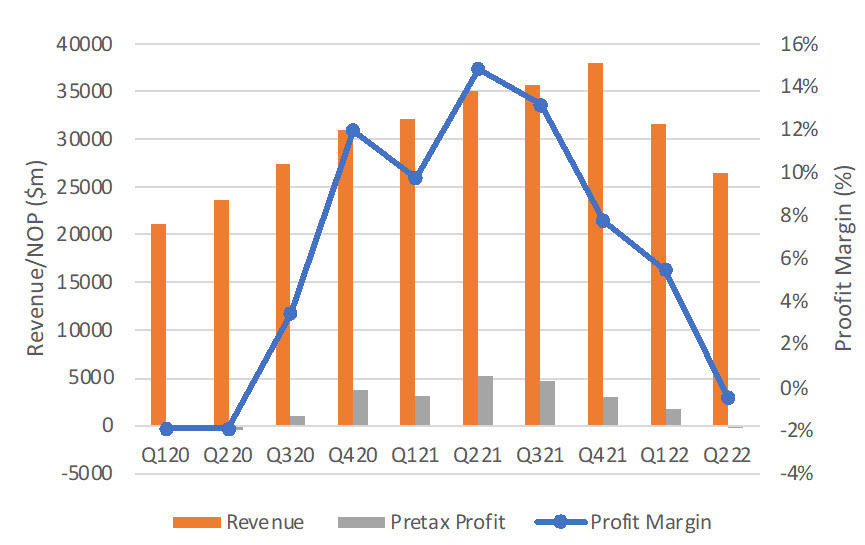

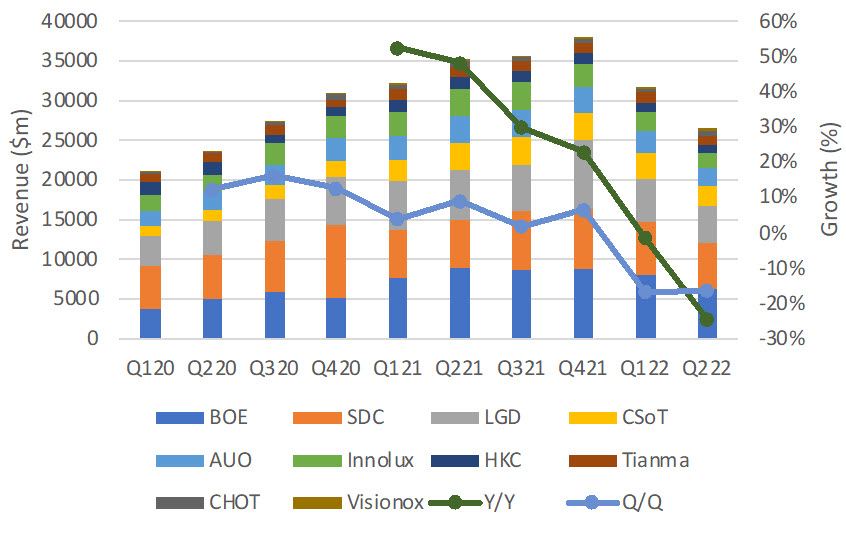

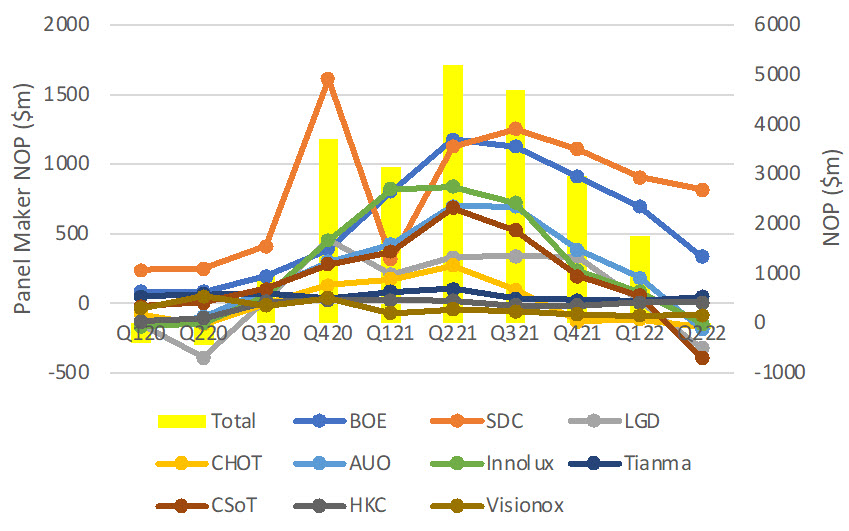

The next set of charts provides a look at the display industry in terms of revenue and Pretax profits, with the exception of Sony, Sharp, JDI, the smallest Chinese panel makers and micro display panel makers. We estimate that the charts include >95% of display production.

Display Revenue peaked in Q421, at $38 billion up 23% Y/Y. In Q122 and Q2 22, revenues were sequentially down 16.7% and 16.4% respectively. Net profit for the industry, which was $3.0 billion in Q421, dropped to a loss of $115m in Q2 22. The losses were led by LGD at $324m, AUO at $192m, Innolux at $147m and CSoT at $395m and Visionox at $86m. SDC posted pretax profits of $816m and BOE had profits of $334m.

Figure 2: Panel Maker Revenue Profits And Profit Margin – Q120-Q122

Figure 3: Panel Maker Revenue and Growth—Q120 – Q222

The next charts show industry profitability (yellow bar) and individual panel maker performance (lines).

Figure 4: Panel Maker Net Operating Profit—Q120 – Q222

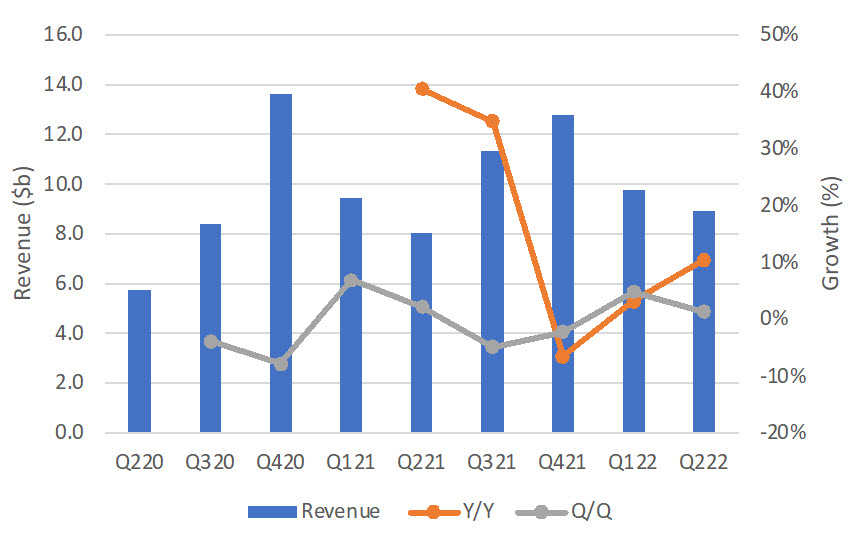

The next chart shows OLED revenue of $8.4 billion in Q222, up 10% Y/Y, and 1% sequentially. (BY)

Figure 5: OLED Panel Maker Revenue and Growth—Q220 – Q222

Barry Young is the CEO of the OLED Association