Bob O’Brien, a founder of DSCC, opened up the second session of the business conference which looked at the ‘Current State of the Consumer Electronic Market’.

Bob O’Brien, a founder of DSCC, opened up the second session of the business conference which looked at the ‘Current State of the Consumer Electronic Market’.

O’Brien started by looking at the big picture. Demand for big LCDs is increasing because of the increasing size of TVs. Innovation in the TV industry is driving bigger and better TVs and capacity growth is driving the supply side.

IT applications are important, but are the ‘tail of the dog’. Displays in IT are getting bigger and better, but are not driving the industry.

Mobile phones are, of course, innovating in resolution and form factors and are the second battleground of LCD vs. OLED.

Other applications are interesting and innovative, but they aren’t big enough to influence the big investment decisions. e.g. automotive, digital signage and AR/VR are all useful markets, but none is big enough to persuade someone to invest in a new fab.

Caution is Needed

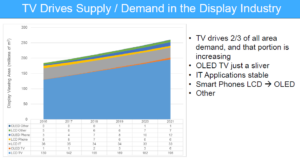

He had a couple of notes of caution. O’Brien said that he learned at Corning, where he looked after the market intelligence function, that area, rather than unit volume, is the key driver for not only glass, but also for materials such as films, polarisers and even LED backlights. He showed a chart of his forecast by area. TV is two thirds of the area, but OLED TV is ‘just a sliver’. IT has a significant share, but it isn’t growing. Phones are significant, but not big in area terms.

OLED is growing in all applications, but is limited by supply capacity. In LCD applications, only TV is growing, with IT displays shrinking. OLED is replacing LCD for TV.

IT applications are surviving just on replacement. There are a lot of monitor panels and notebook panels sold, and developers in other applications would like their volume, but the market is not growing and the replacement cycle is lengthening. Further, some users are moving to use smartphones, which is one of the main problems for tablets, where there is an opportunity for cannibalisation.

O’Brien said that picture quality and form factor are the key drivers for TV, but connectivity is also a help in driving volume in the TV market. As well as better picture quality, thinner and lighter displays drive replacement and the development of larger sizes.

By 2021 the average TV will be just below 50″. There is a question of how big TVs get. Wall-sized TVs are still the long term goal, so 50″ is nowhere near the end, in his view.

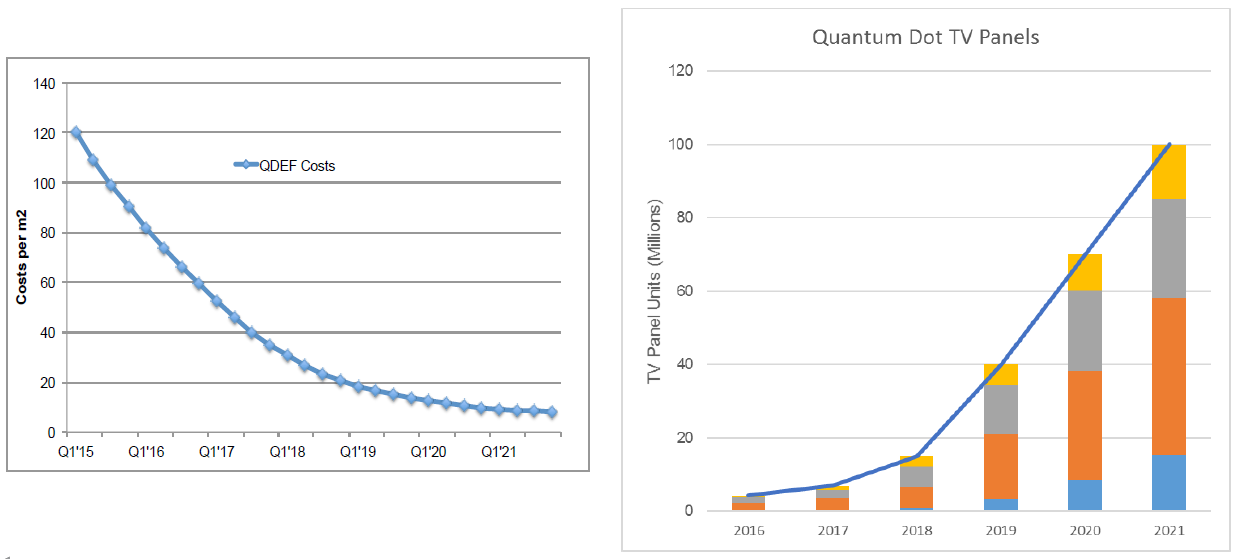

DSCC has modelled the costs of QDs and sees the technology penetrating into the market widely. By the end of the forecast, the technology will be, effectively, free, so is likely to be universally adopted.

There are some cautionary points. O’Brien said that there are limits on TV viewing. He showed a chart from Nielsen that showed that the youngest demographic segments watch less TV on the big screen. What is not known is whether they will change to bigger displays as they get older. It may apply a limit to the growth in the TV market.

Twenty years ago, Philips, where O’Brien worked was in all of the display component businesses, CRT, LCD, PDP, projection, etc. At a company forum, that discussed the development of the industry, the delegates from different segments were talking and the conclusion was that the display would always grow, but there is a chance that there might be a move to bypassing the eye and going ‘straight to the brain’. Elon Musk is investing in that area.

A question is how long will LG be the only maker of OLED TVs? Another is how many G10.5 fabs will actually get built. QDs are an interesting and developing area,