Max McDaniel is from Applied Materials, the production equipment maker, where he is CMO for the Display and Flexible Technology group.

Max McDaniel is from Applied Materials, the production equipment maker, where he is CMO for the Display and Flexible Technology group.

Applied Materials is 50 years old, started in Mountain View, California and is the biggest equipment maker in semiconductors. The company has a big semiconductor business, a service business and the ‘others’, but the others are mainly displays. Last year the company invested $1.8 billion in R&D and made $1.9 billion in display revenues out of a total of $14.5 billion.

The equipment is often huge, giving real logistical challenges, but with incredible precision needed in assembly.

There are three big waves in flat panels, McDaniel said. First LCD, then Mobile OLED, then future displays. LCD has been the biggest technology, but the key to its success has been scaling up production to reduce cost which enabled monitors and TVs to use LCDs. OLED is not being adopted as quickly as the most optimistic predictions, but there is likely to be continued investment and development in the technology.

New technologies need a lot more investment and technology than LCD production, which is what is driving the increased capex in recent years. McDaniel expects more fabs to be built than DSCC or Mizhuo, but it normalises the number to a standard of 60K substrates per month so its 13 forecast may match Nakane’s nine fab prediction as some of those will be bigger than 60K.

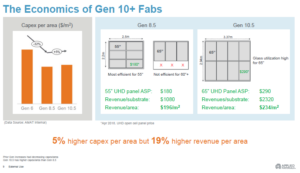

Going from G6 to G8.5, there was a 32% capex per area cost reduction, but G10.5 is 5% more expensive per m². The only reason to go to that generation is to make “eight up” 65″ panels. Revenue per substrate goes up a lot if you can do that. Applied calculates that it currently goes up from $196 per sq metre to $234

G10+ Fabs cost more per sq metre of production, but the value goes up.

“How do you differentiate when there are a lot of fabs?”, McDaniel asked. 8K means shrinking the transistors, but also means more RC delays and you have to move to oxide TFT, but that in turn means more capex. Even with 48% CAGR in OLED area capacity growth, OLED still only gets to 3% of the TV market in the next few years. It’s too expensive at the moment compared to LCD to penetrate the mass market.

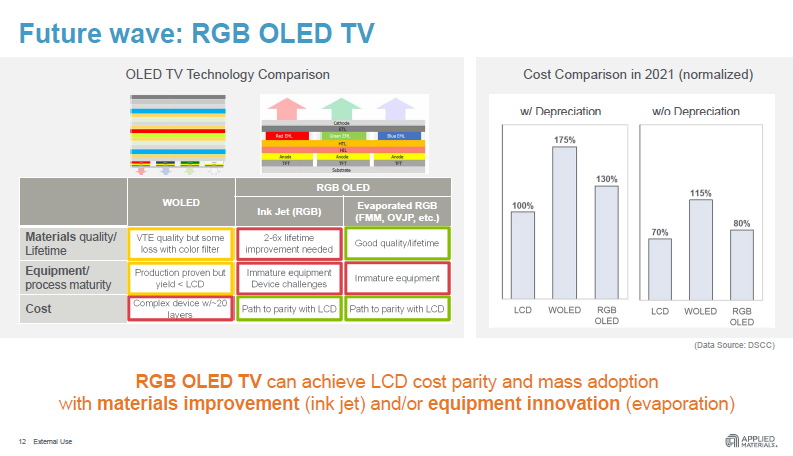

You need something nearer the cost of LCD and that means RGB OLEDs, which means either using inkjet printing or evaporation for patterning. OLED could reach the cost target of parity, but the materials need to be improved and so does the equipment.

RGB OLED could compete with LCD costs, but needs a good deposition process.

RGB OLED could compete with LCD costs, but needs a good deposition process.

Rigid OLED can meet the cost requirement to match LCD for smartphones and of course flexible has big advantages in form factor. There are more transistors and capacitors per pixel than in LCD. Bigger transistors as a share of the display area means more chance of a defect happening on the transistor area, reducing yield, potentially. OLED is extraodinarily complex and very hard to get to production yield.

In the future there is a lot of work to be done on flexible OLED. OLED replaces a lot of the material used in LCD with more processes. There are lots of challenges in getting to foldable OLEDs and the display becomes even more processor intensive – meaning more capex again.

All these things mean more capex per fab by a factor of 2X to 5X depending on the type of fab. That is why annual capex has risen from $8 billion to more than $18 billion. Before today, the industry was very volatile for equipment but more capex has stabilised the equipment market.