John Zhang introduced his company, Corning, where he is a VP and General Manager. The company sees itself as a centre of glass science, optical physics and ceramic science – with unique fusion drawing and precision forming technology.

John Zhang introduced his company, Corning, where he is a VP and General Manager. The company sees itself as a centre of glass science, optical physics and ceramic science – with unique fusion drawing and precision forming technology.

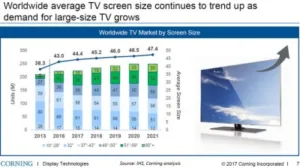

Zhang then looked at the development of the display glass market since 1995 and he showed that it has continually expanded. The area of glass will reach 6.5 billion sq ft (603 million m²) in 2021, mainly because of growth in large size TVs. Units will grow modestly and new applications include digital signage and automotive.

A key enabler of this growth has been the affordable prices for large TVs with attractive form factors and high resolution.

Prices have really come down allowing much better value for consumers and really big displays and that is matched by better colour and HDR and resolution. Despite the better performance and design, the prices have declined by more than 10% per year.

Corning is more conservative than DSCC on screen size growth, but still sees a trend to the 65″ segment, which will push up the average screen size. That will drive a lot more demand.

As we heard from earlier speakers, there are lots of development in G10 and Corning already has many years experience of Gen 10 glass, as a supplier to Sharp. Corning is monitoring large supply demand closely and sees demand being stronger than supply until 2020 when a fourth G10.5 might be built There are not enough G10 fabs until then, so there will need to be some supply of large sizes from other substrate sizes using multi-cut technology.

Corning’s strategy is to maintain stable market share and help the supply demand balance. The company is also using existing assets to leverage to serve other opportunities. For example, there are new markets in Light Guide Plates (LGPs) and cover glass as well as substrates.

Corning agrees that the handheld market is switching to OLED with most of the growth coming from flexible displays. The company also expects flexible displays to have strong penetration in tablets and wearables.

Corning has developed Lotus NXT glass for high resolution for more accurate and higher resolution displays. NXT glass also good for use carrier glass in making flexible OLEDs.

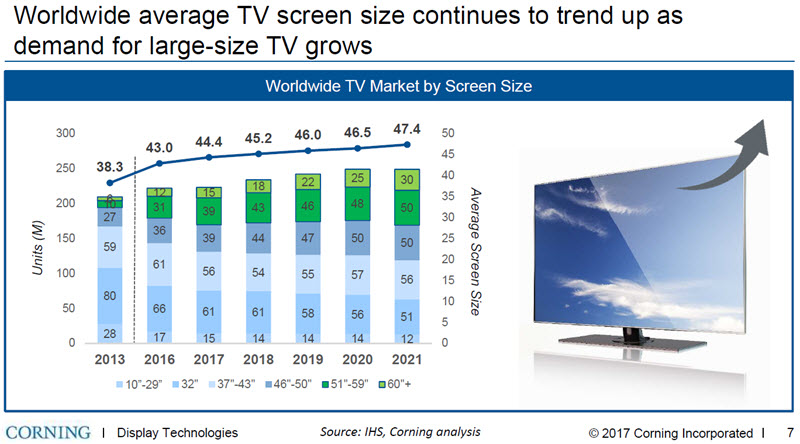

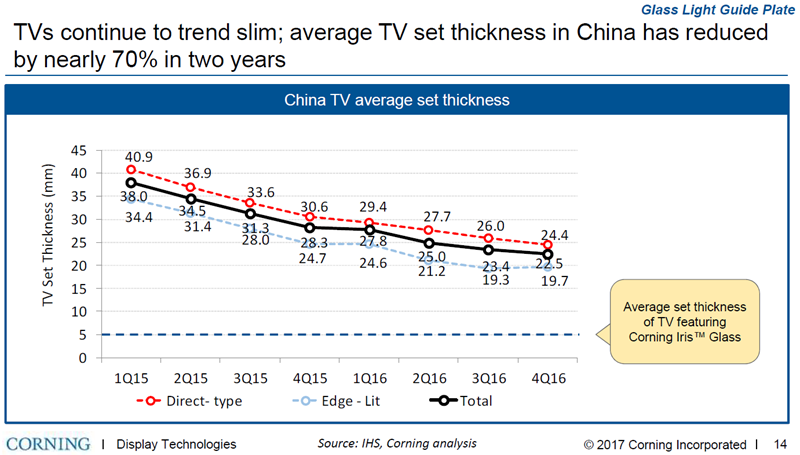

The industry is moving to thinner TV sets – average depths have been rapidly reducing and by the end of 2016, sets were down 40% in thickness compared to two years before. Corning Iris glass is for LGPs to enable thinner displays by replacing the plastic plates normally used in edge-lit TVs. There is less distortion and expansion than plastic, Zhang said.

The Iris LGP glass is gaining traction in the market, Zhang said, after winning an award at SID last year and Corning is seeing ‘good customer pull’ for its use in both TVs and monitors.

Another area where the company has been doing well is cover glass, where Corning has its Gorilla Glass brand. The newest version is Gorilla Glass 5 and this allows a phone to withstand a drop height of 1.6m – which means shoulder height or above. Zhang quoted data that 80% of field returns of smartphones can be from sharp contact damage.

Gorrilla Glass has now been used on more than five billion products and new applications are being developed, for example, for wearables to replace sapphire. and with coatings for anti-fingerprint, anti-glare as well as improving rf transparency to allow wireless charging.

Analyst Comment

I suspect that the investment that Apple has made (which Zhang would not comment on, when asked) is aimed at the sapphire replacement by glass. (BR)