Barco announced a big change in its approach to the digital cinema market in an announcement and webinar with CEO, Jan de Witte, on Monday morning. We took advantage of being in the same time zone to listen in.

The main news is that Barco has decided to form a joint venture to continue the company’s development in the digital cinema market. The partners in the new company will be:

- Barco, which will have 55% of the company and will be the exclusive OEM for products and hardware for new projectors. Barco will be the technology developer and supplier with the J/V as a ‘go-to-market’ enabler. The deal includes an agreement that hardware would be sold to the J/V with distributor prices as the transfer price.

- Appotronics of China, which will have 20% and will be the exclusive OEM for laser phosphor retrofit hardware both for Barco and other brand projectors

- China Film Group (CFG) will also have 20% and will develop its premium large format (PLF – think of an alternative to iMax) and has content and other services including optimisation technology for high quality display. It has installations in PLF in the Middle East and Asia already.

- CITICPE of China will offer finance and other services and will have 5%. Many of the laser phosphor retrofits will be rented and leased rather than purchased and CITICPE will be able to support this

The company will have a start-up capital of $100 million, with contributions from the partners according to their shareholdings.

Background

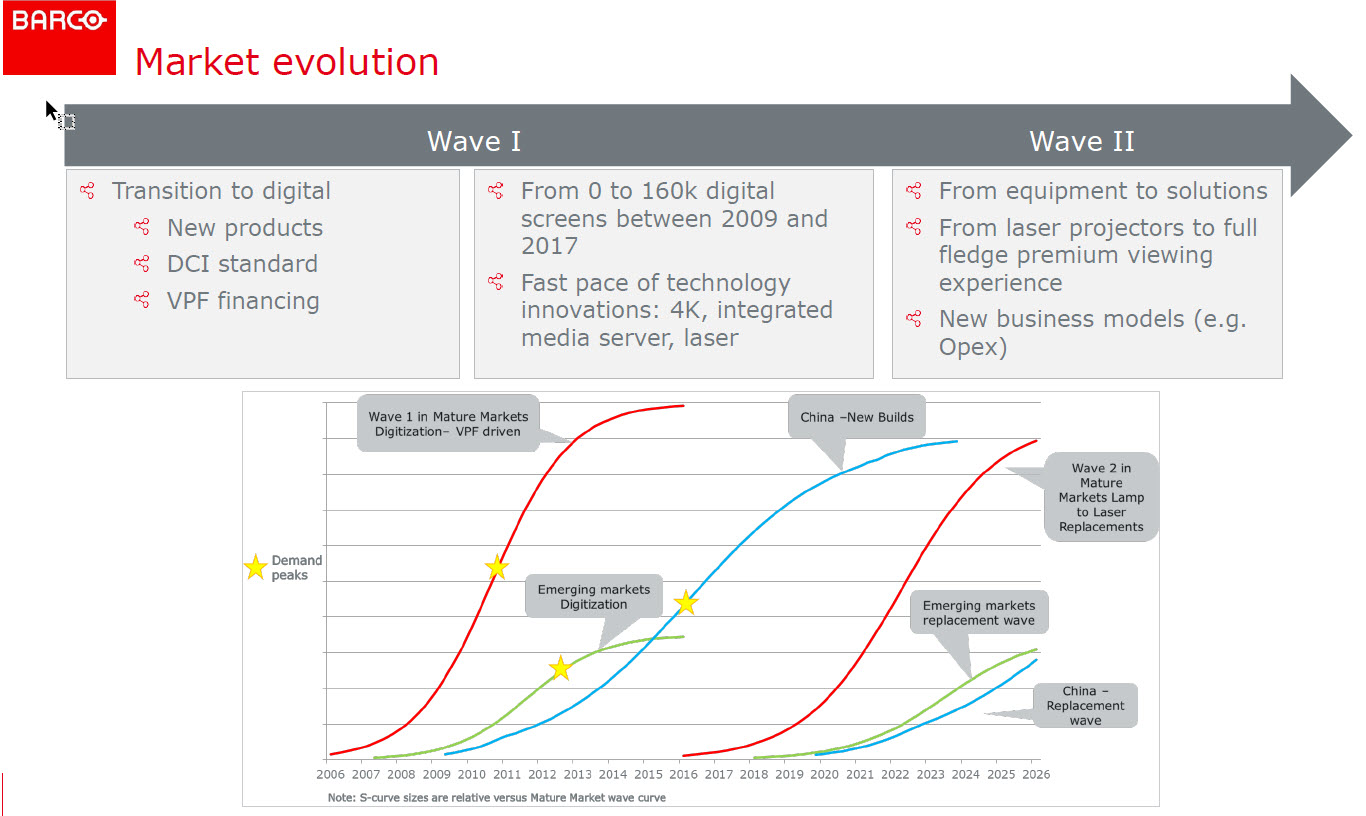

The cinema industry has completed its first phase in going digital with around 160,000 screens deployed between 2009 and 2017 and Barco claims the leading position in this market. The cinema market is developing and Barco said there is both more professionalisation and also consolidation among exhibitors.

Barco showed this chart of cinema market evolution – click for higher resolution

Barco showed this chart of cinema market evolution – click for higher resolution

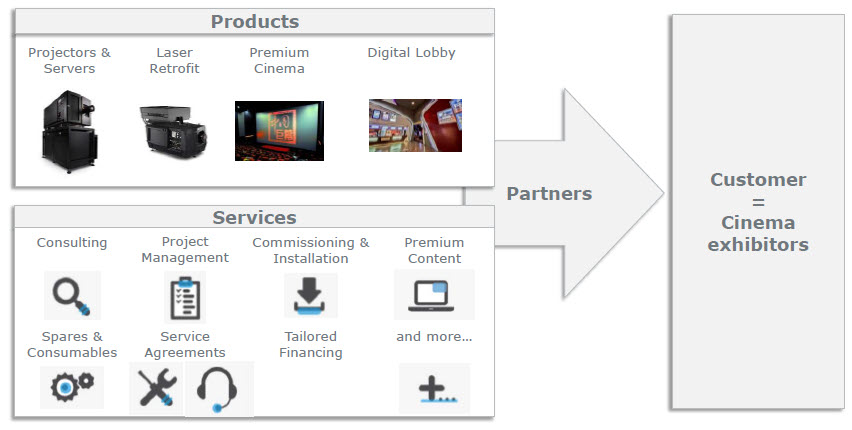

de Witte said that Barco expects 40,000 projectors to be replaced over the next five years and the joint venture will target sales of 45% to 50% of those units. Some of those replacements will be from operators that want to increase their differentiation from the home experience by moving to premium and PLF formats. (de Witte did clarify that the Barco Escape initiative for immersive cinema is outside the scope of the J/V). CFG’s technology and services will be particularly helpful in that segment where Barco believes it is the market leader.

The other opportunity is for updating lamp-based projectors to use laser phosphor sources. de Witte said that there has already been a fair amount of cooperation in these areas and in 2014, China Film Equipment, Appotronics and Shenzhen Resources Investment & Development Co formed a J/V (CineAppo) to supply laser/phosphor equipment to the industry in China. As we reported (Laser Sources at CinemaCon), by earlier this year and had already converted by retrofitting 2,500 Barco projectors in China with L/P light sources using multi-coloured laser.

Appotronics will be the exclusive supplier of retrofit laser phosphor for at least ten years. (The company is very strong in this area and we have previously reported that it has more than 1,000 patents in laser phosphor illumination.) In answering questions from analysts, de Witte also confirmed that the Appotronics retrofit technology would only be available to the J/V and not to other suppliers. It was stated that NEC is the only other supplier of L/P projectors in the cinema segment, but would not have access to the Appotronics suite of products.

The scope of the deal is global, excluding China and although it will start operations in Q2 of 2018, it will probably be the end of 2018 before all the set up is done.

de Witte said that “the cinema experience starts before the purchase of the popcorn”, so the joint venture will also work to further develop lobby and other services to expand its market scope beyond just the projection side.

Another Deal for China

Barco already has a joint venture in China (BarcoCFG) and will sell 9% of that company to China Film Group for RMB 175 million ($26.5 million – reflecting a value of $295 million and around thirteen times earnings according to an analyst on the call). The change will mean that CFG will have 51% of the company.

Barco believes that CFG will be in a better position to lead the next phase of development in China. BarcoCFG has 50%+ market share in new build cinemas and more than 20K of the 40K screens deployed in tier 1 and tier 2 cities. There is still a market for 30K+ screens in tier three, four and five cities, de Witte said. CFG will pay RMB 175 million ($26.5 million) for the 9% share of the business and will take control of the company. Barco will de-consolidate the results of the J/V and deal with the company on an equity basis, but the new joint venture will be fully consolidated.

The firm does not expect a significant impact on the operational results in 2018, but lead to growth in 2019. (BR)