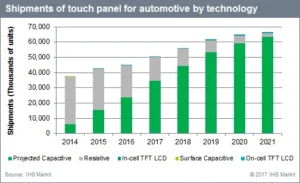

In case you missed it, IHS recently reported touch display panel shipments in automobiles will reach 50 million units this year and global revenue for display systems in cars will hit a whopping plus $20 billion five years out (2022).

That number is going up from $11.6B in 2017, and coming off rather flat revenue growth over the past five years. Auto display system revenue numbers reported by IHS in 2012 were $9.2 billion so five year growth has seen just a $2.4 billion increase according to the company.

Drilling down to specifics, IHS reported “TFT LCD panels, used for the display systems, are expected to account for more than 67% (200 million units) of total display shipments by 2022,” that’s up from 2016’s 135 million units shipped in 2016, according to the IHS “Automotive Display Systems Forecasts”.

Meanwhile, IHS has also been doing some demand side research to help to better understand what’s driving these numbers and published in their recent 2017 Automotive Connected Services and Apps Consumer Analysis report. Here, the group found geographic diversity in consumers’ tastes for advanced technology in cars. Remarkably, RSE (rear seat entertainment) topped the technology add-on feature list in the USA with consumers willing to spend $640 for the back seat displays used to keep kids happy. RSE came in second in both the UK and China with consumers willing to pay a $388 premium for the technology, IHS reported. Interestingly, the technology did not register with either Canadians or German consumers, the other two regions included in the survey.

IHS also reported that by 2022, significant volumes of new vehicles will be equipped with advanced telematics that will combine GPS with diagnostic software and 3G and 4G communication that could be used “to send both data and communications back and forth between a vehicle and a central management system,” according to TechRadar. IHS reported telematics in vehicles will reach 87% of the vehicles in the US; up to 91% in Germany, 92% in the UK, 89% in vehicles sold in Canada and 54% of Chinese cars. They also reckon that more than half of the global fleet of vehicles in operation will be connected.

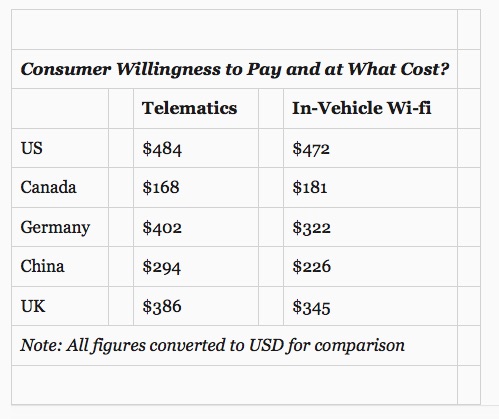

According to IHS, “32 percent of all respondents surveyed agreed that telematics would be a feature they would be willing to pay for in their next new vehicle, and in-car wi-fi was noted by 29 percent. However, when asked about cost, both of these technologies were mentioned with a much lower price point by consumers willing to pay for them and different price points that varied by region,” the report stated.

As car’s continue their transition from simple transport to entertainment hubs, and the ultimate mobile device, we expect to see these trends in both display demand and advanced technology continue. A case in point; insurance companies remain very interested in the data that advanced telematic systems can bring to the table. Now, specific driver behavior can be tracked and logged over time, resulting in much better driver risk assessment over the long run. As cars become piloted, “creature comforts” will continue to move to the top of the demand list with perhaps entertainment leading the way. – Stephen Sechrist

As car’s continue their transition from simple transport to entertainment hubs, and the ultimate mobile device, we expect to see these trends in both display demand and advanced technology continue. A case in point; insurance companies remain very interested in the data that advanced telematic systems can bring to the table. Now, specific driver behavior can be tracked and logged over time, resulting in much better driver risk assessment over the long run. As cars become piloted, “creature comforts” will continue to move to the top of the demand list with perhaps entertainment leading the way. – Stephen Sechrist

JDI Extends Pixel Eyes in LCD Module for Automotive