The 2017 business conference track, co-hosted by SID and industry display research pioneer, Ross Young’s Digital Supply Chain Consultants (DSCC). This year the business track included an automotive market focus conference targeting Automotive Displays. The session began on Tuesday May 23rd. with the theme of “Safety, Utility, Ubiquity,” and explored market opportunities, from both a demand (product) side and the quantitive market data supporting it.

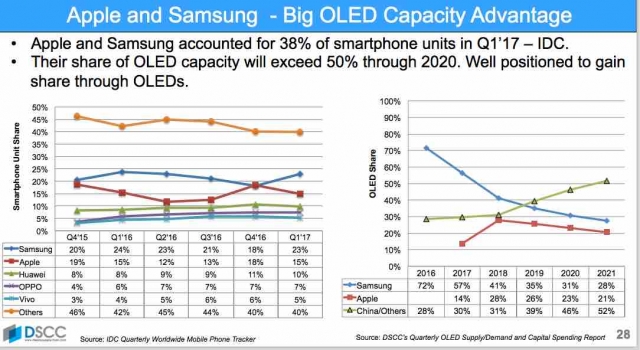

Ross Young kicked off the main business conference with a keynote that focused on “outperformance and investment opportunities.” Young briefly touched on the Auto display market stating in 2016 it saw “…larger sizes gaining share along with monitors, phones and other applications.” This strong migration to larger sizes impacted industry capacity as did amorphous silicon LCD fab closures, and Apple’s move in the mobile space toward flexible AMOLED panels for future iPhones and other devices (see chart).

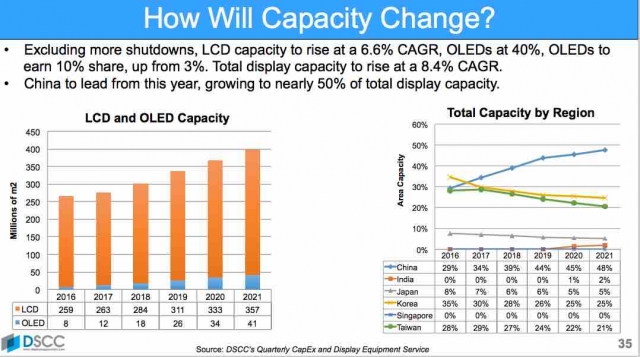

But OLED capacity is still minor compared to AMLCD. Young reckons there will be a 6.6% CAGR in LCD capacity with OLEDs gaining in both share and capacity at 40% CAGR and up to 10% market share by 2021. Meanwhile, it’s China that is on the move with growth in capacity moving toward 50% total display capacity in that same time frame. Catch more details on the general display market from our Business conference report.

Meanwhile focusing on Automotive and the demand side, GM was featured at the auto conference with a compelling presentation on Integrating Next-Generation Displays in Automotive Design given by Thomas Seder Chief Technologist, HMI GM Technical Fellow GM R&D and James Carpenter GM Global Display Lead GM Technical Fellow GM Global Engineering.

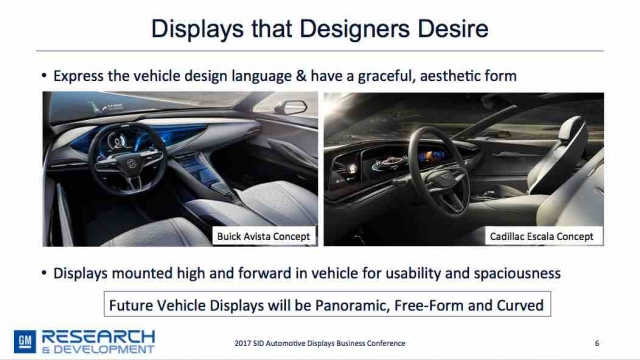

Their talk targeted the role of displays as elements in the design of vehicle interiors that included both features and technologies. The goal was no less than making future displays “…seem life-like.” They also looked a what may be required to integrate AR (augmented reality) systems into vehicles.

The GM talk focused on pushing the display industry providing products that met the needs of the driver, car interior designers, and human machine interface engineers that look to minimize distractions, and thus help maximize safety. Future vehicles will include an “amalgamated blend” of these attributes.

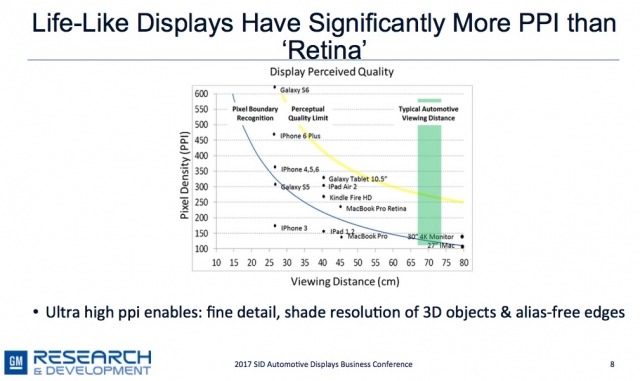

GM’s Seder reckons that future vehicles will include panoramic, curved, free-form displays with high resolution (beyond current displays today, see chart) with ultra high pixel density that enables: fine detail, shade resolution of 3D objects & alias-free edges, all required to meet the future needs of drivers. They also targeted “substantial color gamut, grayscale and bit depth” greater than 100% NTSC, where color space is preserved in high ambient conditions.

Augmented reality systems are highly desirable due to their support for advanced driver assisted systems (ADAS) that can eventually lead to autonomous driving. Engineering challenges include price and packaging volumes.

At the automotive market conference, BOE’s Alex Ma gave an LCD take on car displays, that included a ‘must have’ list that auto makers are requiring of display makers, much of which LCD fabs are providing to other suppliers already. (Yes this was a bit of a corporate commercial presentation.) This includes:

- Long term commitment

- Quality control, PPM, number of incident, 0km / field return

- Fast responses to RFIs, RFQs and quality issues

- Integrated panel and module facility

- Stable and on time supply

- Long design period – it takes average 2 years or more to SOP

- Stable, product life cycle up to 5-8 years

- Product part approval process (PPAP), Advanced product quality planning (APQP)

- Root cause analysis advanced problem solving (8D, FTA, fish-bone analysis)

- 4M (man, machine, methodology, material) & 1E (environment) are vital

- On time delivery (OTD)

- Stringent contract, agreement with high penalty for violation.

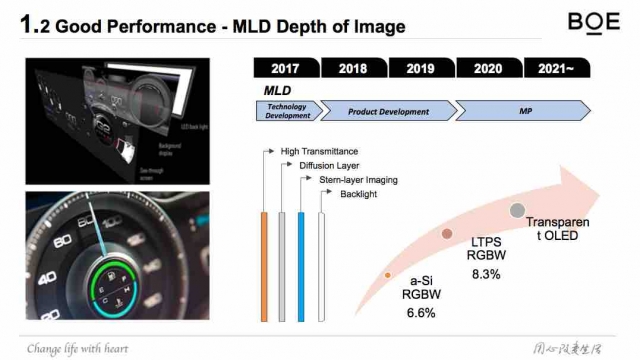

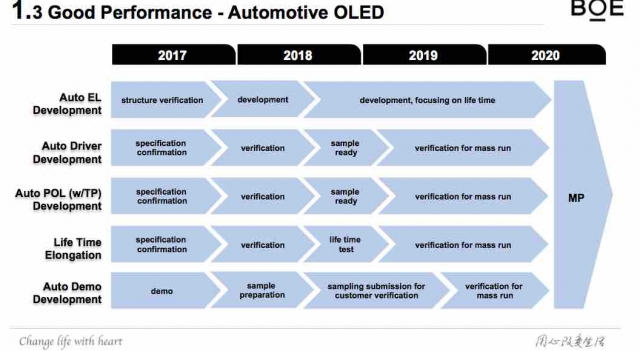

BOE targeted five areas to help the company capture the automotive market, including good performance, low power, cost effective, functional integration, and stylish design. We were taken on a grand tour of BOE products that met these needs that included an aggressive roadmap of technology development to meet future needs of the auto display market that includes auto OLED displays in mass production in the 2020 time frame (see chart.)

We also heard from glass maker AGC where Tom Trill, president, AGC business development Americas group presented on the car’s transition from an analog platform, to a digital platform where every surface becomes a display. Trill said glass is the first point of contact “AKA the user interface” also calling it the “fabric that knits displays together,” and “provides a uniform, consistent user experience.” He said the UI “forms the user experience.”

AGC’s vision of automotive displays is no less than “…a single unified 360º glass screen that includes HUD; Glazing; Dashboard; Rear-seat, Glass becomes the Fabric (Mesh).” What is needed is Curved, molded 3-D Glass Displays (not necessarily “flexible” displays), seamless transition of infotainment from surface to surface, integrated dynamic gesture recognition, touch and HMI (human machine interface). Plus high speed interconnectivity that includes screen to screen, vehicle to vehicle (V2V), vehicle to infrastructure (V2i) and, vehicle to smartphone (V2SmartPhone).

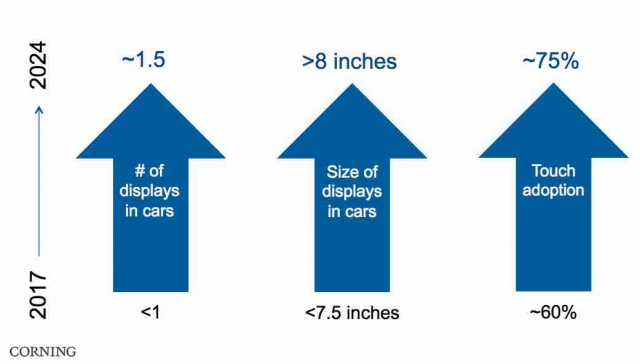

Corning also weighed in with their glass option focusing on Gorilla glass technology. Fabio Salgado, program manager, Corning automotive interiors, reckons by 2024 that we will see growth beyond 1.5 displays on average in cars vs. <1 today. The display size will grow from less than 7.5 inch today to more than 8.0 inch and from 60% to above 75% touch screen enabled. Corning also showed an image of a traditional HUD on soda lime windscreen vs a Gorilla glass version.

Other presentations included material suppliers, 3M and Fujifilm, who focused respectively on optimum human touch perception that influence customer preference. and metal mesh technology and its application in automotive touch surfaces.

Displays in cars have gone from a small niche market to an industry driver (no pun here) that have fabs and auto suppliers making significant investment in the space. Suffice it to say, the SID auto display conference proved to be a day packed with presentations on just how the display (and ancillary devices) will interface, influence, and change the automotive market for the better. – Steve Sechrist